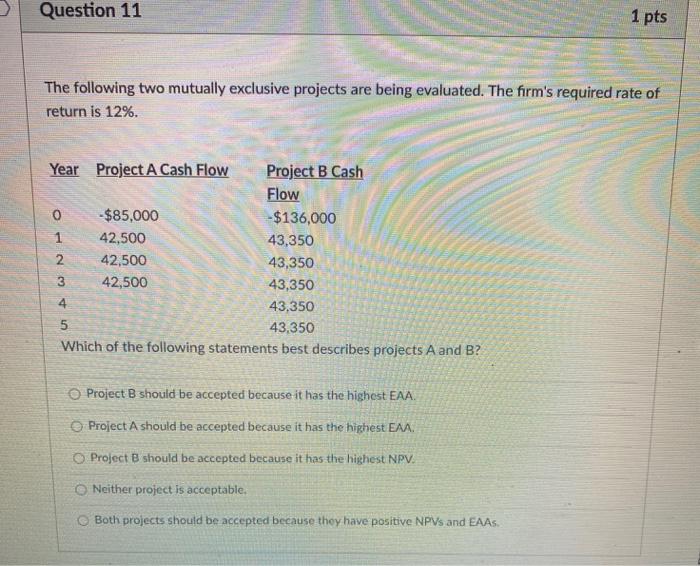

Question: Question 11 1 pts The following two mutually exclusive projects are being evaluated. The firm's required rate of return is 12%. Year Project A Cash

Question 11 1 pts The following two mutually exclusive projects are being evaluated. The firm's required rate of return is 12%. Year Project A Cash Flow Project B Cash Flow 0 -$85,000 -$136,000 1 42,500 43,350 2 42,500 43,350 3 42,500 43,350 4 43,350 5 43,350 Which of the following statements best describes projects A and B? Project B should be accepted because it has the highest EAA. Project A should be accepted because it has the highest EAA. Project B should be accepted because it has the highest NPV. Neither project is acceptable. Both projects should be accepted because they have positive NPVs and EAAS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts