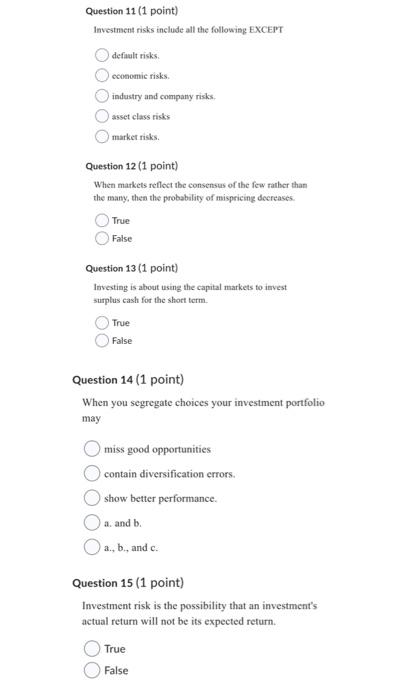

Question: Question 11 (1 point) Investment risks include all the following EXCEPT default risks. economic risks. industry and company risks. ssset class risks market risks. Question

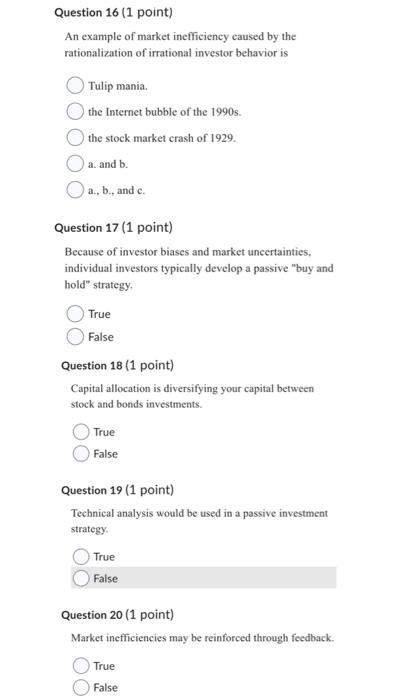

Question 11 (1 point) Investment risks include all the following EXCEPT default risks. economic risks. industry and company risks. ssset class risks market risks. Question 12 (1 point) When markets reflect tbe consensus of the few rather than the many, then the probability of mispricing doereases. True False Question 13 (1 point) Irvesting is about using the capital markets to invest surplus cash for the short term. True False Question 14 (1 point) When you segregate choices your investment portfolio may miss good opportunities contain diversification crrors. show better performance. a. and b. a., b., and c. Question 15 (1 point) Investment risk is the possibility that an investment's actual return will not be its expected refurn. True False An example of market inefficiency caused by the rationalization of irrational investor behavior is Tulip mania. the Internet bubble of the 1990s. the stock market crash of 1929. a. and b. a., b., and c. Question 17 (1 point) Because of investor biases and market uncertainties, individual investors typically develop a passive "buy and hold" strategy. True False Question 18 (1 point) Capital allocation is diversifying your capital between stock and bonds investments. True False Question 19 (1 point) Technical analysis would be used in a passive investment strategy. True False Question 20 ( 1 point) Market inefficiencies may be reinforced through feedback. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts