Question: question 10,11,12 Question 10 (Chapter 8) Please determine Pete's depreciation deduction (without $179 expensing or first year additional depreciation). Pete acquired the following new assets

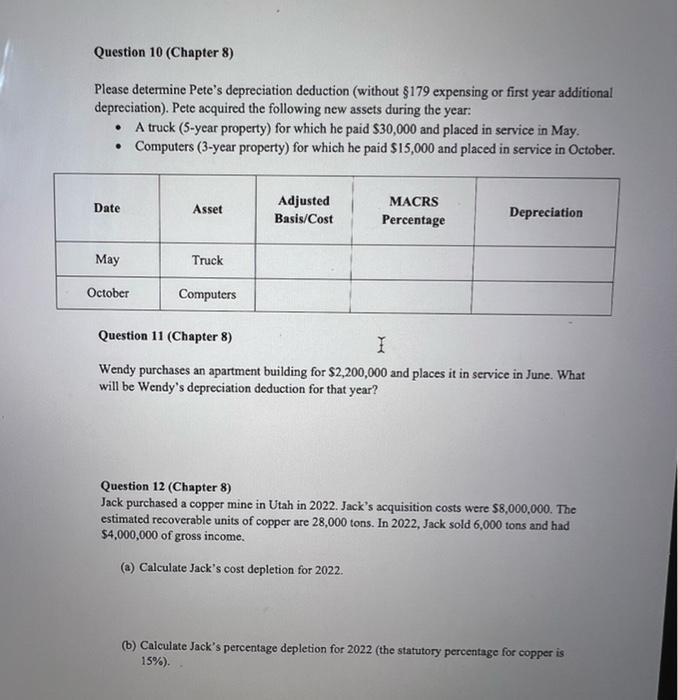

Question 10 (Chapter 8) Please determine Pete's depreciation deduction (without $179 expensing or first year additional depreciation). Pete acquired the following new assets during the year: - A truck ( 5 -year property) for which he paid $30,000 and placed in service in May. - Computers (3-year property) for which he paid $15,000 and placed in service in October. Question 11 (Chapter 8) Wendy purchases an apartment building for $2,200,000 and places it in service in June. What will be Wendy's depreciation deduction for that year? Question 12 (Chapter 8) Jack purchased a copper mine in Utah in 2022. Jack's acquisition costs were $8,000,000. The estimated recoverable units of copper are 28,000 tons. In 2022 , Jack sold 6,000 tons and had $4,000,000 of gross income. (a) Calculate Jack's cost depletion for 2022. (b) Calculate Jack's percentage depletion for 2022 (the statutory percentage for copper is 15%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts