Question: Question 10 Longhorn Software has just completed an R&D project that required borrowing $70 million in senior debt from a bank This R&D effort has

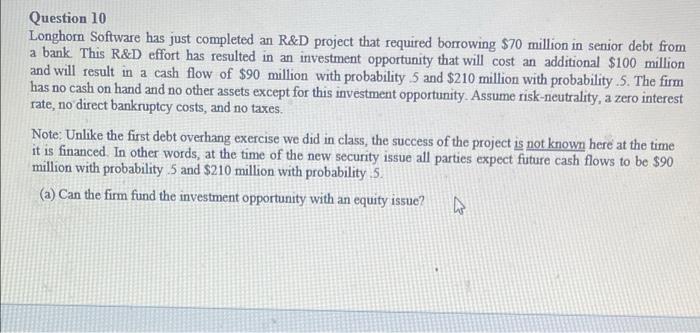

Question 10 Longhorn Software has just completed an R&D project that required borrowing $70 million in senior debt from a bank This R&D effort has resulted in an investment opportunity that will cost an additional $100 million and will result in a cash flow of $90 million with probability 5 and $210 million with probability 5. The firm has no cash on hand and no other assets except for this investment opportunity. Assume risk-neutrality, a zero interest rate, no direct bankruptcy costs, and no taxes. Note: Unlike the first debt overhang exercise we did in class, the success of the project is not known here at the time it is financed. In other words, at the time of the new security issue all parties expect future cash flows to be $90 million with probability 5 and $210 million with probability 5. (a) Can the firm fund the investment opportunity with an equity issue? N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts