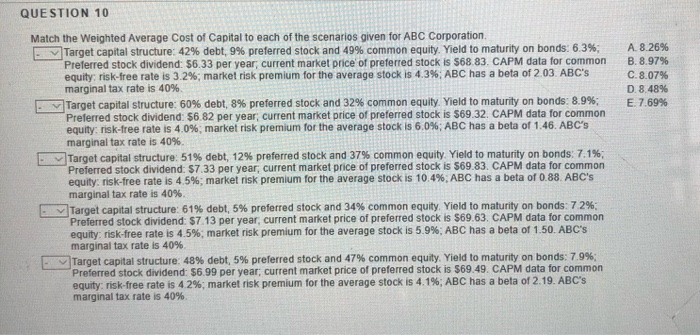

Question: QUESTION 10 A. 8.26% B. 8.97% C. 8.07% D. 8.48% E. 7.69% Match the Weighted Average Cost of Capital to each of the scenarios given

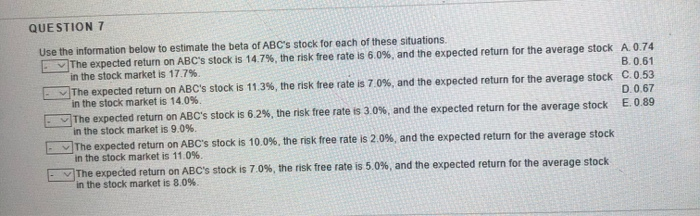

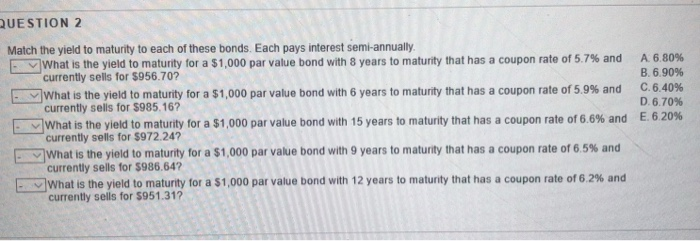

QUESTION 10 A. 8.26% B. 8.97% C. 8.07% D. 8.48% E. 7.69% Match the Weighted Average Cost of Capital to each of the scenarios given for ABC Corporation Target capital structure: 42% debt, 9% preferred stock and 49% common equity. Yield to maturity on bonds: 6.3% Preferred stock dividend: 56.33 per year, current market price of preferred stock is 568 83. CAPM data for common equity risk-free rate is 3.2%; market risk premium for the average stock is 4.3%, ABC has a beta of 2.03. ABC's marginal tax rate is 40% Target capital structure: 60% debt, 8% preferred stock and 32% common equity. Yield to maturity on bonds: 8.9% Preferred stock dividend: $6.82 per year, current market price of preferred stock is $69.32. CAPM data for common equity risk-free rate is 4.0%, market risk premium for the average stock is 6.0%, ABC has a beta of 1.46. ABC'S marginal tax rate is 40%. Target capital structure: 51% debt, 12% preferred stock and 37% common equity. Yield to maturity on bonds: 7.1%; Preferred stock dividend: $7.33 per year, current market price of preferred stock is $69.83. CAPM data for common equity risk-free rate is 4.5%, market risk premium for the average stock is 10.4%, ABC has a beta of 0.88. ABC's marginal tax rate is 40%. - Target capital structure: 61% debt, 5% preferred stock and 34% common equity. Yield to maturity on bonds: 72%; Preferred stock dividend: $7.13 per year, current market price of preferred stock is $69.63. CAPM data for common equity risk-free rate is 4.5%, market risk premium for the average stock is 5.9%, ABC has a beta of 1.50. ABC's marginal tax rate is 40%. Target capital structure: 48% debt, 5% preferred stock and 47% common equity. Yield to maturity on bonds: 7.9% Preferred stock dividend: $6.99 per year, current market price of preferred stock is $69.49. CAPM data for common equity risk-free rate is 4.2%, market risk premium for the average stock is 4.1%; ABC has a bela of 2.19. ABC'S marginal tax rate is 40% QUESTION 7 Use the information below to estimate the beta of ABC's stock for each of these situations The expected return on ABC's stock is 14.7%, the risk free rate is 6.0%, and the expected return for the average stock A. 0.74 in the stock market is 17.7%. B. 0.61 The expected return on ABC's stock is 11.3%, the risk tree rate is 70%, and the expected return for the average stock C.0.53 in the stock market is 14.0%. D.0.67 The expected return on ABC's stock is 6.2%, the risk free rate is 3.0%, and the expected return for the average stock E. 0.89 in the stock market is 9.0% The expected return on ABC's stock is 10.0%, the risk free rate is 2.0%, and the expected return for the average stock in the stock market is 11.0% - The expected return on ABC's stock is 7.0%, the risk free rate is 5.0%, and the expected return for the average stock in the stock market is 8.0% QUESTION 2 Match the yield to maturity to each of these bonds. Each pays interest semi-annually What is the yield to maturity for a $1,000 par value bond with 8 years to maturity that has a coupon rate of 5.7% and currently sells for $956.70? - What is the yield to maturity for a $1,000 par value bond with 6 years to maturity that has a coupon rate of 5.9% and currently sells for $985.16? What is the yield to maturity for a $1,000 par value bond with 15 years to maturity that has a coupon rate of 6.6% and currently sells for $972.24? What is the yield to maturity for a $1,000 par value bond with 9 years to maturity that has a coupon rate of 6.5% and currently sells for $986.64? What is the yield to maturity for a $1,000 par value bond with 12 years to maturity that has a coupon rate of 6.2% and currently sells for $951.31? A 6.80% B. 6.90% C.6.40% D.6.70% E.6.20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts