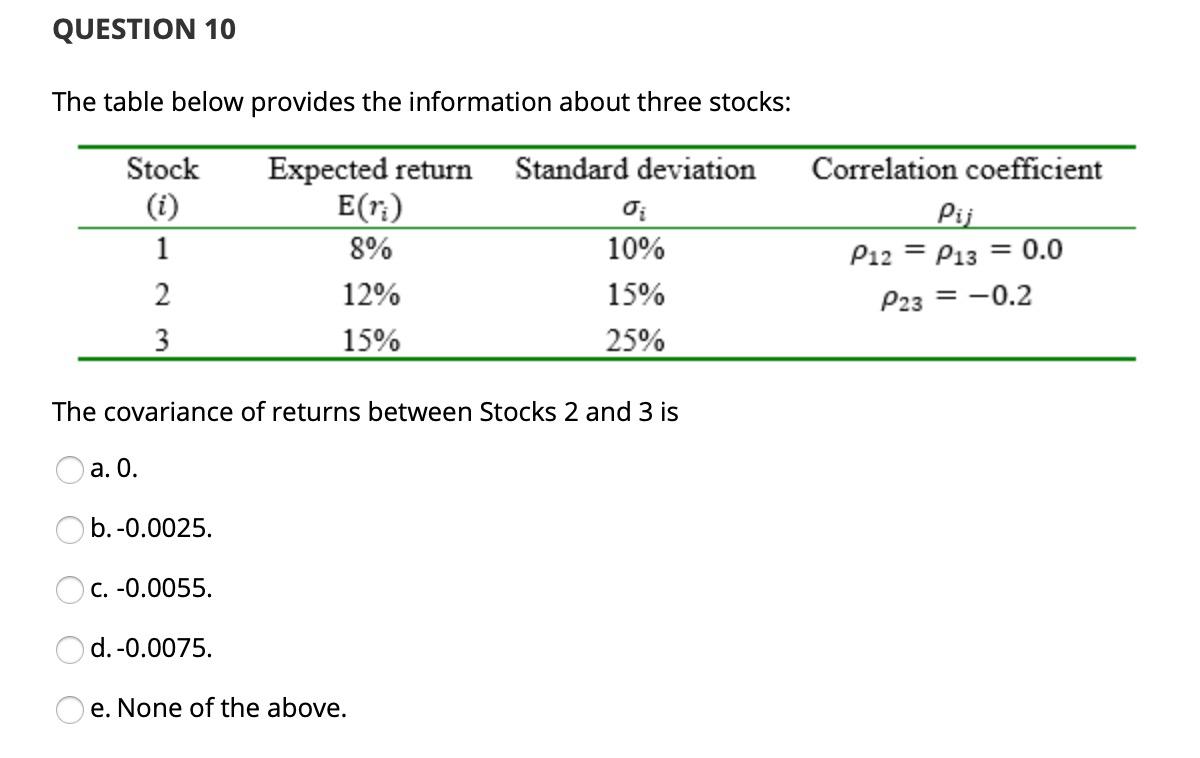

Question: QUESTION 10 The table below provides the information about three stocks: Stock Expected return Eri) 8% 12% 15% Standard deviation o; 10% 15% 25% Correlation

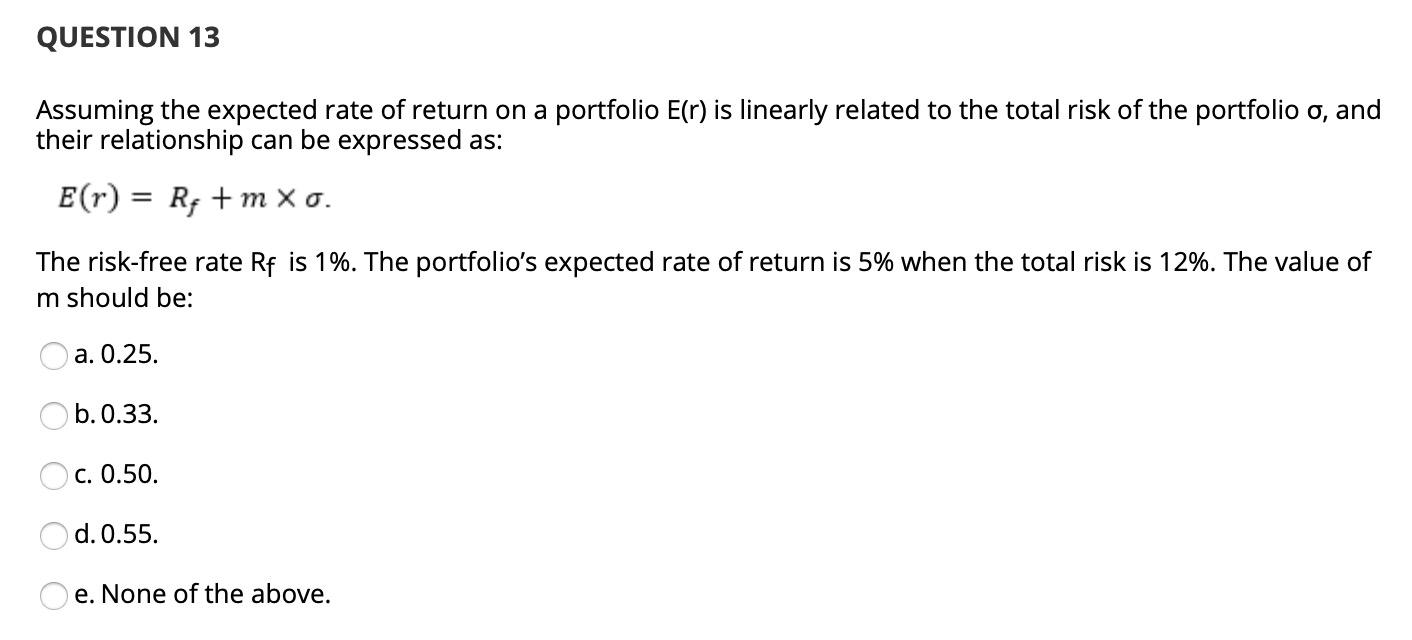

QUESTION 10 The table below provides the information about three stocks: Stock Expected return Eri) 8% 12% 15% Standard deviation o; 10% 15% 25% Correlation coefficient Pij P12 = P13 = 0.0 P23 = -0.2 2 3 The covariance of returns between Stocks 2 and 3 is a. O. b.-0.0025. C. -0.0055. d. -0.0075. e. None of the above. QUESTION 13 Assuming the expected rate of return on a portfolio E(r) is linearly related to the total risk of the portfolio o, and their relationship can be expressed as: E(r) = Rp + m Xo. The risk-free rate Rf is 1%. The portfolio's expected rate of return is 5% when the total risk is 12%. The value of m should be: a. 0.25. b.0.33. c. 0.50. d. 0.55. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts