Question: Question 10 Case Study 1: Buhoath Led. is planning for the next two years of production and debating whether to construct a large cross-dook facility

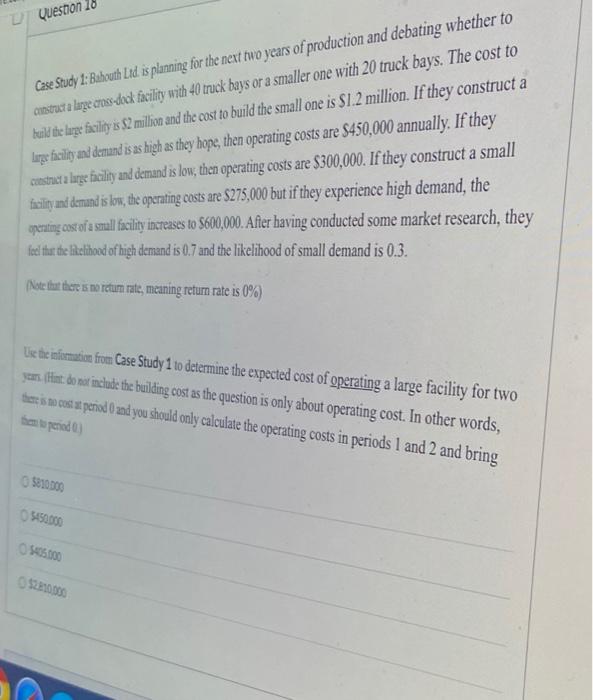

Question 10 Case Study 1: Buhoath Led. is planning for the next two years of production and debating whether to construct a large cross-dook facility with 40 truck bays or a smaller one with 20 truck bays. The cost to build the large facility is $2 million and the cost to build the small one is $1.2 million. If they construct a Large facility and demand is as high as they hope, then operating costs are $450,000 annually. If they custre a large facility and demand is low, then operating costs are $300,000. If they construct a small facility and demand is low, the operating costs are $275,000 but if they experience high demand, the operating cost of a small facility increases to $600,000. After having conducted some market research, they feel that the likelihood of high demand is 0.7 and the likelihood of small demand is 0.3. Note at there is no retum rate, meaning return rate is 0%) Lise the information from Case Study 1 to determine the expected cost of operating a large facility for two years. (Hint: do not include the building cost as the question is only about operating cost. In other words, there is no cost at period and you should only calculate the operating costs in periods 1 and 2 and bring hem period 5810300 55100 Question 10 Case Study 1: Buhoath Led. is planning for the next two years of production and debating whether to construct a large cross-dook facility with 40 truck bays or a smaller one with 20 truck bays. The cost to build the large facility is $2 million and the cost to build the small one is $1.2 million. If they construct a Large facility and demand is as high as they hope, then operating costs are $450,000 annually. If they custre a large facility and demand is low, then operating costs are $300,000. If they construct a small facility and demand is low, the operating costs are $275,000 but if they experience high demand, the operating cost of a small facility increases to $600,000. After having conducted some market research, they feel that the likelihood of high demand is 0.7 and the likelihood of small demand is 0.3. Note at there is no retum rate, meaning return rate is 0%) Lise the information from Case Study 1 to determine the expected cost of operating a large facility for two years. (Hint: do not include the building cost as the question is only about operating cost. In other words, there is no cost at period and you should only calculate the operating costs in periods 1 and 2 and bring hem period 5810300 55100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts