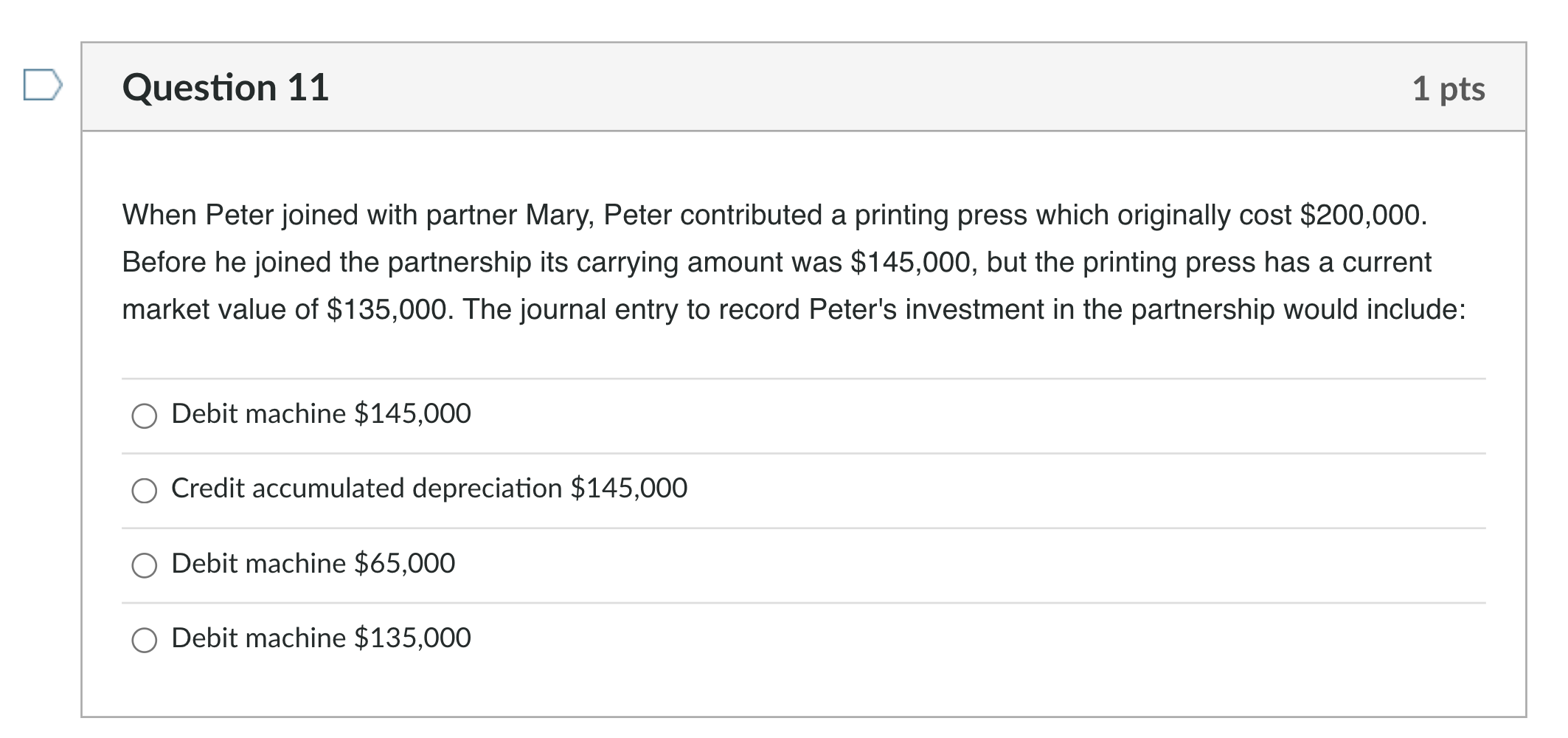

Question: Question 11 1 pts When Peter joined with partner Mary, Peter contributed a printing press which originally cost $200,000. Before he joined the partnership its

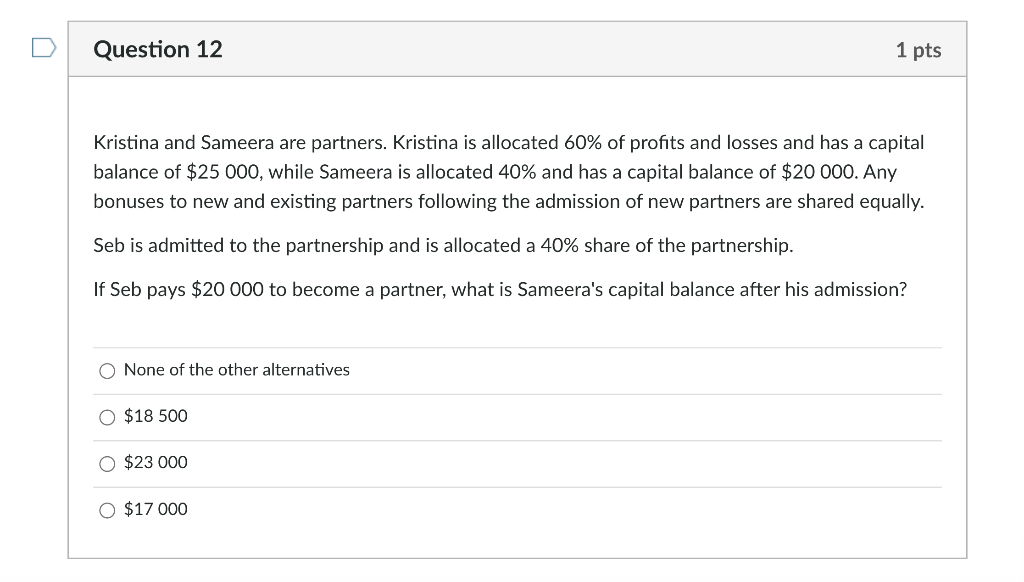

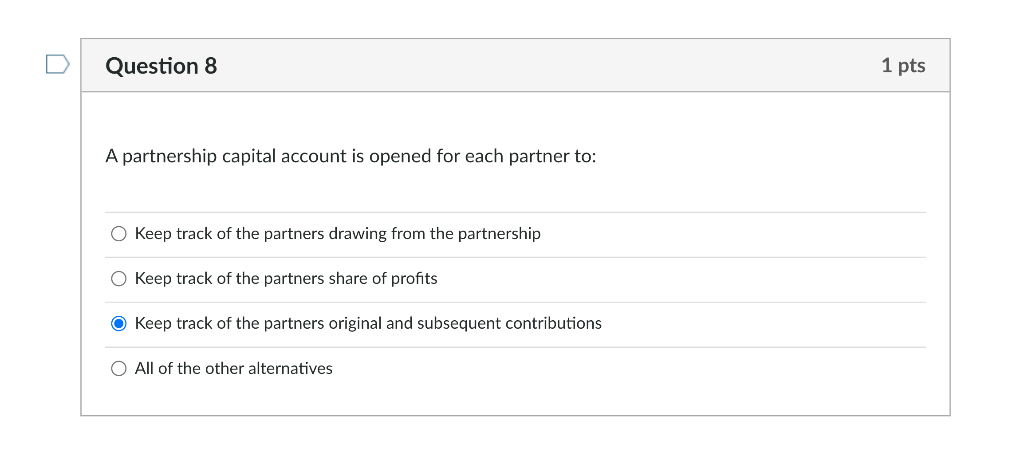

Question 11 1 pts When Peter joined with partner Mary, Peter contributed a printing press which originally cost $200,000. Before he joined the partnership its carrying amount was $145,000, but the printing press has a current market value of $135,000. The journal entry to record Peter's investment in the partnership would include: Debit machine $145,000 Credit accumulated depreciation $145,000 Debit machine $65,000 Debit machine $135,000 U Question 12 1 pts Kristina and Sameera are partners. Kristina is allocated 60% of profits and losses and has a capital balance of $25 000, while Sameera is allocated 40% and has a capital balance of $20 000. Any bonuses to new and existing partners following the admission of new partners are shared equally. Seb is admitted to the partnership and is allocated a 40% share of the partnership. If Seb pays $20 000 to become a partner, what is Sameera's capital balance after his admission? None of the other alternatives O $18 500 O $23 000 O $17 000 Question 8 1 pts A partnership capital account is opened for each partner to: Keep track of the partners drawing from the partnership Keep track of the partners share of profits Keep track of the partners original and subsequent contributions All of the other alternatives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts