Question: Question 10 There a need for regulatory discipline when there is the market discipline to control the banking Datory discipline reduces the regulation cost to

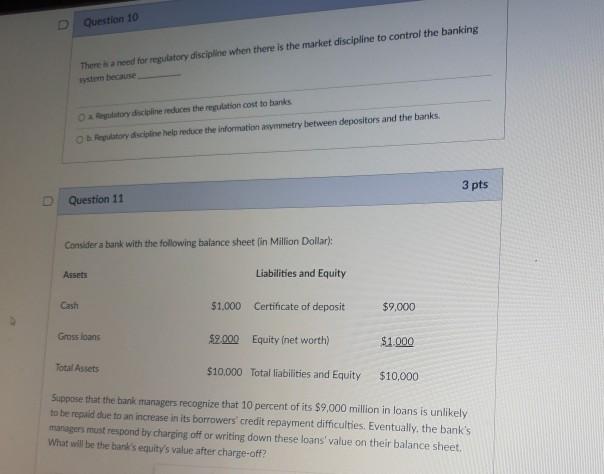

Question 10 There a need for regulatory discipline when there is the market discipline to control the banking Datory discipline reduces the regulation cost to banks Opatory disease help reduce the information asymmetry between depositors and the banks. 3 pts Question 11 Consider a bank with the following balance sheet (in Million Dollar): Assets Liabilities and Equity Cash 51.000 Certificate of deposit $9,000 Grass loans $2.000 Equity fnet worth) $1.000 Total Assets $10.000 Total liabilities and Equity $10,000 Suppose that the bank managers recognize that 10 percent of its $9.000 million in loans is unlikely to be repaid due to an increase in its borrowers' credit repayment difficulties. Eventually, the bank's managers must respond by charging off or writing down these loans' value on their balance sheet. What will be the bank's equity's value after charge-off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts