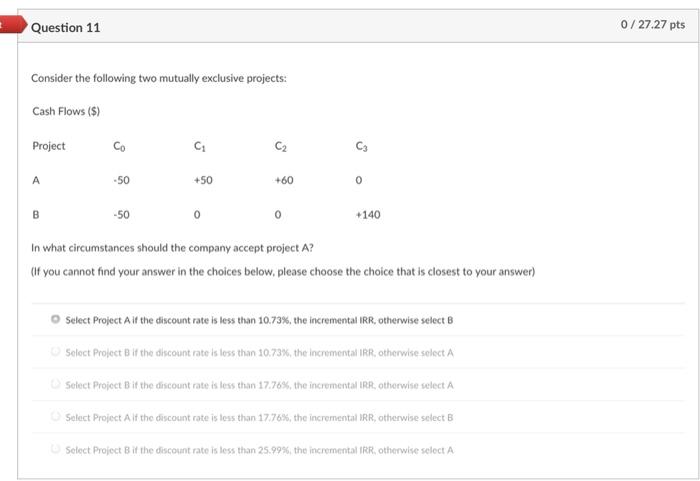

Question: Question 11 0/ 27.27 pts Consider the following two mutually exclusive projects: Cash Flows (s) Project C C2 C3 A -50 +50 +60 0 B

Question 11 0/ 27.27 pts Consider the following two mutually exclusive projects: Cash Flows (s) Project C C2 C3 A -50 +50 +60 0 B -50 0 +140 In what circumstances should the company accept project A? Oif you cannot find your answer in the choices below, please choose the choice that is closest to your answer) Select Project A if the discount rate is less than 10.73%, the incremental IRR, otherwise select B Select Project Bit the discount rate is loss than 10.73%, the incremental IRR, otherwise select A Select Project Bit the discount rate is less than 17.76%, the incremental IRA, otherwise select A Select Project Alf the discount rate is less than 17.76%, the incremental RR, otherwise select B Select Project Bit the discount rate is less than 25.99% the incremental IRR, otherwise select A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts