Question: QUESTION 10??? The project's expected NPV is about $60,000 and the probability of a negative NPV is about 20%. The project's IRR = 79.47% The

QUESTION 10???

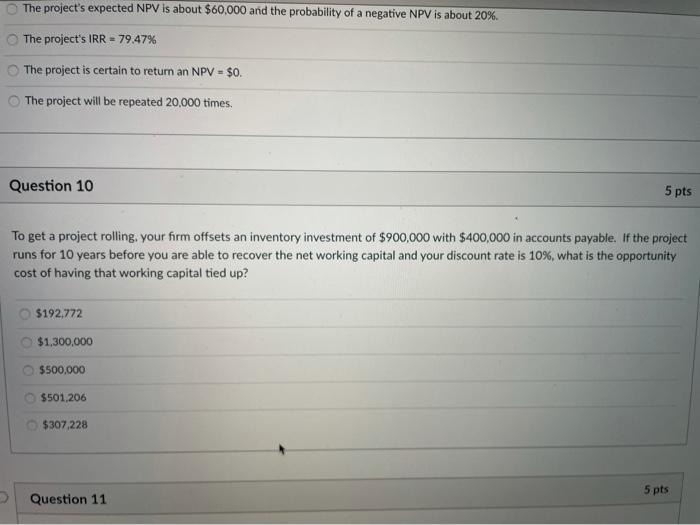

The project's expected NPV is about $60,000 and the probability of a negative NPV is about 20%. The project's IRR = 79.47% The project is certain to return an NPV - $0. The project will be repeated 20,000 times. Question 10 5 pts To get a project rolling, your firm offsets an inventory investment of $900,000 with $400,000 in accounts payable. If the project runs for 10 years before you are able to recover the net working capital and your discount rate is 10%, what is the opportunity cost of having that working capital tied up? $192,772 $1,300,000 $500,000 $501,206 $307,228 5 pts Question 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts