Question: Question 11 10 points Saved Max. Marks = 10 - 4+1.5x4) Suppose an investor contacts his broker to SELL 3 October 2013 Live Cattle Futures

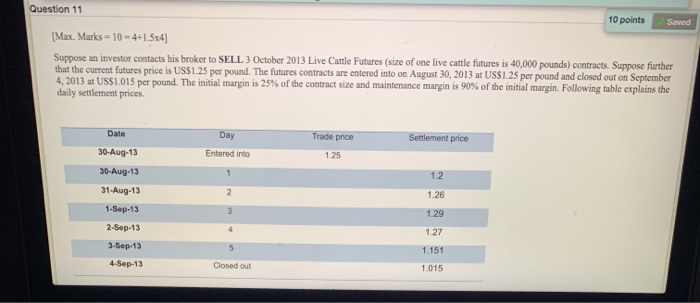

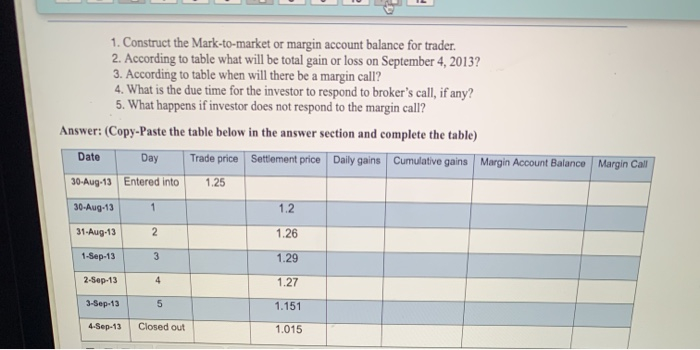

Question 11 10 points Saved Max. Marks = 10 - 4+1.5x4) Suppose an investor contacts his broker to SELL 3 October 2013 Live Cattle Futures (size of one live cattle futures is 40,000 pounds) contracts. Suppose further that the current futures price is US$1.25 per pound. The futures contracts are entered into on August 30, 2013 at USSI 25 per pound and closed out on September 4, 2013 at US$1.015 per pound. The initial margin is 25% of the contract size and maintenance margin is 90% of the initial margin. Following table explains the daily settlement prices. Date Trade price Settlement price Day Entered into 30-Aug-13 1.25 30-Aug-13 12 31-Aug-13 1-Sep-13 1.26 1.29 2-Sep-13 1.27 1.151 3-Sep-13 4-Sep-13 1015 1. Construct the Mark-to-market or margin account balance for trader. 2. According to table what will be total gain or loss on September 4, 2013? 3. According to table when will there be a margin call? 4. What is the due time for the investor to respond to broker's call, if any? 5. What happens if investor does not respond to the margin call? Answer: (Copy-paste the table below in the answer section and complete the table) Date Day Settlement price Daily gains Cumulative gains Margin Account Balance Margin Call Trade price 1.25 30-Aug-13 Entered into 30-Aug-13 1 12 31-Aug-13 1.26 1-Sep-13 3 1.29 1.27 2-Sep-13 3-Sep- 135 1.151 4-Sep-13 Closed out 1.015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts