Question: QUESTION 10 A CMO is being issued with 2 tranches and a residual (same set-up as the previous question): - Tranche A has 6,000,000 in

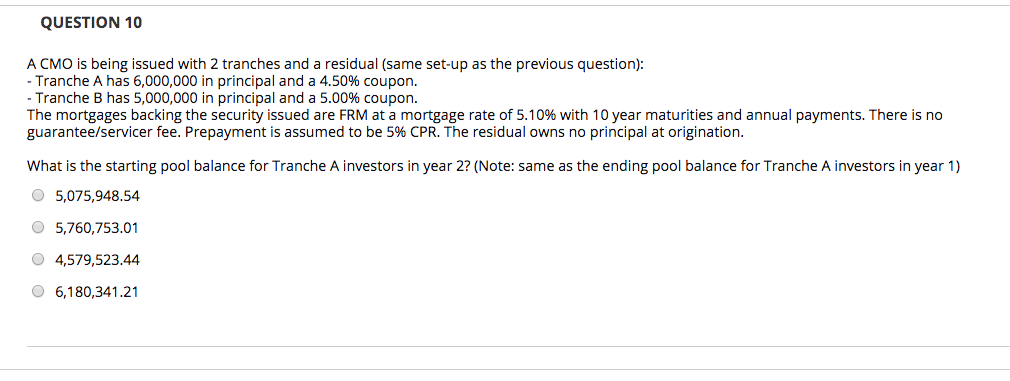

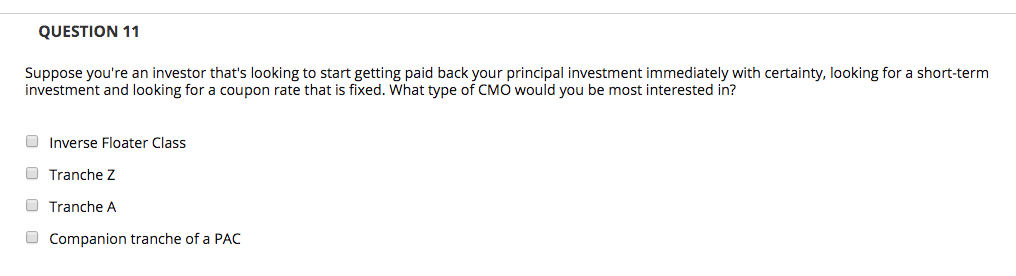

QUESTION 10 A CMO is being issued with 2 tranches and a residual (same set-up as the previous question): - Tranche A has 6,000,000 in principal and a 4.50% coupon. - Tranche B has 5,000,000 in principal and a 5.00% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 5.10% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. The residual owns no principal at origination. What is the starting pool balance for Tranche A investors in year 2? (Note: same as the ending pool balance for Tranche A investors in year 1) 5,075,948.54 5,760,753.01 4,579,523.44 6,180,341.21 QUESTION 11 Suppose you're an investor that's looking to start getting paid back your principal investment immediately with certainty, looking for a short-term investment and looking for a coupon rate that is fixed. What type of CMO would you be most interested in? Inverse Floater Class Tranche z Tranche A Companion tranche of a PAC QUESTION 10 A CMO is being issued with 2 tranches and a residual (same set-up as the previous question): - Tranche A has 6,000,000 in principal and a 4.50% coupon. - Tranche B has 5,000,000 in principal and a 5.00% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 5.10% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. The residual owns no principal at origination. What is the starting pool balance for Tranche A investors in year 2? (Note: same as the ending pool balance for Tranche A investors in year 1) 5,075,948.54 5,760,753.01 4,579,523.44 6,180,341.21 QUESTION 11 Suppose you're an investor that's looking to start getting paid back your principal investment immediately with certainty, looking for a short-term investment and looking for a coupon rate that is fixed. What type of CMO would you be most interested in? Inverse Floater Class Tranche z Tranche A Companion tranche of a PAC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts