Question: Question 10 Lorre Co. needs 200,000 Canadian dollars (C$) in 90 days and is trying to determine whether or not to hedge this position. Lorre

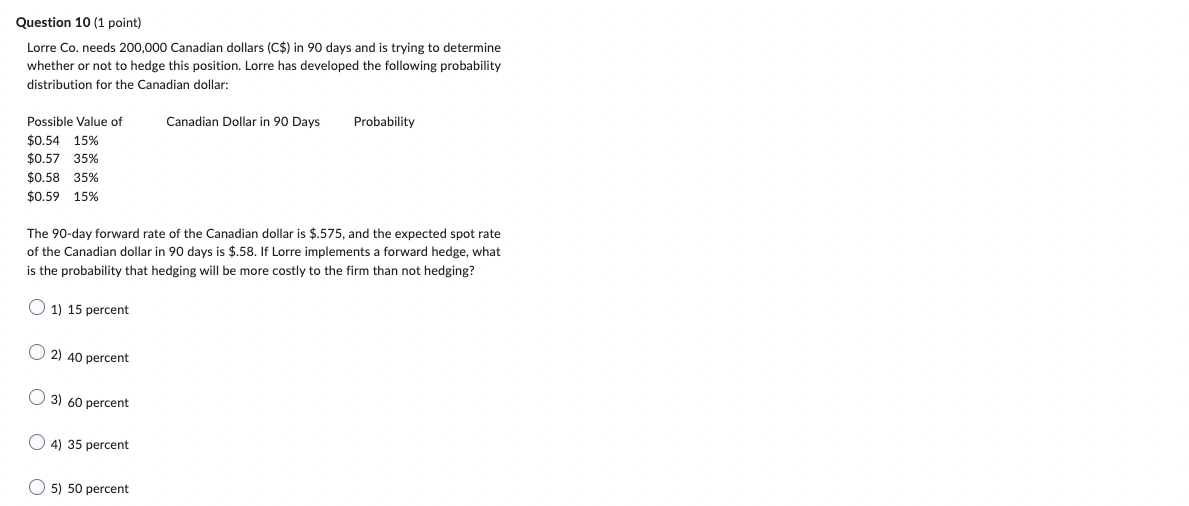

Question 10 Lorre Co. needs 200,000 Canadian dollars (C$) in 90 days and is trying to determine whether or not to hedge this position. Lorre has developed the following probability distribution for the Canadian dollar: Possible Value of Canadian Dollar in 90 Days Probability $0.54 15% $0.57 35% $0.58 35% $0.59 15% The 90-day forward rate of the Canadian dollar is $.575, and the expected spot rate of the Canadian dollar in 90 days is $.58. If Lorre implements a forward hedge, what is the probability that hedging will be more costly to the firm than not hedging? Question 10 options: 1) 15 percent 2) 40 percent 3) 60 percent 4) 35 percent 5) 50 percent

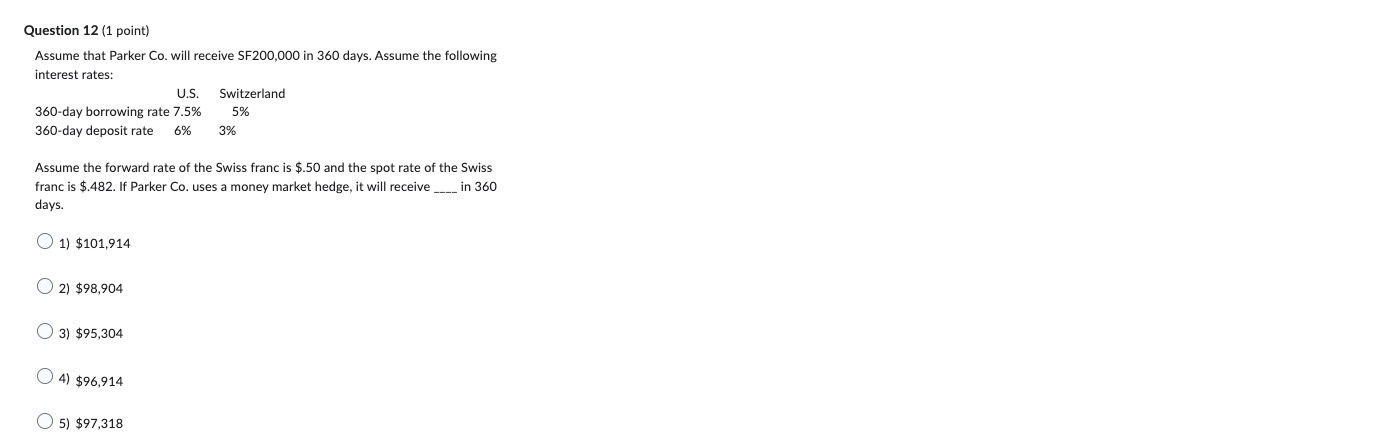

Question 12 Assume that Parker Co. will receive SF200,000 in 360 days. Assume the following interest rates: U.S. Switzerland 360-day borrowing rate 7.5% 5% 360-day deposit rate 6% 3% Assume the forward rate of the Swiss franc is $.50 and the spot rate of the Swiss franc is $.482. If Parker Co. uses a money market hedge, it will receive ____ in 360 days. Question 12 options: 1) $101,914 2) $98,904 3) $95,304 4) $96,914 5) $97,318

Question 10 (1 point) Lorre Co. needs 200,000 Canadian dollars (C\$) in 90 days and is trying to determine whether or not to hedge this position. Lorre has developed the following probability distribution for the Canadian dollar: The 90-day forward rate of the Canadian dollar is $.575, and the expected spot rate of the Canadian dollar in 90 days is $.58. If Lorre implements a forward hedge, what is the probability that hedging will be more costly to the firm than not hedging? 1) 15 percent 2) 40 percent 3) 60 percent 4) 35 percent 5) 50 percent Question 12 (1 point) Assume that Parker Co. will receive SF200,000 in 360 days. Assume the following interest rates: Assume the forward rate of the Swiss franc is $.50 and the spot rate of the Swiss franc is $.482. If Parker Co. uses a money market hedge, it will receive in 360 days. 1) $101,914 2) $98,904 3) $95,304 4) $96,914 5) $97,318

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts