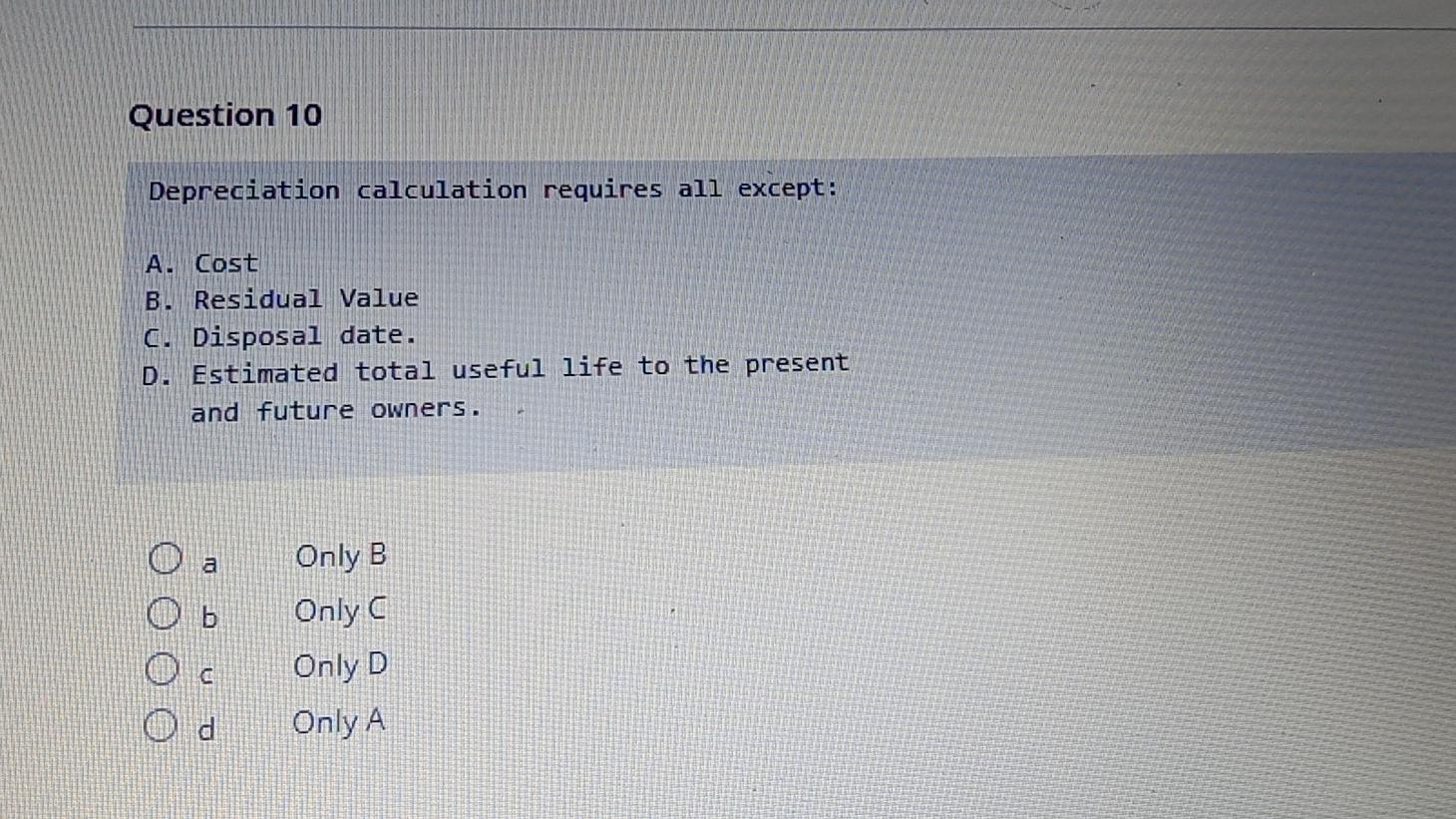

Question: Question 10 Depreciation calculation requires all except: A. Cost B. Residual Value C. Disposal date. D. Estimated total useful life to the present and future

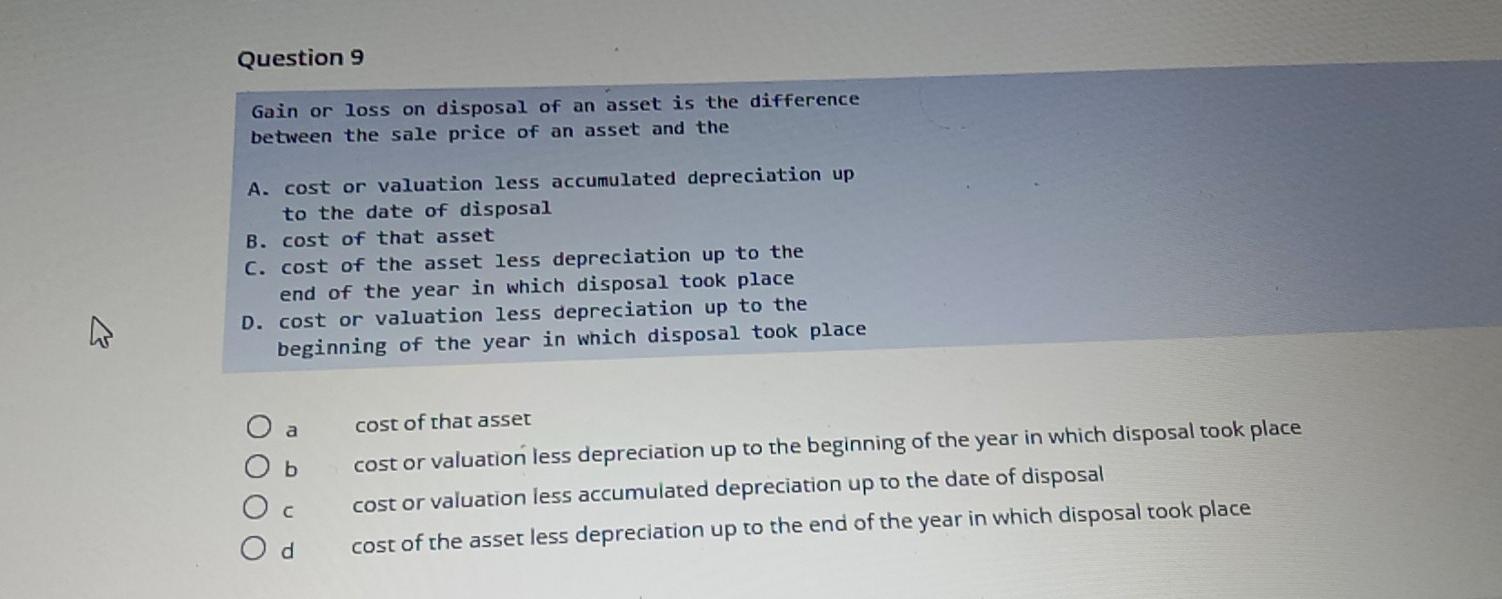

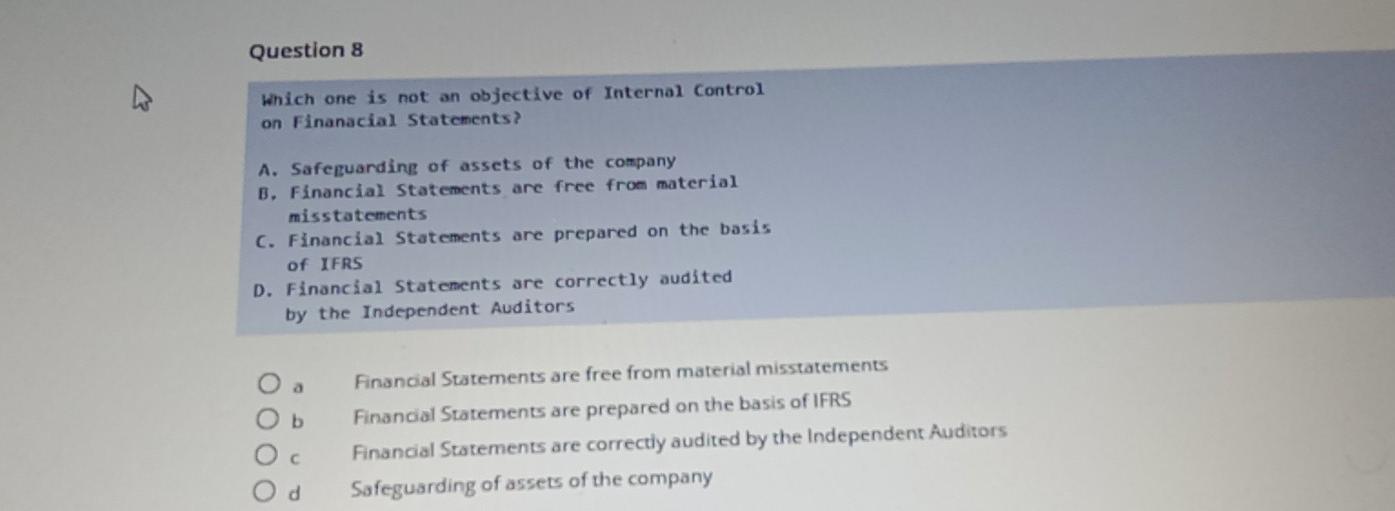

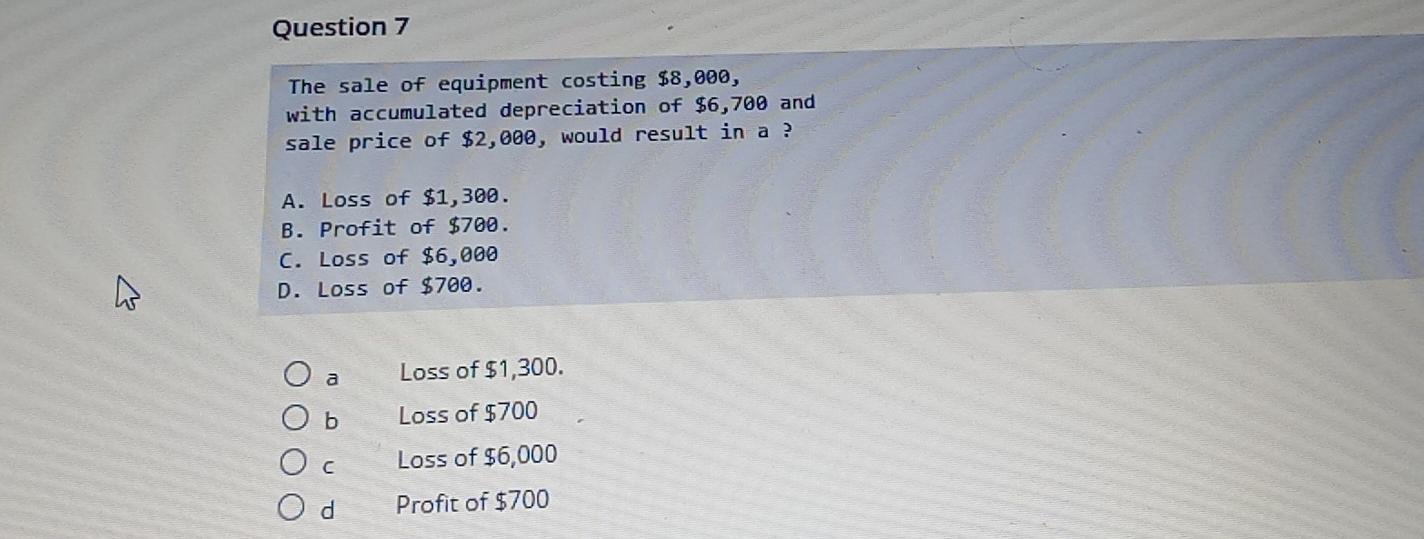

Question 10 Depreciation calculation requires all except: A. Cost B. Residual Value C. Disposal date. D. Estimated total useful life to the present and future owners. a Only B Only C Only D Only A C Question 9 Gain or loss on disposal of an asset is the difference between the sale price of an asset and the A. cost or valuation less accumulated depreciation up to the date of disposal B. cost of that asset C. cost of the asset less depreciation up to the end of the year in which disposal took place D. cost or valuation less depreciation up to the beginning of the year in which disposal took place 27 cost of that asset cost or valuation less depreciation up to the beginning of the year in which disposal took place cost or valuation less accumulated depreciation up to the date of disposal cost of the asset less depreciation up to the end of the year in which disposal took place d Question 8 Which one is not an objective of Internal Control on Finanacial Statements? A. Safeguarding of assets of the company B. Financial Statements are free from material misstatements C. Financial Statements are prepared on the basis of IFRS D. Financial Statements are correctly audited by the Independent Auditors Financial Statements are free from material misstatements Financial Statements are prepared on the basis of IFRS Financial Statements are correctly audited by the Independent Auditors Safeguarding of assets of the company d Question 7 The sale of equipment costing $8,000, with accumulated depreciation of $6,700 and sale price of $2,000, would result in a ? A. Loss of $1,300. B. Profit of $700. C. Loss of $6,000 D. Loss of $700. a Loss of $1,300. O O b Loss of $700 Loss of $6,000 d Profit of $700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts