Question: Question 11 (2 points) Saved Patrick was granted a stock option in September 2010 under his employer's nonstatutory stock option plan. Patrick was granted an

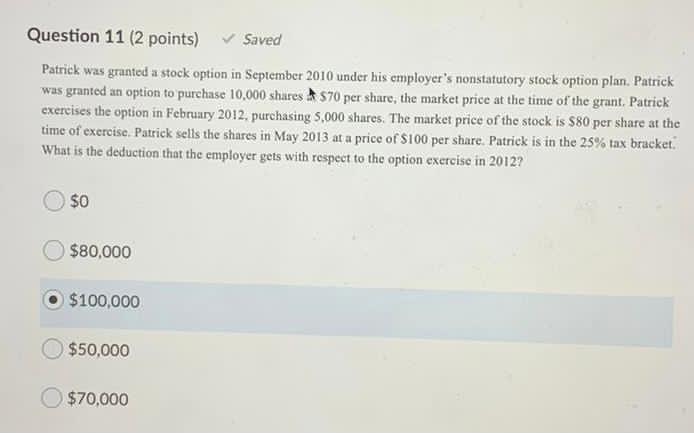

Question 11 (2 points) Saved Patrick was granted a stock option in September 2010 under his employer's nonstatutory stock option plan. Patrick was granted an option to purchase 10,000 shares & S70 per share the market price at the time of the grant. Patrick exercises the option in February 2012, purchasing 5,000 shares. The market price of the stock is $80 per share at the time of exercise. Patrick sells the shares in May 2013 at a price of $100 per share. Patrick is in the 25% tax bracket. What is the deduction that the employer gets with respect to the option exercise in 2012? $0 $80,000 $100,000 $50,000 $70,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts