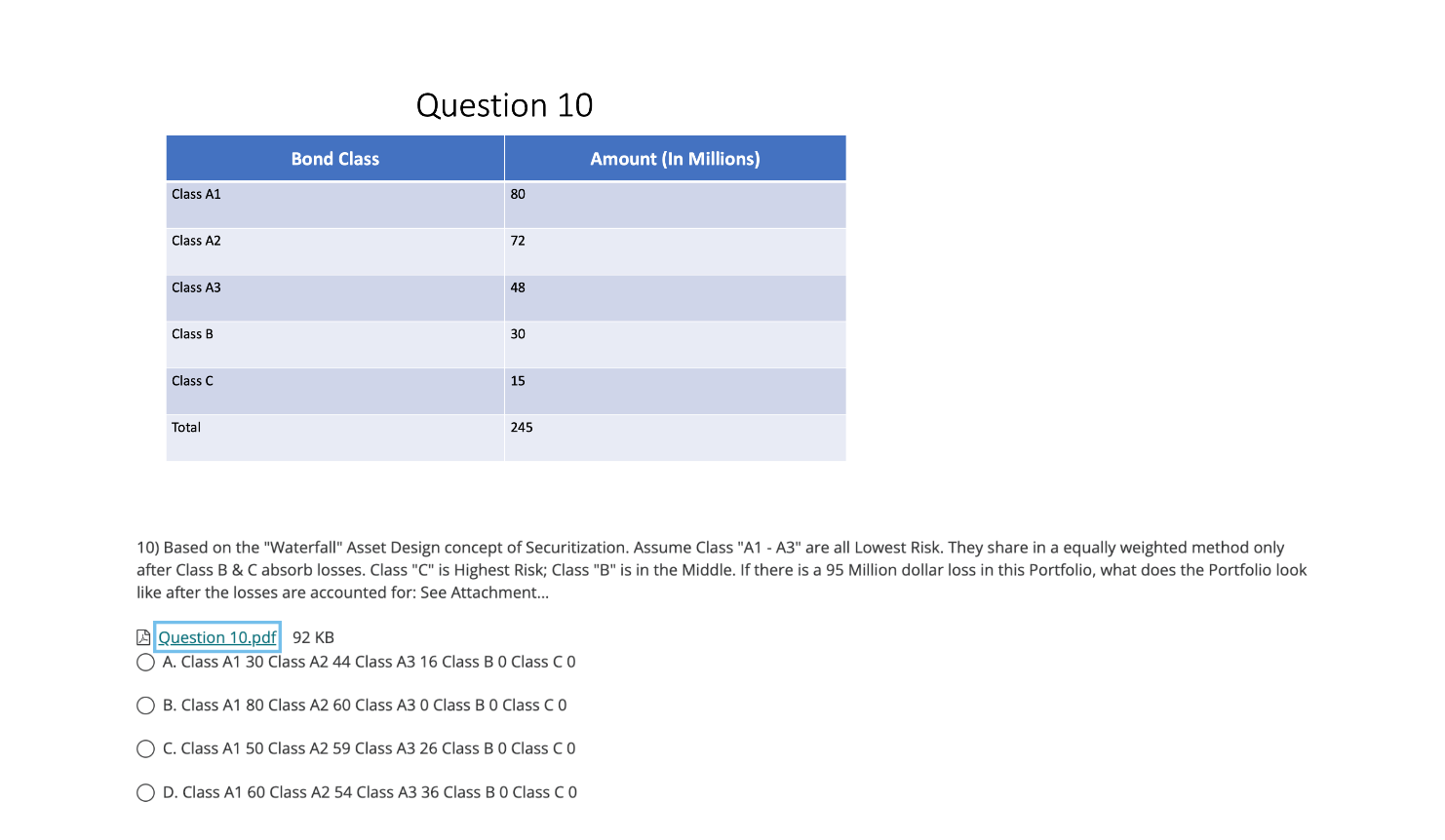

Question: Question 10 Bond Class Amount (in Millions) Class A1 80 Class A2 72 Class A3 48 Class B 30 Class C 15 Total 245 10)

Question 10 Bond Class Amount (in Millions) Class A1 80 Class A2 72 Class A3 48 Class B 30 Class C 15 Total 245 10) Based on the "Waterfall" Asset Design concept of Securitization. Assume Class "A1 - A3" are all Lowest Risk. They share in a equally weighted method only after Class B & C absorb losses. Class "C" is Highest Risk; Class "B" is in the Middle. If there is a 95 Million dollar loss in this Portfolio, what does the Portfolio look like after the losses are accounted for: See Attachment... Question 10.pdf 92 KB O A. Class A1 30 Class A2 44 Class A3 16 Class B O Class CO O B. Class A1 80 Class A2 60 Class A3 O Class B O Class CO O C. Class A1 50 Class A2 59 Class A3 26 Class B O Class CO O D. Class A1 60 Class A2 54 Class A3 36 Class B O Class CO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts