Question: Question 10 Not yet answered Marked out of 25.00 P Flag question A $5,800 par bond with an annual coupon has only one year until

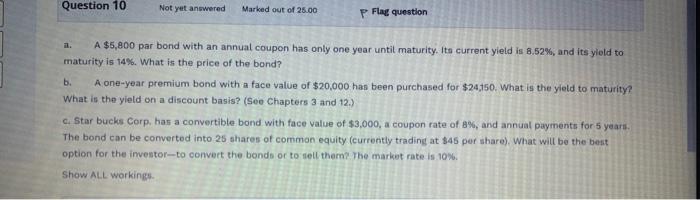

Question 10 Not yet answered Marked out of 25.00 P Flag question A $5,800 par bond with an annual coupon has only one year until maturity. Its current yield is 8.52%, and its yield to maturity is 14%. What is the price of the bond? b. A one-year premium bond with a face value of $20,000 has been purchased for $24,150. What is the yield to maturity? What is the yield on a discount basis? (See Chapters 3 and 12.) c. Starbucks Corp, has a convertible bond with face value of $3,000, a coupon rate of 8%, and annual payments for 5 years The bond can be converted into 25 shares of common equity (currently trading at $45 per share). What will be the best option for the inventor-to convert the bonds or to sell there. The market rate is 10%. Show ALL working

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts