Question: Question 10 Assume a $1,000 face value bond has a coupon rate of 6.8 percent paid semiannually and has an eight-year life. (a) If investors

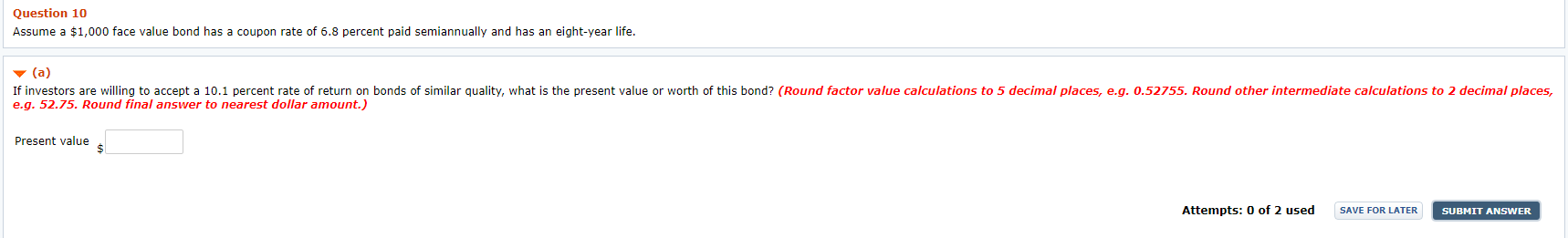

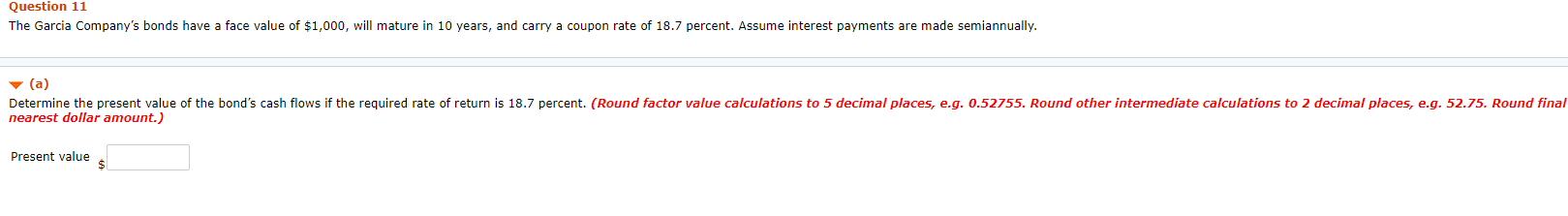

Question 10 Assume a $1,000 face value bond has a coupon rate of 6.8 percent paid semiannually and has an eight-year life. (a) If investors are willing to accept a 10.1 percent rate of return on bonds of similar quality, what is the present value or worth of this bond? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value $ Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER Question 11 The Garcia Company's bonds have a face value of $1,000, will mature in 10 years, and carry a coupon rate of 18.7 percent. Assume interest payments are made semiannually. (a) Determine the present value of the bond's cash flows if the required rate of return is 18.7 percent. (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final nearest dollar amount.) Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts