Question: Question 11 (2 points) How much money would you have at the end of 15 years if you initially invested $5,000 at a nominal interest

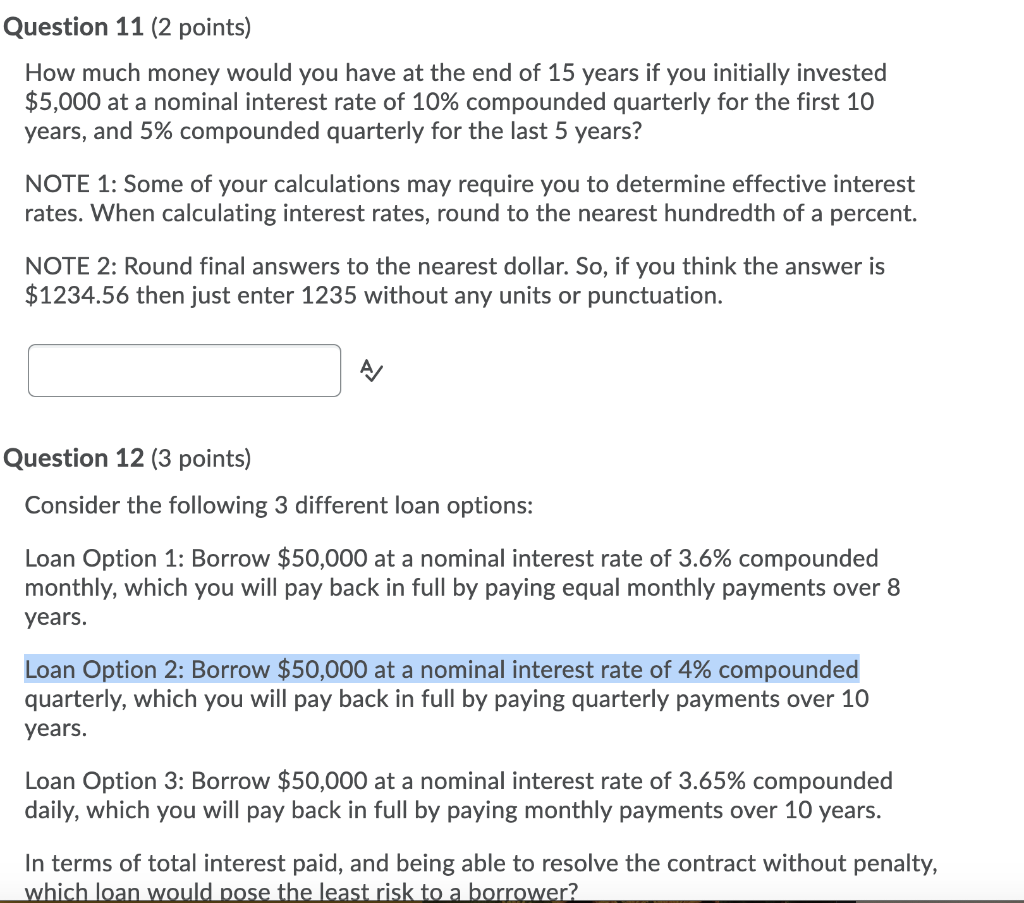

Question 11 (2 points) How much money would you have at the end of 15 years if you initially invested $5,000 at a nominal interest rate of 10% compounded quarterly for the first 10 years, and 5% compounded quarterly for the last 5 years? NOTE 1: Some of your calculations may require you to determine effective interest rates. When calculating interest rates, round to the nearest hundredth of a percent. NOTE 2: Round final answers to the nearest dollar. So, if you think the answer is $1234.56 then just enter 1235 without any units or punctuation. Question 12 (3 points) Consider the following 3 different loan options: Loan Option 1: Borrow $50,000 at a nominal interest rate of 3.6% compounded monthly, which you will pay back in full by paying equal monthly payments over 8 years. Loan Option 2: Borrow $50,000 at a nominal interest rate of 4% compounded quarterly, which you will pay back in full by paying quarterly payments over 10 years. Loan Option 3: Borrow $50,000 at a nominal interest rate of 3.65% compounded daily, which you will pay back in full by paying monthly payments over 10 years. In terms of total interest paid, and being able to resolve the contract without penalty, which loan would pose the least risk to a borrower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts