Question: Question 11 (2 points) (Questions 11-20 use this data) On July 31, 2019, the Cash account in Scallop Co's general ledger reports a balance of

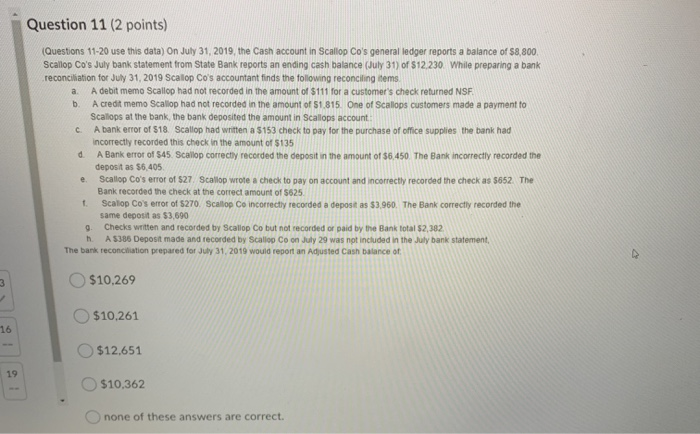

Question 11 (2 points) (Questions 11-20 use this data) On July 31, 2019, the Cash account in Scallop Co's general ledger reports a balance of $8,800 Scallop Co's July bank statement from State Bank reports an ending cash balance (July 31) of $12 230 While preparing a bank reconciliation for July 31, 2019 Scallop Co's accountant finds the following reconciling items a. A debit memo Scallop had not recorded in the amount of $111 for a customer's check returned NSF. 6. Acredit memo Scallop had not recorded in the amount of 51.815. One of Scallops customers made a payment to Scallops at the bank, the bank deposited the amount in Scallops account: c. A bank error of $18. Scallop had written a $153 check to pay for the purchase of office supplies the bank had incorrectly recorded this check in the amount of $135 d A Bank error of $45. Scallop correctly recorded the deposit in the amount of $6.450 The Bank incorrectly recorded the deposit as $6.405 e. Scallop Co's error of $27 Scallop wrote a check to pay on account and incorrectly recorded the check as 5652 The Bank recorded the check at the correct amount of 5625. 1. Scallop Co's error of $270. Scallop Co incorrectly recorded a deposit as $3.960. The Bank correctly recorded the same deposit as $3,690 Q. Checks written and recorded by Scallop Co but not recorded or paid by the Bank total $2,382 h A5385 Deposit made and recorded by Scallop Co on July 29 was not included in the July bank statement The bank reconciliation prepared for July 31, 2019 would report an Adjusted Cash balance of $10,269 2 $10.261 $12,651 $10,362 none of these answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts