Question: Question 10 below is based on the following information and assumptions: - The Milk Futures contract has contract size =100 units (multiplier). - The value

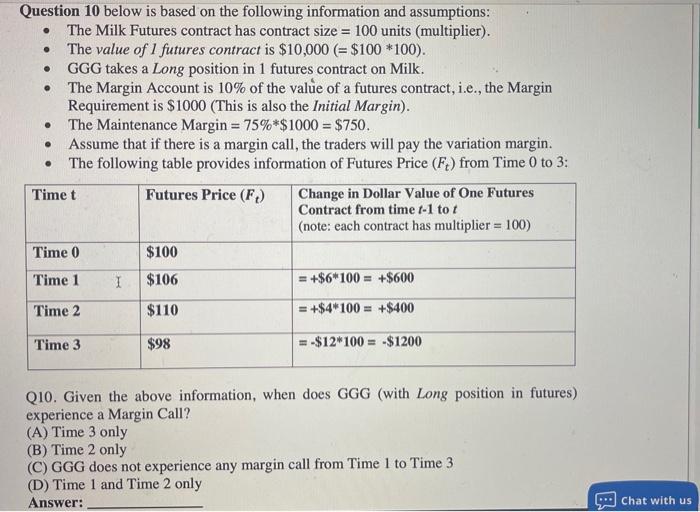

Question 10 below is based on the following information and assumptions: - The Milk Futures contract has contract size =100 units (multiplier). - The value of 1 futures contract is $10,000(=$100100). - GGG takes a Long position in 1 futures contract on Milk. - The Margin Account is 10% of the value of a futures contract, i.e., the Margin Requirement is $1000 (This is also the Initial Margin). - The Maintenance Margin =75%$1000=$750. - Assume that if there is a margin call, the traders will pay the variation margin. - The following table provides information of Futures Price (Ft) from Time 0 to 3 : Q10. Given the above information, when does GGG (with Long position in futures) experience a Margin Call? (A) Time 3 only (B) Time 2 only (C) GGG does not experience any margin call from Time 1 to Time 3 (D) Time 1 and Time 2 only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts