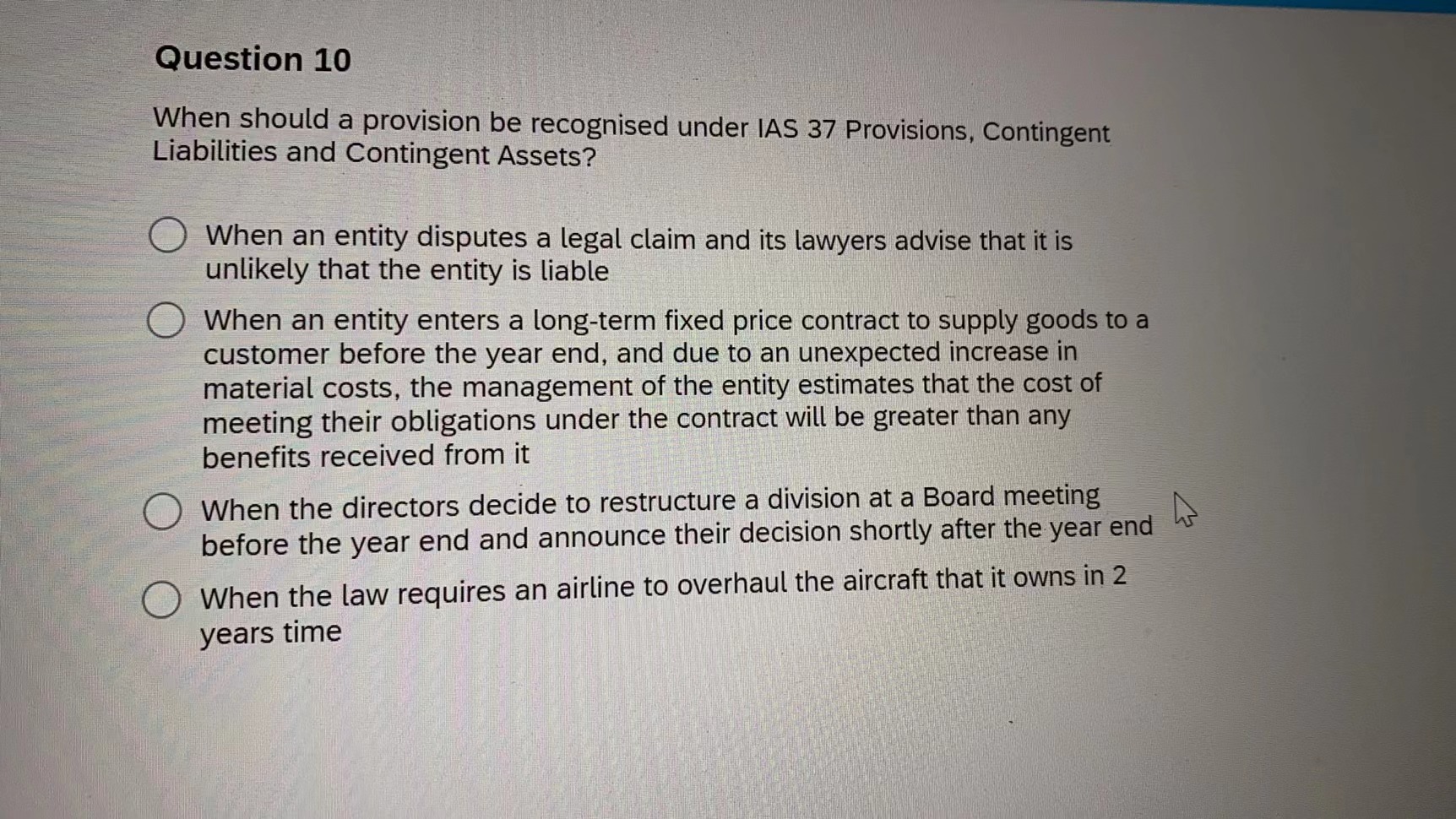

Question: Question 10 When should a provision be recognised under IAS 37 Provisions, Contingent Liabilities and Contingent Assets? When an entity disputes a legal claim and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts