Question: Question 11 (1 point) Listen S8 - Part 3 - line 8 OR 10 This is the amount of enhanced CPP contributions Anna may have

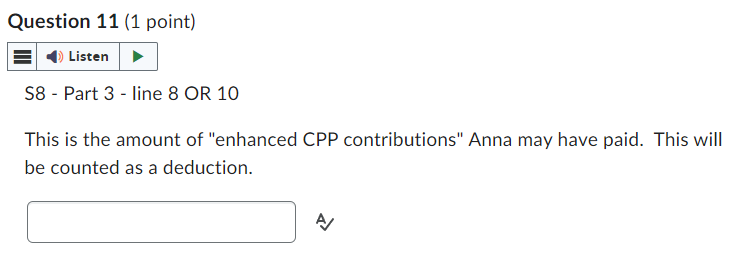

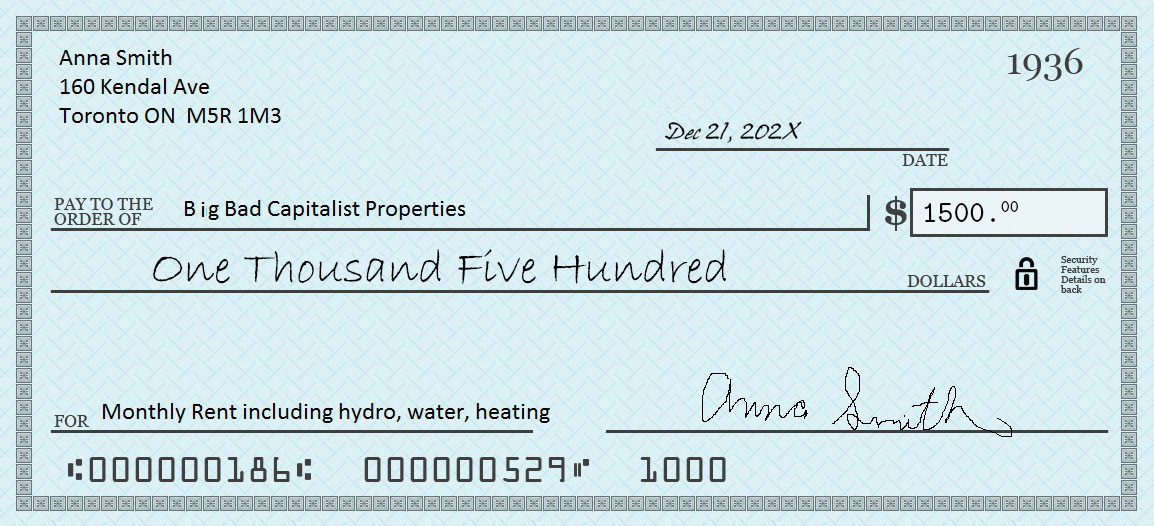

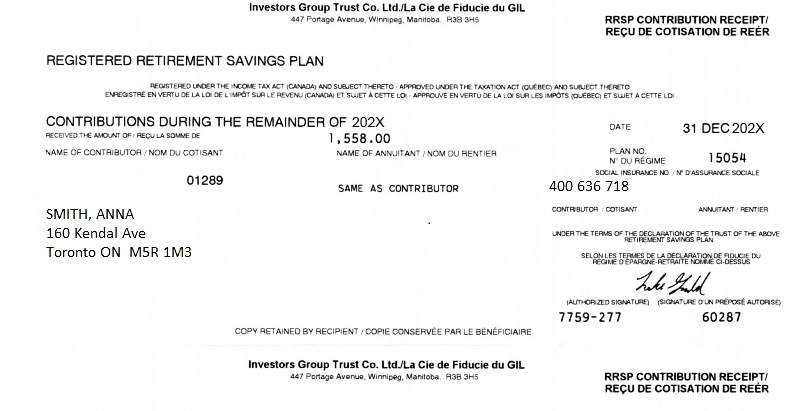

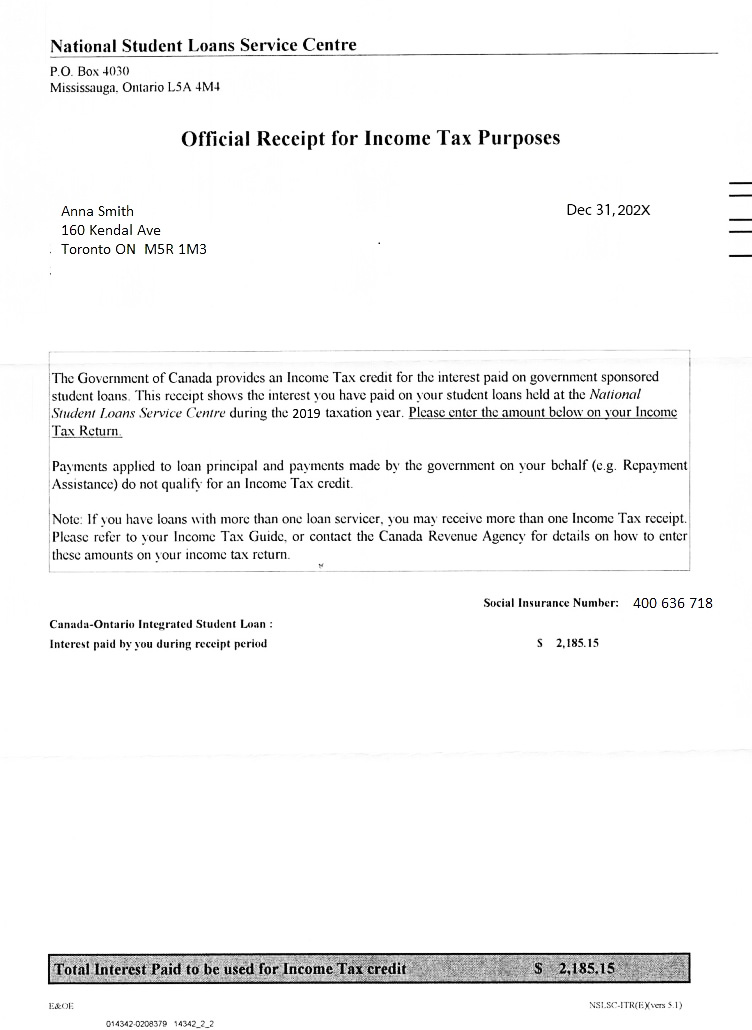

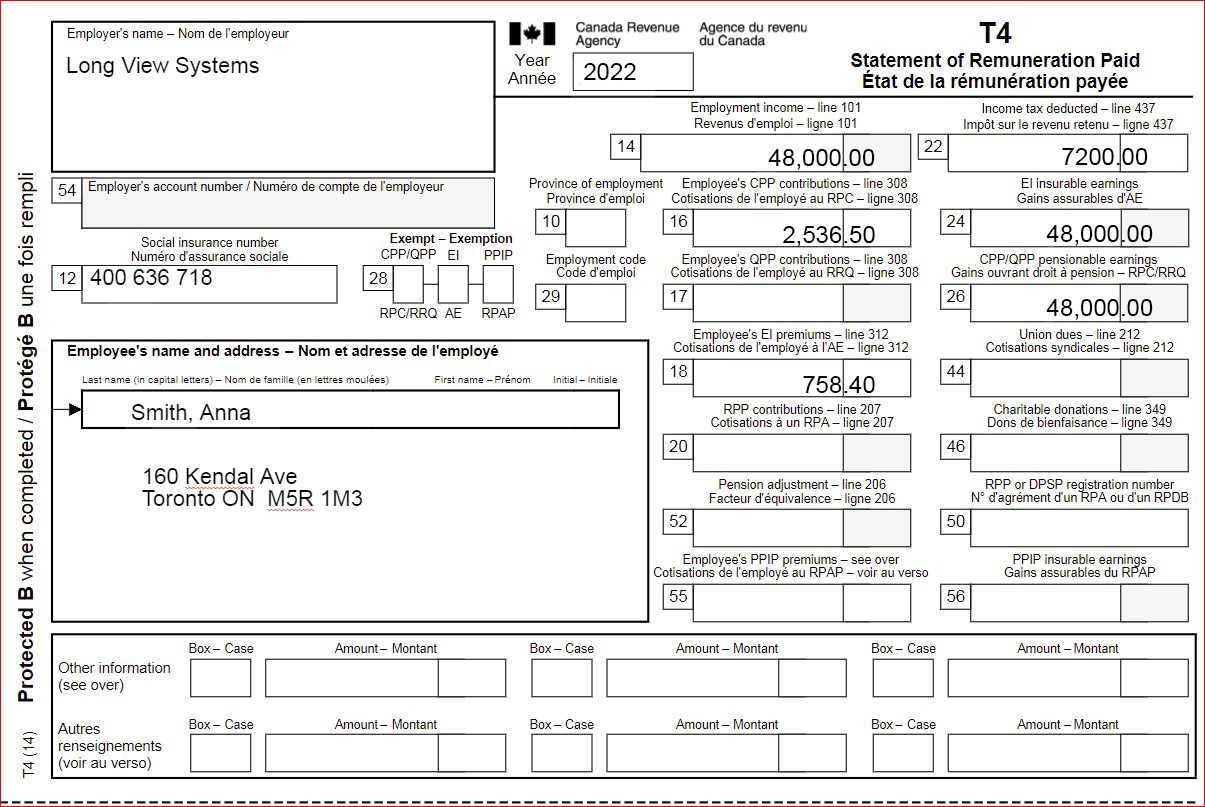

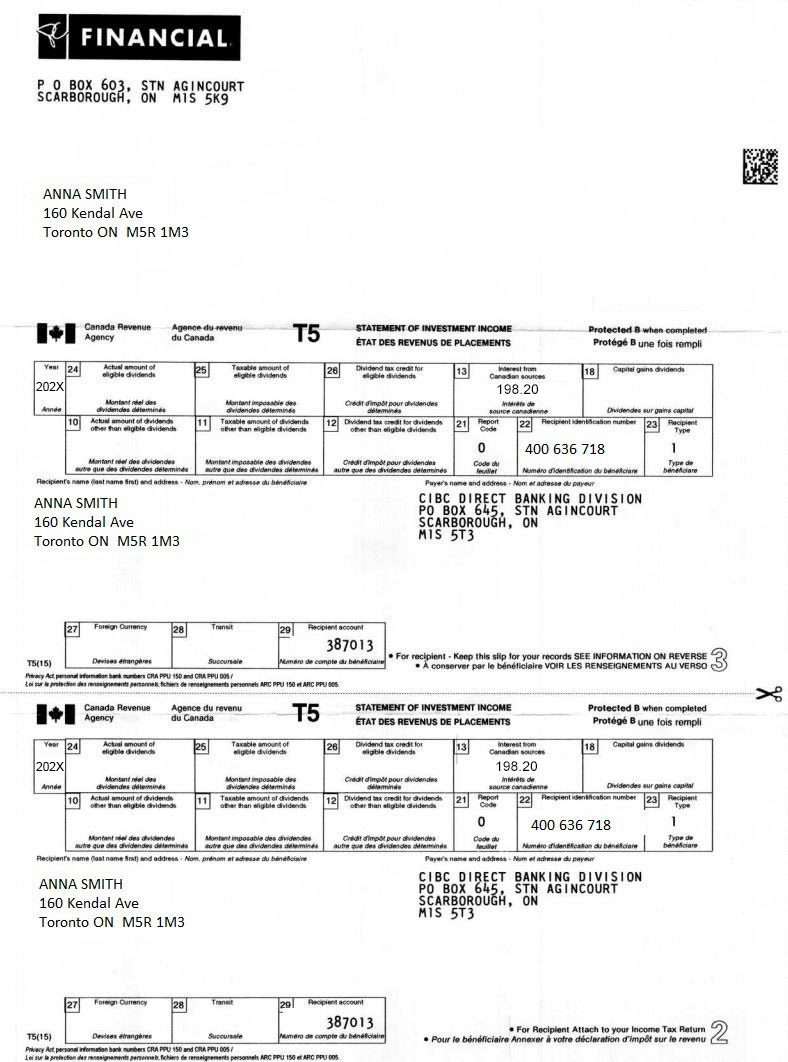

Question 11 (1 point) Listen S8 - Part 3 - line 8 OR 10 This is the amount of "enhanced CPP contributions" Anna may have paid. This will be counted as a deduction.Anna Smith 1936 160 Kendal Ave Toronto ON M5R 1M3 Dec 21, 202X DATE PAY TO THE ORDER OF Big Bad Capitalist Properties tA 1500 , 00 One Thousand Five Hundred Security Features DOLLARS Details on back FOR Monthly Rent including hydro, water, heating 1:000000186 0000005291 1000PROFILE: Anna Smith - SIN 400 636 718 *note: any tax reporting considerations not explicitly stated in the profile should be assumed to not be applicable in this case scenario (eg. First Nations status, capital gains, dependents, etc.) Anna Smith was born January 25, 1990, was born and raised in Canada, is currently single and graduated from George Brown College several years ago. She lives in Toronto and rents a 600 square foot apartment for $1500/month which includes all of her utilities. Her address, where she has lived for the last few years, is: 160 Kendal Ave Toronto, Ontario, MSR 1M3 Anna has worked all year for the company Long View Systems as an IT systems analyst and she was paid an annual salary. She has received a T4 slip from her employer that she will use for her tax reporting. When Anna graduated from George Brown, her parents gave her some money as a graduation present. Because Anna hasn't decided yet if she wants to use the money to put a down payment on a house, pay down her student loans or go on a trip, she is just keeping the money in her PC Financial savings account for now. This year she earned some interest income on that money in her savings account and so she has also received a T5 from PC Financial, which she will use when filing her tax return. However, she did decide to put some of the money into her RRSP this year. Although her limit from her notice of assessment from last year was $2,200 she decided to deposit a bit less than that into her RRSP account for now. Unfortunately Anna's grandfather passed away this past spring from prostate cancer and so she decided to make a charitable donation for the first time in her life. She donated some money to the "Movember" fundraising campaign for prostate cancer to honor her grandfather. One thing that has been stressing Anna out is her OSAP loan which she borrowed to help pay for her studies at GBC. This year she paid interest on her loan, but thankfully she knows the government gives some sort of tax break on that. But also, that the Ontario government had some extra tax benefit called the Trillium Benefit where she could claim her rental costs for her apartment. She's planning to fill out the form and also use the on-line calculator to get an estimate of what that payment might be this year and whether she still qualifies since her income has increased. Of course she's also going to apply for the Climate Action Incentive to see if she can get more credit money there too. Thankfully, Anna has kept a shoebox with all of her relevant receipts and documents so that she can now sit down and figure out her tax return.MOVEMBER OFFICIAL DONATION RECEIPT Agecute Cancer MOVEMELL OFFICIAL RECEIPT FOR INCOME TAX PURPOSES Anna Smith 160 Kendall Ave Toronto ON M5R 1M3 Donation Details: Receipt Number: R-11289041-14458585 Anna Smith 160 Kendall Ave Donation Received: 05 November 202X Toronto ON MSR 1M3 Amount: $ 100.00 Date Issued: 05 November 202X Place Issued: Toronto Donations are tax deductible to the extent permitted by law Authorized Signature Adam Garone Chief Executive Officer, Movember Movember - changing the face of men's health Movember Canada Charity BN/Registration # BN 84821 5604 RR0001 Suite 901, 119 Spadina Avenue Toronto, ON M5V 2L1 Canada Revenue Agency - www.cra-arc.gc.ca/charities To learn more about Movember's men's health partner Prostate Cancer Canada visit ca.movember.com/about/beneficiary1 MOVEMBER PHONE: 1-855-4GROW MO (1-855-447-6966) WWW.MOVEMBER.COM INFO.CA@MOVEMBER.COMMOVEMBER OFFICIAL DONATION RECEIPT Agecute Cancer MOVEMELL OFFICIAL RECEIPT FOR INCOME TAX PURPOSES Anna Smith 160 Kendall Ave Toronto ON M5R 1M3 Donation Details: Receipt Number: R-11289041-14458585 Anna Smith 160 Kendall Ave Donation Received: 05 November 202X Toronto ON MSR 1M3 Amount: $ 100.00 Date Issued: 05 November 202X Place Issued: Toronto Donations are tax deductible to the extent permitted by law Authorized Signature Adam Garone Chief Executive Officer, Movember Movember - changing the face of men's health Movember Canada Charity BN/Registration # BN 84821 5604 RR0001 Suite 901, 119 Spadina Avenue Toronto, ON M5V 2L1 Canada Revenue Agency - www.cra-arc.gc.ca/charities To learn more about Movember's men's health partner Prostate Cancer Canada visit ca.movember.com/about/beneficiary1 MOVEMBER PHONE: 1-855-4GROW MO (1-855-447-6966) WWW.MOVEMBER.COM INFO.CA@MOVEMBER.COMInvestors Group Trust Co. Lid./La Cie de Fiducia du GIL 447 Portage Avenue. Winnipeg. Manitoba R38 3:5 RRSP CONTRIBUTION RECEIPT/ RECU DE COTISATION DE REER REGISTERED RETIREMENT SAVINGS PLAN RECUSTERLD UNDER THE INCOME TAX ACT ( CANADA) AND SUBJECT THERETO . APPROVED UNDER THE TAXATION ACT (QUEDIED) AND SLAVJECT THERETO ENREGISTRE EN VERTU DE LA LOI DE LIMPOT SUA LE REVENUI CANADY ET SUJET A CETTE LOI . APPROUVE EN VERTU DE LA LO SUR LES IMPOTS (QUEBEC) ET SUJET A CETTE LOI CONTRIBUTIONS DURING THE REMAINDER OF 202X DATE 31 DEC 202X RECEIVED THE AMOUNT OF / REQU LA SOUNE DE 1, 558.00 NAME OF CONTRIBUTOR / NOM DU COTISANT NAME OF ANNUITANT / NOM DU RENTIER PLAN NO. N' DU REGIME 15054 SOCIAL INSURANCE NO IN' D'ASSURANCE SOCIALE 01289 SAME AS CONTRIBUTOR 400 636 718 SMITH, ANNA CONTRIBUTOR / OOTISANT ANNUITANT I RENTIER 160 Kendal Ave UNDER THE TERMS OF THE DECLARATION OF THE TRUST OF THE ABOVE RETIREMENT SAVINGS PLAN Toronto ON MSR 1M3 SELONLES TETIMES DE LA DECLARATION OF ADLCIE DU RECHIME D SPARCONE-PETRAITE NOMME CI-DESSUS (AUTHORIZED SIGNATURE) (SIGNATURE OUN PREPOSE AUTORSQ) 7759-277 60287 COPY RETAINED BY RECIPIENT / COPIE CONSERVEE PAR LE BENEFICIAIRE Investors Group Trust Co. Ltd/La Cie de Fiducia du GIL 447 Portage Avenue. Winnipeg, Manitoba, A38 3H5 RRSP CONTRIBUTION RECEIPT/ RECU DE COTISATION DE REERInvestors Group Trust Co. Lid./La Cie de Fiducia du GIL 447 Portage Avenue. Winnipeg. Manitoba R38 3:5 RRSP CONTRIBUTION RECEIPT/ RECU DE COTISATION DE REER REGISTERED RETIREMENT SAVINGS PLAN RECUSTERLD UNDER THE INCOME TAX ACT ( CANADA) AND SUBJECT THERETO . APPROVED UNDER THE TAXATION ACT (QUEDIED) AND SLAVJECT THERETO ENREGISTRE EN VERTU DE LA LOI DE LIMPOT SUA LE REVENUI CANADY ET SUJET A CETTE LOI . APPROUVE EN VERTU DE LA LO SUR LES IMPOTS (QUEBEC) ET SUJET A CETTE LOI CONTRIBUTIONS DURING THE REMAINDER OF 202X DATE 31 DEC 202X RECEIVED THE AMOUNT OF / REQU LA SOUNE DE 1, 558.00 NAME OF CONTRIBUTOR / NOM DU COTISANT NAME OF ANNUITANT / NOM DU RENTIER PLAN NO. N' DU REGIME 15054 SOCIAL INSURANCE NO IN' D'ASSURANCE SOCIALE 01289 SAME AS CONTRIBUTOR 400 636 718 SMITH, ANNA CONTRIBUTOR / OOTISANT ANNUITANT I RENTIER 160 Kendal Ave UNDER THE TERMS OF THE DECLARATION OF THE TRUST OF THE ABOVE RETIREMENT SAVINGS PLAN Toronto ON MSR 1M3 SELONLES TETIMES DE LA DECLARATION OF ADLCIE DU RECHIME D SPARCONE-PETRAITE NOMME CI-DESSUS (AUTHORIZED SIGNATURE) (SIGNATURE OUN PREPOSE AUTORSQ) 7759-277 60287 COPY RETAINED BY RECIPIENT / COPIE CONSERVEE PAR LE BENEFICIAIRE Investors Group Trust Co. Ltd/La Cie de Fiducia du GIL 447 Portage Avenue. Winnipeg, Manitoba, A38 3H5 RRSP CONTRIBUTION RECEIPT/ RECU DE COTISATION DE REERNational Student Loans Service Centre P.O. Box 4030 Mississauga. Ontario LSA 4M4 Official Receipt for Income Tax Purposes Anna Smith Dec 31, 202X 160 Kendal Ave Toronto ON MSR 1M3 The Government of Canada provides an Income Tax credit for the interest paid on government sponsored student loans. This receipt shows the interest you have paid on your student loans held at the National Student Loans Service Centre during the 2019 taxation year. Please enter the amount below on your Income Tax Return. Payments applied to loan principal and payments made by the government on your behalf (e.g. Repayment Assistance) do not qualify for an Income Tax credit. Note: If you have loans with more than one loan servicer, you may receive more than one Income Tax receipt. Please refer to your Income Tax Guide, or contact the Canada Revenue Agency for details on how to enter these amounts on your income tax return. Social Insurance Number: 400 636 718 Canada-Ontario Integrated Student Loan : Interest paid by you during receipt period S 2,185.15 Total Interest Paid to be used for Income Tax credit $ 2,185.15 E&Ol 014342-0208379 14342_2_2National Student Loans Service Centre P.O. Box 4030 Mississauga. Ontario LSA 4M4 Official Receipt for Income Tax Purposes Anna Smith Dec 31, 202X 160 Kendal Ave Toronto ON MSR 1M3 The Government of Canada provides an Income Tax credit for the interest paid on government sponsored student loans. This receipt shows the interest you have paid on your student loans held at the National Student Loans Service Centre during the 2019 taxation year. Please enter the amount below on your Income Tax Return. Payments applied to loan principal and payments made by the government on your behalf (e.g. Repayment Assistance) do not qualify for an Income Tax credit. Note: If you have loans with more than one loan servicer, you may receive more than one Income Tax receipt. Please refer to your Income Tax Guide, or contact the Canada Revenue Agency for details on how to enter these amounts on your income tax return. Social Insurance Number: 400 636 718 Canada-Ontario Integrated Student Loan : Interest paid by you during receipt period S 2,185.15 Total Interest Paid to be used for Income Tax credit $ 2,185.15 E&Ol 014342-0208379 14342_2_2Employer's name - Nom de l'employeur Canada Revenue Agence du revenu Agency du Canada T4 Long View Systems Year Annee 2022 Statement of Remuneration Paid Etat de la remuneration payee Employment income - line 101 Income tax deducted - line 437 Revenus d'emploi - ligne 101 Impot sur le revenue retenu - ligne 437 14 48,000,00 22 7200.00 54 Employer's account number / Numero de compte de l'employeur Province of employment Employee's CPP contributions - line 308 El insurable earnings Province d'emploi Cotisations de l'employe au RPC - ligne 308 Gains assurables d'AE 10 16 Social insurance number Exempt - Exemption 2,536.50 24 48,000.00 Numero d'assurance sociale CPP/QPP E| PPIP Employment code Employee's QPP contributions - line 308 CPP/QPP pensionable earnings 12 400 636 718 28 Code d'emploi Cotisations de l'employe au RRQ - ligne 308 Gains ouvrant droit a pension - RPC/RRQ 29 17 26 RPC/RRQ AE RPAP 48,000.00 Employee's El premiums - line 312 Union dues - line 212 Employee's name and address - Nom et adresse de l'employe Cotisations de l'employe a l'AE - ligne 312 Cotisations syndicales - ligne 212 18 44 Last name (in capital letters) - Nom de famille (en lettres moulees) First name - Prenom Initial - Initiale 758.40 Smith, Anna RPP contributions - line 207 Charitable donations - line 349 Cotisations a un RPA - ligne 207 Dons de bienfaisance - ligne 349 Protected B when completed / Protege B une fois rempli 20 46 160 Kendal Ave Pension adjustment - line 206 RPP or DPSP registration number Toronto ON M5R 1M3 Facteur d'equivalence - ligne 206 N' d'agrement d'un RPA ou d'un RPDB 52 50 Employee's PPIP premiums - see over PPIP insurable earnings Cotisations de l'employe au RPAP - voir au verso Gains assurables du RPAP 55 56 Box - Case Amount - Montant Box - Case Amount - Montant Box - Case Amount - Montant Other information (see over) Autres Box - Case Amount - Montant Box - Case Amount - Montant Box - Case Amount - Montant renseignements T4 (14) (voir au verso)Employer's name - Nom de l'employeur Canada Revenue Agence du revenu Agency du Canada T4 Long View Systems Year Annee 2022 Statement of Remuneration Paid Etat de la remuneration payee Employment income - line 101 Income tax deducted - line 437 Revenus d'emploi - ligne 101 Impot sur le revenue retenu - ligne 437 14 48,000,00 22 7200.00 54 Employer's account number / Numero de compte de l'employeur Province of employment Employee's CPP contributions - line 308 El insurable earnings Province d'emploi Cotisations de l'employe au RPC - ligne 308 Gains assurables d'AE 10 16 Social insurance number Exempt - Exemption 2,536.50 24 48,000.00 Numero d'assurance sociale CPP/QPP E| PPIP Employment code Employee's QPP contributions - line 308 CPP/QPP pensionable earnings 12 400 636 718 28 Code d'emploi Cotisations de l'employe au RRQ - ligne 308 Gains ouvrant droit a pension - RPC/RRQ 29 17 26 RPC/RRQ AE RPAP 48,000.00 Employee's El premiums - line 312 Union dues - line 212 Employee's name and address - Nom et adresse de l'employe Cotisations de l'employe a l'AE - ligne 312 Cotisations syndicales - ligne 212 18 44 Last name (in capital letters) - Nom de famille (en lettres moulees) First name - Prenom Initial - Initiale 758.40 Smith, Anna RPP contributions - line 207 Charitable donations - line 349 Cotisations a un RPA - ligne 207 Dons de bienfaisance - ligne 349 Protected B when completed / Protege B une fois rempli 20 46 160 Kendal Ave Pension adjustment - line 206 RPP or DPSP registration number Toronto ON M5R 1M3 Facteur d'equivalence - ligne 206 N' d'agrement d'un RPA ou d'un RPDB 52 50 Employee's PPIP premiums - see over PPIP insurable earnings Cotisations de l'employe au RPAP - voir au verso Gains assurables du RPAP 55 56 Box - Case Amount - Montant Box - Case Amount - Montant Box - Case Amount - Montant Other information (see over) Autres Box - Case Amount - Montant Box - Case Amount - Montant Box - Case Amount - Montant renseignements T4 (14) (voir au verso)FINANCIAL P 0 BOX 603, STN AGINCOURT SCARBOROUGH, ON MIS 5K9 ANNA SMITH 160 Kendal Ave Toronto ON M5R 1M3 Canada Revenue Agance du-revenu STATEMENT OF INVESTMENT INCOME Protected B when completed Agency du Canada T5 ETAT DES REVENUS DE PLACEMENTS Protege B une fois rempli Your 24 Actual amount of Taxable amount of 26 Dividend mix credit for eligble dividends eligible dividends eligible dividends 13 18 Capital gains dividends 202X 198.20 Annde dontant impecable da Credit dimost pour ofvidandes lendes defarming Inidrare de dividendes delemings Dividendes sur gains capital 10 Actund amount of dividend Taxable amount of divide other than eligible dividends 11 other than eligible dividen 12 Dividand tax credit los dividends 21 Popor 22 Recipient Went cabon number 23 Recipient other than eligible dividends Type 400 636 718 Montant sded des ofvidandel Mantant imposable des dividendes Credit d imper pour ofvidandes Type de Invite que des dividendes determines wife que des adividendes delivmind autre que des dividendes dereminds Code du ist name Bron and address - Nom, prenon of adresse du benddownve Payer's name and address . Nom et adresse du pageur ANNA SMITH CIBC DIRECT BANKING DIVISION PO BOX 645, STN AGINCOURT 160 Kendal Ave SCARBOROUGH, ON Toronto ON MSR 1M3 MIS 5T3 27 28 raneit 29 Recipient account 387013 T5(15) Derises dirangerer Succursale For recipient . Keep this slip for your records SEE INFORMATION ON REVERSE . A conserver par le beneficiaire VOIR LES RENSEIGNEMENTS AU VERSO Bers CRA PPU 190 and CRA PPU 901 meh ARC PPU 150 Canada Revenue Agence du revenu du Canada T5 STATEMENT OF INVESTMENT INCOME Protected B when completed Agency ETAT DES REVENUS DE PLACEMENTS Protege B une fois rempli Year 24 26 Dividend fix credit to eligible dividends 25 Taxable amount of eligble dividends agble dividends 13 Interest from Capital gains dividends Canadian sources 18 202X 198.20 Carddit dimple pour dividangies Annde Montand reel daw Montand Imposable de Interers da icandes celes dividendes delayminds ource canadienne Dividendes sur paine capis 10 Actual amount of dividend Taxable amount of dividends other than eligible dividends 11 other than eligible dividends 12 Dividend tax credit for dividend other than eligible dividends 21 22 bon number 2 23 Recipient Type 0 400 636 718 Mdonrant seed des dividendes dontand imposable des dividendes Credit dimpot pour dividendes autre que des dividendes oftommy wire que des dividandes dflemings 's name fast name Sroff and address . Non. print Paper's name ANNA SMITH CIBC DIRECT BANKING DIVISION PO BOX 645, STN AGINCOURT 160 Kendal Ave SCARBOROUGH, ON MIS 5T3 Toronto ON MSR 1M3 27 Foreign Currency 28 maneit 291 Recipient account 387013 75(15) Service Strangeres Surcurie compte do beneficiain . For Recipient Attach to your Income Tax Return . Pour to beneficiaire Annexer a votre declaration d impet sur le revenu CRA PPU 150 and CRA PPU DOSFINANCIAL P 0 BOX 603, STN AGINCOURT SCARBOROUGH, ON MIS 5K9 ANNA SMITH 160 Kendal Ave Toronto ON M5R 1M3 Canada Revenue Agance du-revenu STATEMENT OF INVESTMENT INCOME Protected B when completed Agency du Canada T5 ETAT DES REVENUS DE PLACEMENTS Protege B une fois rempli Your 24 Actual amount of Taxable amount of 26 Dividend mix credit for eligble dividends eligible dividends eligible dividends 13 18 Capital gains dividends 202X 198.20 Annde dontant impecable da Credit dimost pour ofvidandes lendes defarming Inidrare de dividendes delemings Dividendes sur gains capital 10 Actund amount of dividend Taxable amount of divide other than eligible dividends 11 other than eligible dividen 12 Dividand tax credit los dividends 21 Popor 22 Recipient Went cabon number 23 Recipient other than eligible dividends Type 400 636 718 Montant sded des ofvidandel Mantant imposable des dividendes Credit d imper pour ofvidandes Type de Invite que des dividendes determines wife que des adividendes delivmind autre que des dividendes dereminds Code du ist name Bron and address - Nom, prenon of adresse du benddownve Payer's name and address . Nom et adresse du pageur ANNA SMITH CIBC DIRECT BANKING DIVISION PO BOX 645, STN AGINCOURT 160 Kendal Ave SCARBOROUGH, ON Toronto ON MSR 1M3 MIS 5T3 27 28 raneit 29 Recipient account 387013 T5(15) Derises dirangerer Succursale For recipient . Keep this slip for your records SEE INFORMATION ON REVERSE . A conserver par le beneficiaire VOIR LES RENSEIGNEMENTS AU VERSO Bers CRA PPU 190 and CRA PPU 901 meh ARC PPU 150 Canada Revenue Agence du revenu du Canada T5 STATEMENT OF INVESTMENT INCOME Protected B when completed Agency ETAT DES REVENUS DE PLACEMENTS Protege B une fois rempli Year 24 26 Dividend fix credit to eligible dividends 25 Taxable amount of eligble dividends agble dividends 13 Interest from Capital gains dividends Canadian sources 18 202X 198.20 Carddit dimple pour dividangies Annde Montand reel daw Montand Imposable de Interers da icandes celes dividendes delayminds ource canadienne Dividendes sur paine capis 10 Actual amount of dividend Taxable amount of dividends other than eligible dividends 11 other than eligible dividends 12 Dividend tax credit for dividend other than eligible dividends 21 22 bon number 2 23 Recipient Type 0 400 636 718 Mdonrant seed des dividendes dontand imposable des dividendes Credit dimpot pour dividendes autre que des dividendes oftommy wire que des dividandes dflemings 's name fast name Sroff and address . Non. print Paper's name ANNA SMITH CIBC DIRECT BANKING DIVISION PO BOX 645, STN AGINCOURT 160 Kendal Ave SCARBOROUGH, ON MIS 5T3 Toronto ON MSR 1M3 27 Foreign Currency 28 maneit 291 Recipient account 387013 75(15) Service Strangeres Surcurie compte do beneficiain . For Recipient Attach to your Income Tax Return . Pour to beneficiaire Annexer a votre declaration d impet sur le revenu CRA PPU 150 and CRA PPU DOS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts