Question: Question 11 (1 point) Freeman Software is considering a new project whose data are shown below. The equipment that would be used has a 3-year

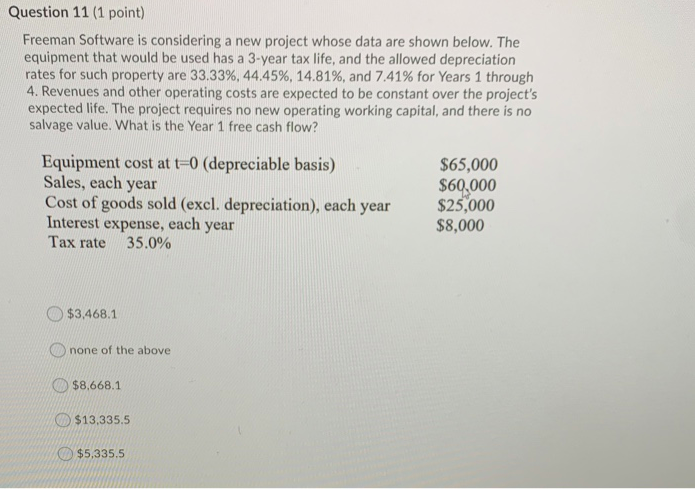

Question 11 (1 point) Freeman Software is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, and the allowed depreciation rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's expected life. The project requires no new operating working capital, and there is no salvage value. What is the Year 1 free cash flow? Equipment cost at t=0 (depreciable basis) Sales, each year Cost of goods sold (excl. depreciation), each year Interest expense, each year Tax rate 35.0% $65,000 $60,000 $25,000 $8,000 $3,468.1 none of the above $8,668.1 $13,335.5 $5,335.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts