Question: Question #10 See the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2022. Expenses other than

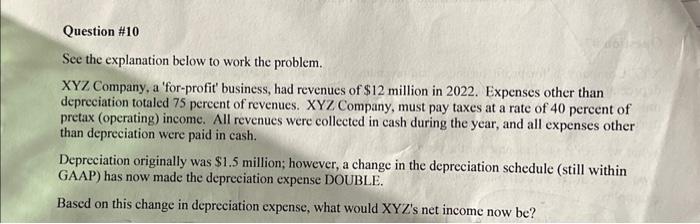

Question \#10 See the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2022. Expenses other than depreciation totaled 75 percent of revenues. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $1.5 million; however, a change in the depreciation schedule (still within GAAP) has now made the depreciation expense DOUBLE. Based on this change in depreciation expense, what would XYZ's net income now be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts