Question: question 10.5 CHAPTER 10 Forecasting Financial Statements Should you ed next year? increase, is the increase a result of volume growth, pc that the firm's

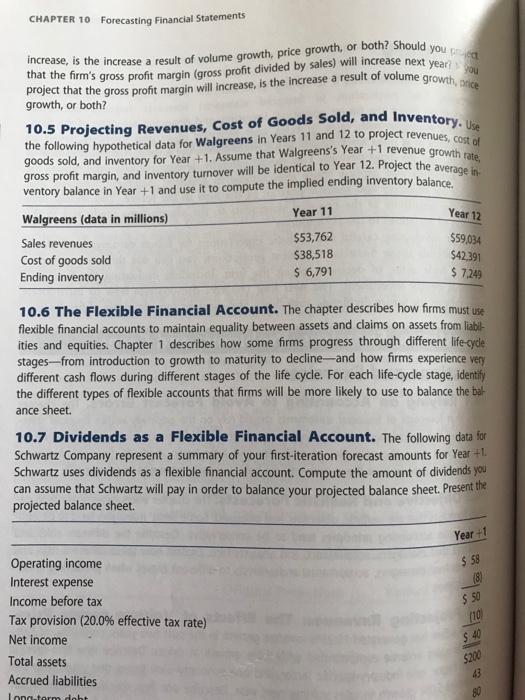

CHAPTER 10 Forecasting Financial Statements Should you ed next year? increase, is the increase a result of volume growth, pc that the firm's project that th growth, or both? gross profit margin (gross profit divided by sales) will increase e gross profit margin will increase, is the increase a result of volume a result of volume growth, price growth, or both? Should 10.5 Projecting Revenues, Cost of Goods Sold, and Inventory the following hypothetical data for Walgreens in Years 11 and 12 to project reven goods sold, and inventory for Year +1. Assume that Walgreens's Year +1 revenue growth gross profit margin, and inventory turnover will be identical to Year 12. Project the av ventory balance in Year +1 and use it to compute the implied ending inventory balance. average in- Year 11 $53,762 $38,518 6,791 Year 12 Walgreens (data in millions) Sales revenues Cost of goods sold Ending inventory $59,034 $42391 7,249 10.6 The Flexible Financial Account. The chapter describes how firms must use flexible financial accounts to maintain equality between assets and claims on assets from liabil- ities and equities. Chapter 1 describes how some firms progress through different life-cyde stages-from introduction to growth to maturity to decline-and how firms experience very different cash flows during different stages of the life cycle. For each life-cycle stage, identify the different types of flexible accounts that firms will be more likely to use to balance the ba ance sheet. 10.7 Dividends as a Flexible Financial Account. The following data for Schwartz Company represent a summary of your first-iteration forecast amounts for Year +1. Schwartz uses dividends as a flexible financial account. Compute the amount of dividends you can assume that Schwartz will pay in order to balance your projected balance sheet. Present the projected balance sheet. Year +1 58 Operating income Interest expense Income before tax Tax provision (20.0% effective tax rate) Net income Total assets Accrued liabilities 40 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts