Question: QUESTION 10 Practice calculating the Present Value with non-annual compounding (Section 5-15 and Video) What is the present value of a security that will pay

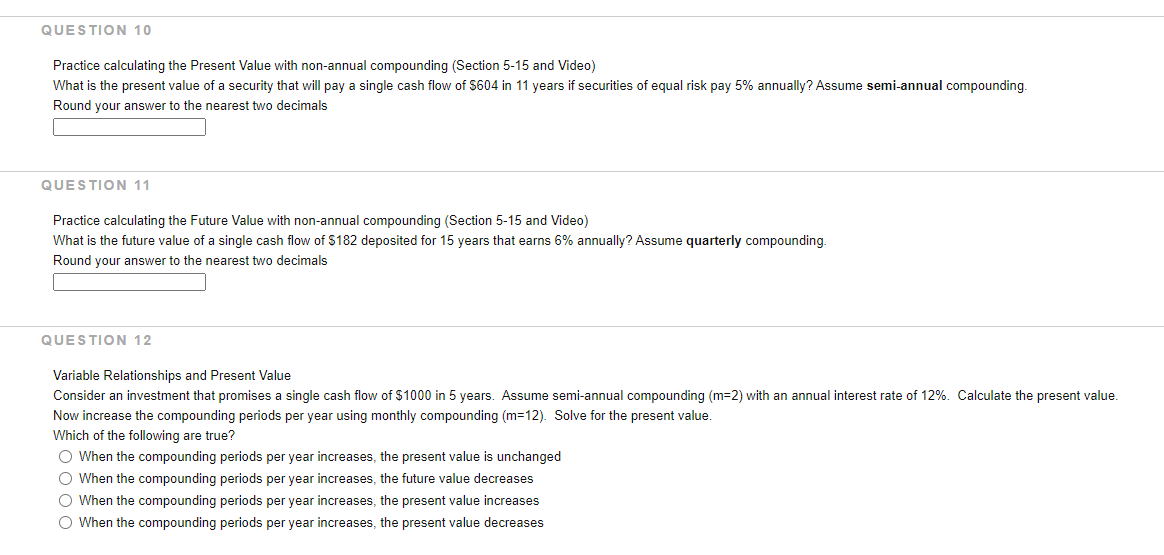

QUESTION 10 Practice calculating the Present Value with non-annual compounding (Section 5-15 and Video) What is the present value of a security that will pay a single cash flow of $604 in 11 years if securities of equal risk pay 5% annually? Assume semi-annual compounding. Round your answer to the nearest two decimals QUESTION 11 Practice calculating the Future Value with non-annual compounding (Section 5-15 and Video) What is the future value of a single cash flow of $182 deposited for 15 years that earns 6% annually? Assume quarterly compounding. Round your answer to the nearest two decimals QUESTION 12 Variable Relationships and Present Value Consider an investment that promises a single cash flow of $1000 in 5 years. Assume semi-annual compounding (m=2) with an annual interest rate of 12%. Calculate the present value. Now increase the compounding periods per year using monthly compounding (m=12). Solve for the present value. Which of the following are true? When the compounding periods per year increases, the present value is unchanged When the compounding periods per year increases, the future value decreases O When the compounding periods per year increases, the present value increases When the compounding periods per year increases, the present value decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts