Question: Question 10 is correct, please answer question 11, thanks! Question 10 2 pts Given the following information: Current Interest Rate is 3% There are 3

Question 10 is correct, please answer question 11, thanks!

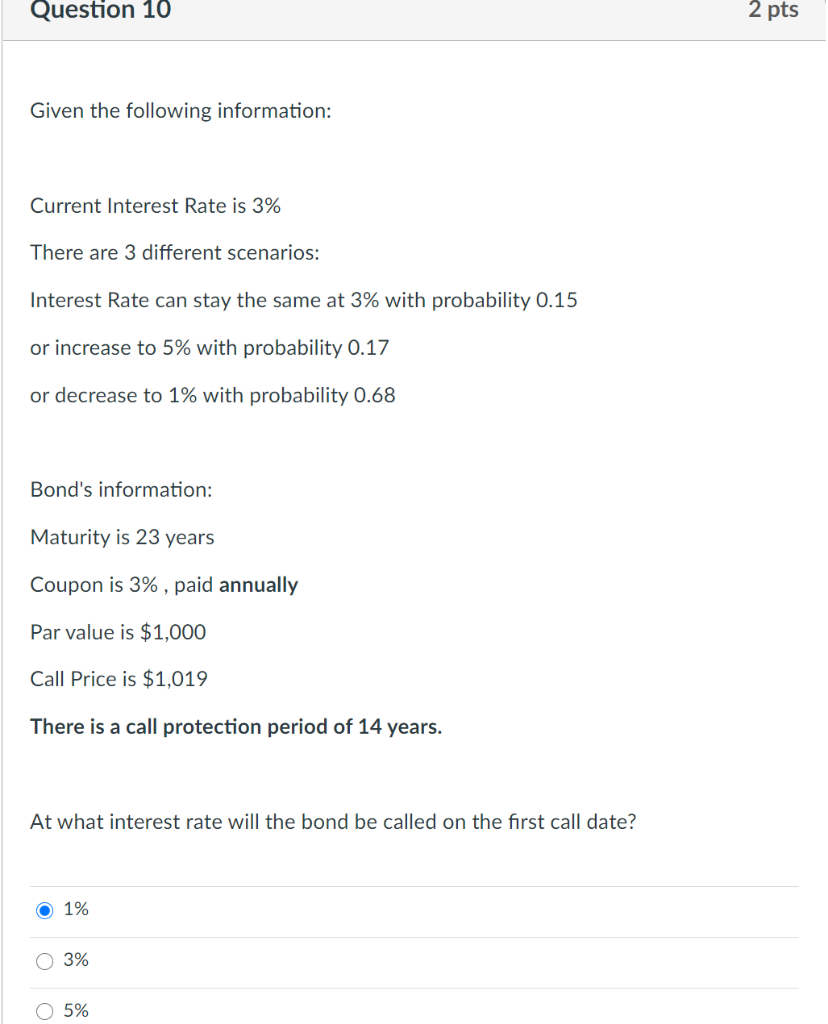

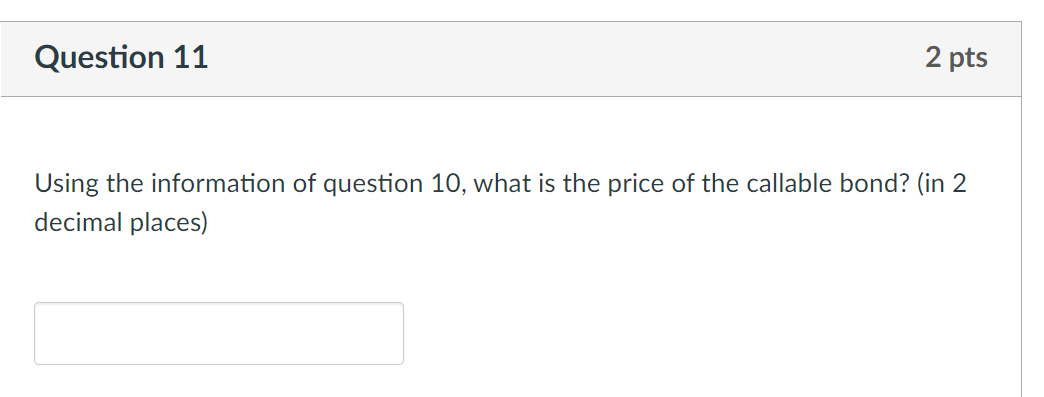

Question 10 2 pts Given the following information: Current Interest Rate is 3% There are 3 different scenarios: Interest Rate can stay the same at 3% with probability 0.15 or increase to 5% with probability 0.17 or decrease to 1% with probability 0.68 Bond's information: Maturity is 23 years Coupon is 3% , paid annually Par value is $1,000 Call Price is $1,019 There is a call protection period of 14 years. At what interest rate will the bond be called on the first call date? O 1% O 3% O 5% Question 11 2 pts Using the information of question 10, what is the price of the callable bond? (in 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts