Question: question 10: b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the

question 10:

b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value.

c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share?

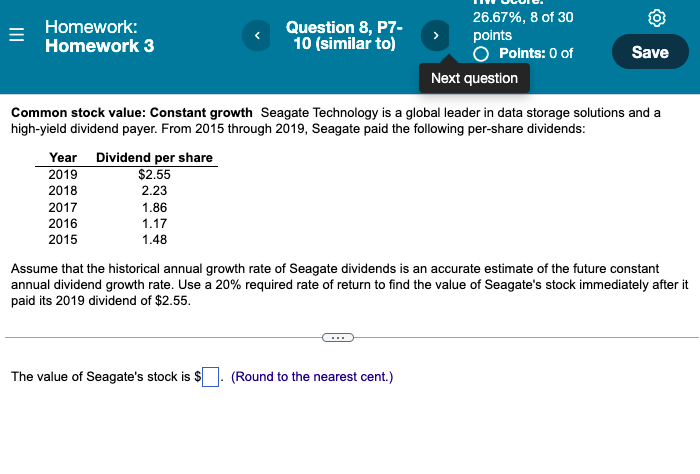

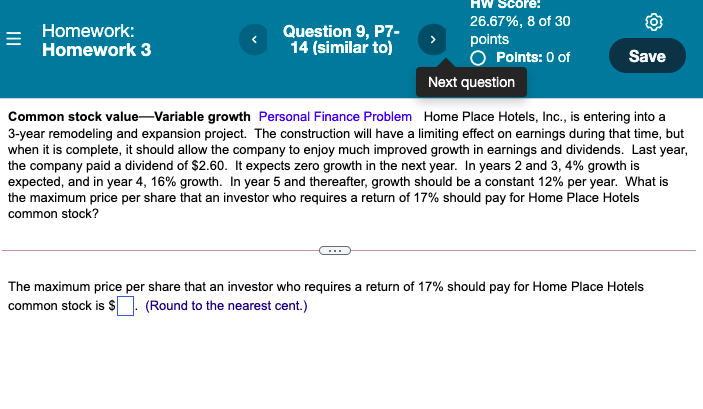

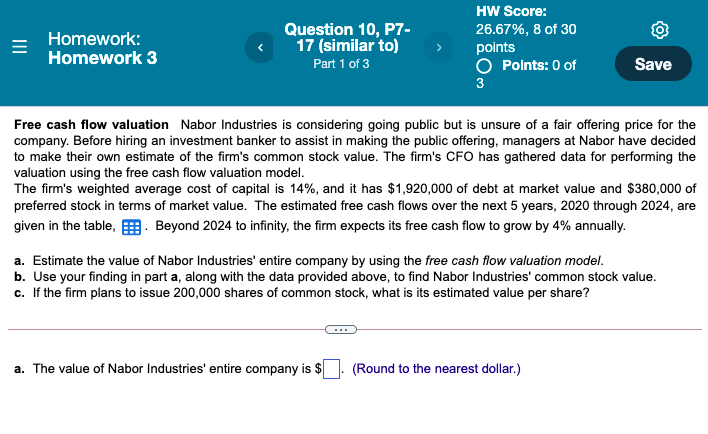

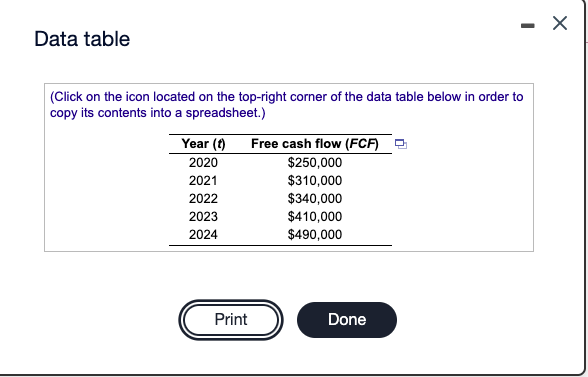

Homework: Homework 3 Question 8, P7- 10 (similar to) 26.67%, 8 of 30 points Points: 0 of Next question Save Common stock value: Constant growth Seagate Technology is a global leader in data storage solutions and a high-yield dividend payer. From 2015 through 2019, Seagate paid the following per-share dividends: Year Dividend per share 2019 $2.55 2018 2.23 2017 1.86 2016 1.17 2015 1.48 Assume that the historical annual growth rate of Seagate dividends is an accurate estimate of the future constant annual dividend growth rate. Use a 20% required rate of return to find the value of Seagate's stock immediately after it paid its 2019 dividend of $2.55. The value of Seagate's stock is $ (Round to the nearest cent.) Scor Homework: Homework 3 Question 9, P7- 14 (similar to) 26.67%, 8 of 30 points Points: 0 of Next question Save Common stock valueVariable growth Personal Finance Problem Home Place Hotels, Inc., is entering into a 3-year remodeling and expansion project. The construction will have a limiting effect on earnings during that time, but when it is complete, it should allow the company to enjoy much improved growth in earnings and dividends. Last year, the company paid a dividend of $2.60. It expects zero growth in the next year. In years 2 and 3,4% growth is expected, and in year 4, 16% growth. In year 5 and thereafter, growth should be a constant 12% per year. What is the maximum price per share that an investor who requires a return of 17% should pay for Home Place Hotels common stock? The maximum price per share that an investor who requires a return of 17% should pay for Home Place Hotels common stock is $. (Round to the nearest cent.) Homework: Homework 3 Question 10, P7- 17 (similar to) Part 1 of 3 HW Score: 26.67%, 8 of 30 points O Points: 0 of 3 Save Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 14%, and it has $1,920,000 of debt at market value and $380,000 of preferred stock in terms of market value. The estimated free cash flows over the next 5 years, 2020 through 2024, are given in the table, B. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 4% annually. a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. b. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share? a. The value of Nabor Industries' entire company is $ (Round to the nearest dollar.) x Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year (0) Free cash flow (FCA) 2020 $250,000 2021 $310,000 2022 $340,000 2023 $410,000 2024 $490,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts