Question: Question 10: Question 11: Ch 08-Assignment - Risk and Rates of Return Ar analyst belioves that inflation is going to increase by 2,0% over the

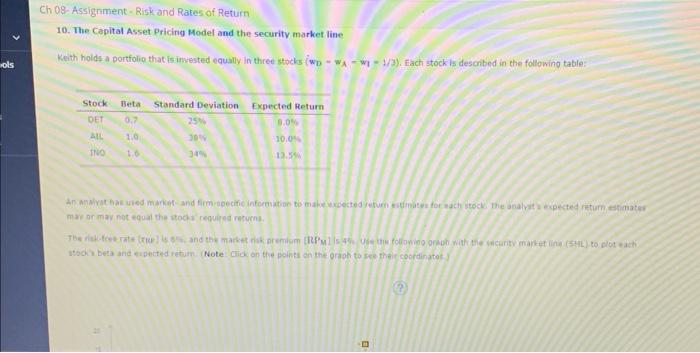

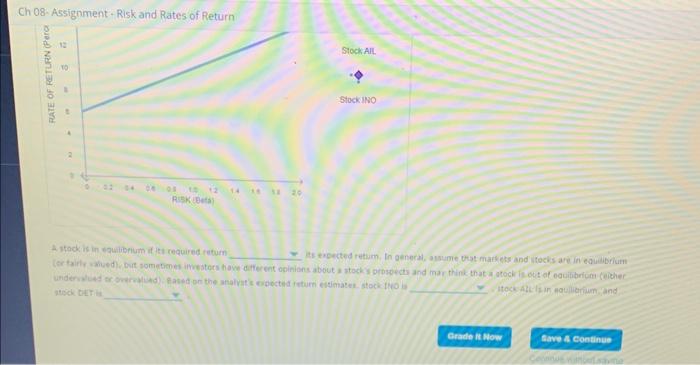

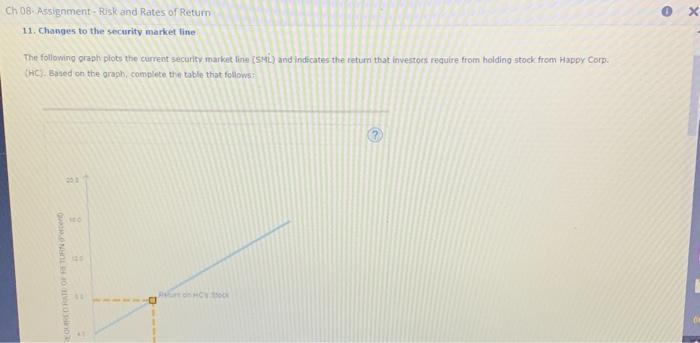

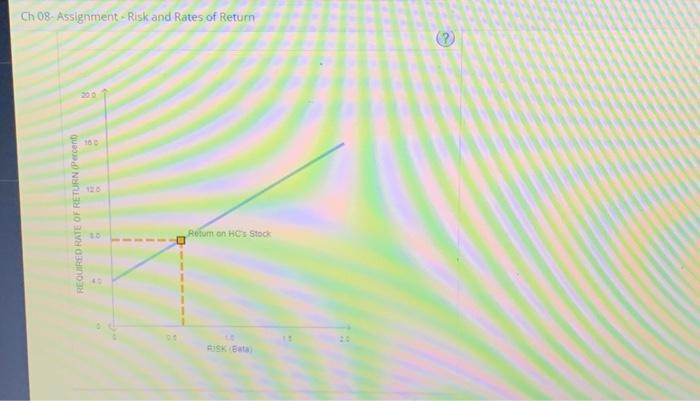

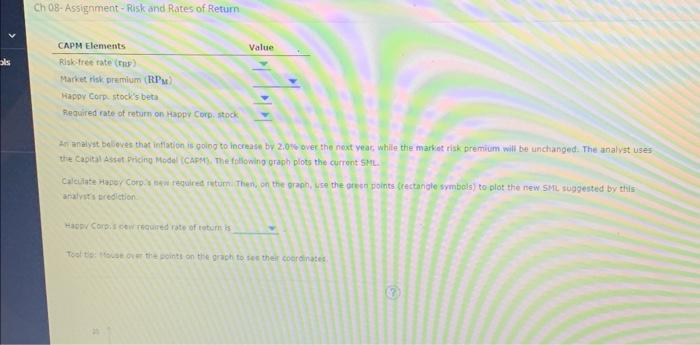

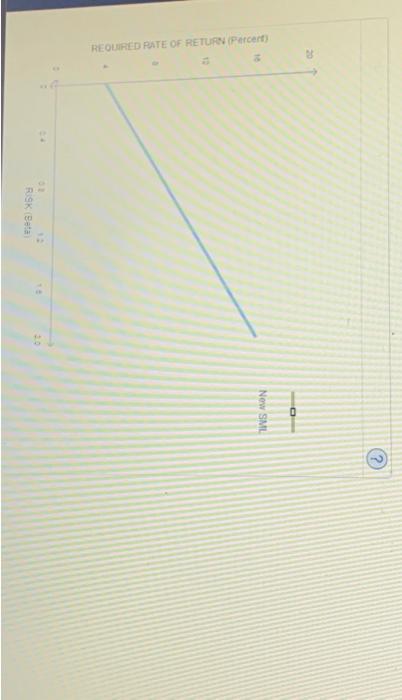

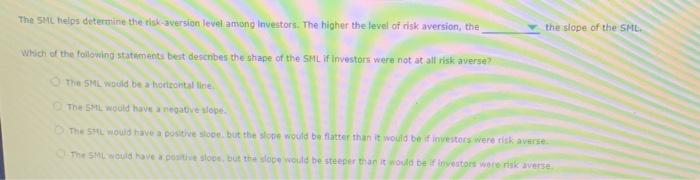

Ch 08-Assignment - Risk and Rates of Return Ar analyst belioves that inflation is going to increase by 2,0\% over the noxt vear, white the market risk premium will be unchanged. The analyst uses aralyats tecoliction. Haper Conpis cew rfouired rate of toturn ks Test te: Helat or the points on the grach to ses their coerdinates. Ch 08- Assignment - Risk and Rates of Return Ch 08-Assignment - Risk and Rates of Return Stockill. stockino A stock is in tauiberium if tet required return itock Ale lis in noulierium and Ch 08-Assignment - Risk and Rates of Return The following oraph plots the current security market line (Su4i) and indicates- the return that investocs require from holding stock from Happy Corp. (HC), Based on the gragh, complece the table that follows: Tha SML helps deteruine the tisk-aversion level among investors. The higher the level of risk aversion, the the slope of the SML. Which of the following statements bet deschbes the shape of the SML if Investork were not at all risk averse? h 08-Assignment - Risk and Rates of Return 10. The Capital Asset Pricing Model and the security market line Keith holds a portfolio that is imvested equally in three stocks (wDwAwI1/3). Fach stock is described in the following table: mas or mav not equal the stock requihed resurns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts