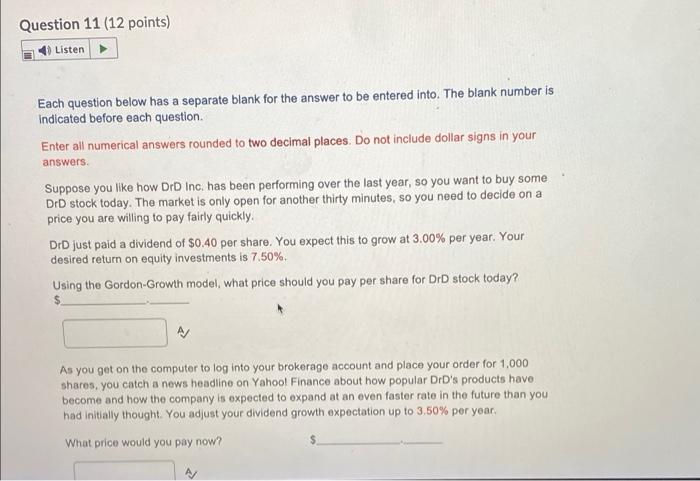

Question: Question 11 (12 points) Listen Each question below has a separate blank for the answer to be entered into. The blank number is Indicated before

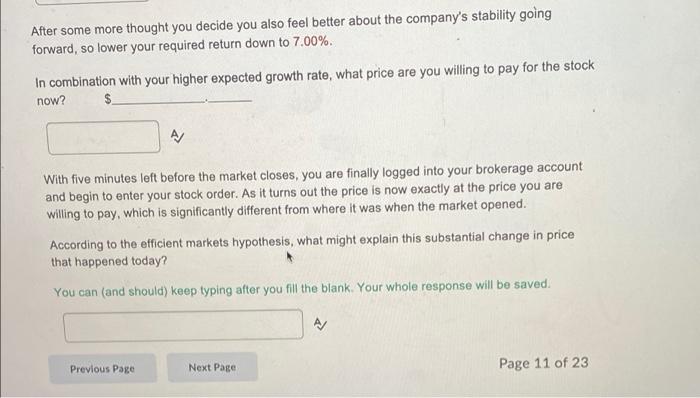

Question 11 (12 points) Listen Each question below has a separate blank for the answer to be entered into. The blank number is Indicated before each question. Enter all numerical answers rounded to two decimal places. Do not include dollar signs in your answers. Suppose you like how DrD Inc. has been performing over the last year, so you want to buy some DID stock today. The market is only open for another thirty minutes, so you need to decide on a price you are willing to pay fairly quickly. DID just paid a dividend of $0.40 per share. You expect this to grow at 3.00% per year. Your desired return on equity investments is 7.50% Using the Gordon-Growth model, what price should you pay per share for DrD stock today? $ A/ As you get on the computer to log into your brokerage account and place your order for 1,000 shares, you catch a news headline on Yahool Finance about how popular DrD's products have become and how the company is expected to expand at an even faster rate in the future than you had initially thought. You adjust your dividend growth expectation up to 3.50% per year. What price would you pay now? A/ After some more thought you decide you also feel better about the company's stability going forward, so lower your required return down to 7.00%. In combination with your higher expected growth rate, what price are you willing to pay for the stock now? A/ With five minutes left before the market closes, you are finally logged into your brokerage account and begin to enter your stock order. As it turns out the price is now exactly at the price you are willing to pay, which is significantly different from where it was when the market opened. According to the efficient markets hypothesis, what might explain this substantial change in price that happened today? You can (and should) keep typing after you fill the blank. Your whole response will be saved. A/ Previous Page Next Page Page 11 of 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts