Question: QUESTION 10 When Ben Jones decided to start his own business, he needed to borrow a large sum. He was able to borrow $500,000 from

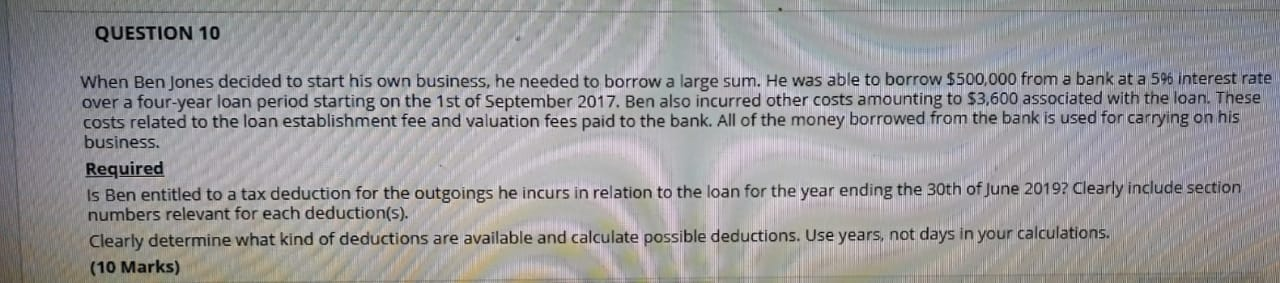

QUESTION 10 When Ben Jones decided to start his own business, he needed to borrow a large sum. He was able to borrow $500,000 from a bank at a 5% interest rate over a four-year loan period starting on the 1st of September 2017. Ben also incurred other costs amounting to $3,600 associated with the loan. These costs related to the loan establishment fee and valuation fees paid to the bank. All of the money borrowed from the bank is used for carrying on his business. Required Is Ben entitled to a tax deduction for the outgoings he incurs in relation to the loan for the year ending the 30th of June 20192 Clearly include section numbers relevant for each deduction(s). Clearly determine what kind of deductions are available and calculate possible deductions. Use years, not days in your calculations. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts