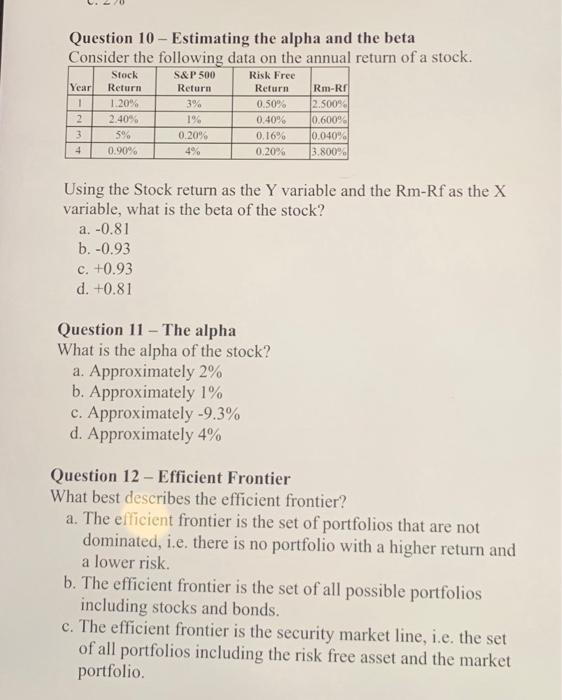

Question: Question 10 - Estimating the alpha and the beta Consider the following data on the annual return of a stock. Using the Stock return as

Question 10 - Estimating the alpha and the beta Consider the following data on the annual return of a stock. Using the Stock return as the Y variable and the RmRf as the X variable, what is the beta of the stock? a. -0.81 b. -0.93 c. +0.93 d. +0.81 Question 11 - The alpha What is the alpha of the stock? a. Approximately 2% b. Approximately 1% c. Approximately 9.3% d. Approximately 4% Question 12 - Efficient Frontier What best describes the efficient frontier? a. The efficient frontier is the set of portfolios that are not dominated, i.e. there is no portfolio with a higher return and a lower risk. b. The efficient frontier is the set of all possible portfolios including stocks and bonds. c. The efficient frontier is the security market line, i.e. the set of all portfolios including the risk free asset and the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts