Question: QUESTION 10 In the above $110K allocation problem, if you decided to allocate 30% weight in A, 50% weight in B, 20% weight in C,

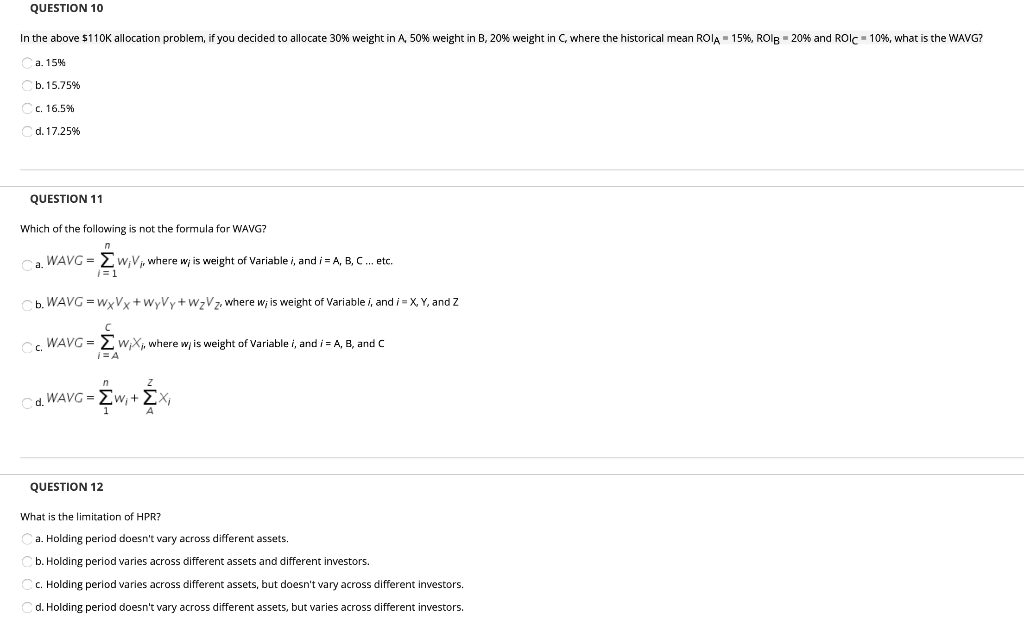

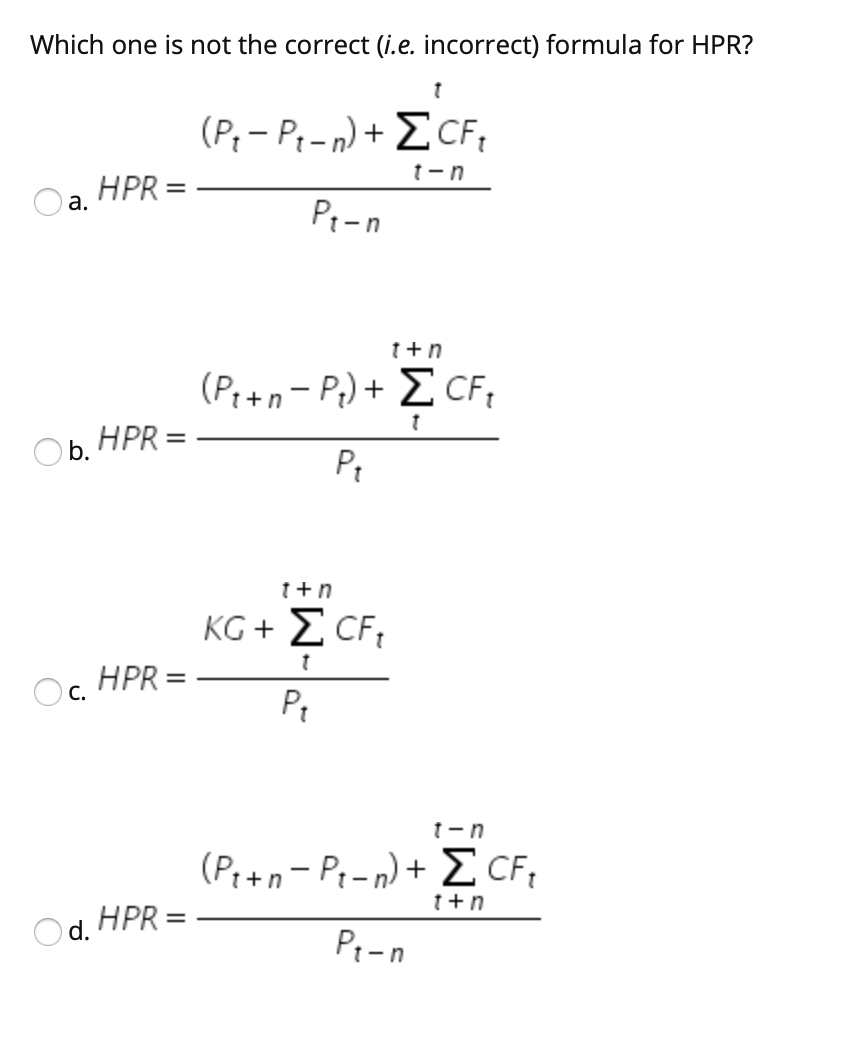

QUESTION 10 In the above $110K allocation problem, if you decided to allocate 30% weight in A, 50% weight in B, 20% weight in C, where the historical mean ROIA - 15%, ROIB - 20% and ROIC -10%, what is the WAVG? a. 15% b. 15.75% c. 16.5% d. 17.25% QUESTION 11 Which of the following is not the formula for WAVG? Ca WAVG = wiVi, where wj is weight of Variable i, and i = A, B, C...etc. 1 = 1 Cb. WAVG = WyVx+wyVy + WzV7, where w; is weight of Variable i, andi - X, Y, and Z CC WAVG = w;X;, where w is weight of Variable i, and i = A, B, and C i = A z Cd. WAVG = Ew;+ Exi A QUESTION 12 What is the limitation of HPR? Ca. Holding period doesn't vary across different assets. Cb. Holding period varies across different assets and different investors. Cc. Holding period varies across different assets, but doesn't vary across different investors. Cd. Holding period doesn't vary across different assets, but varies across different investors. Which one is not the correct (i.e. incorrect) formula for HPR? 1 (P,- Pe-n) + CF, HPR= Pen t-n a. f+n (Pe+n-P)+ CF, HPR= P. t Ob. t+n KG + CF, t Oc. HPR P t-n (Pe+n-Pe-n) + CF, t+n HPR Pron

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts