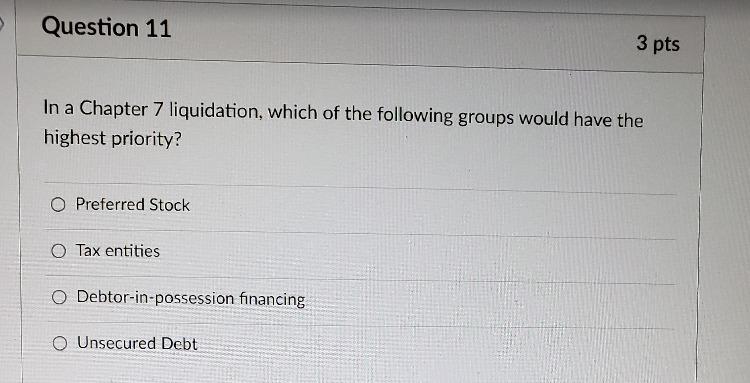

Question: Question 11 3 pts In a Chapter 7 liquidation, which of the following groups would have the highest priority? O Preferred Stock O Tax entities

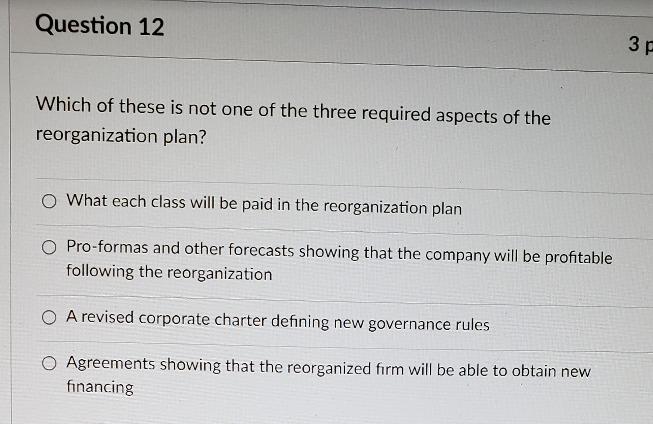

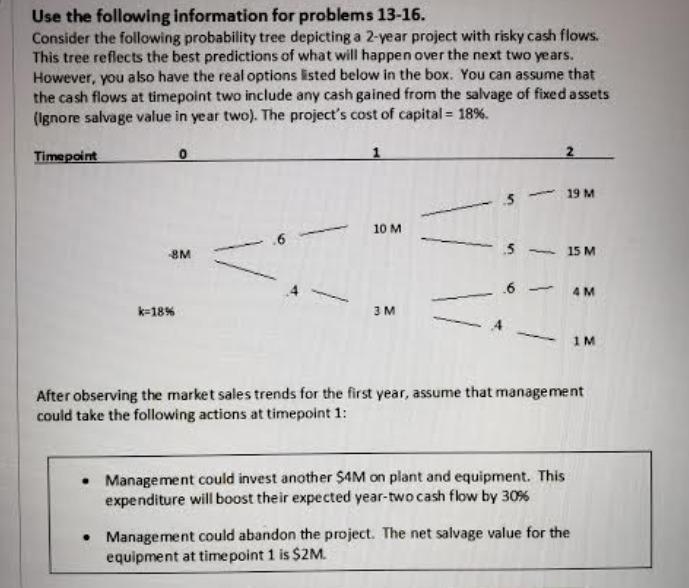

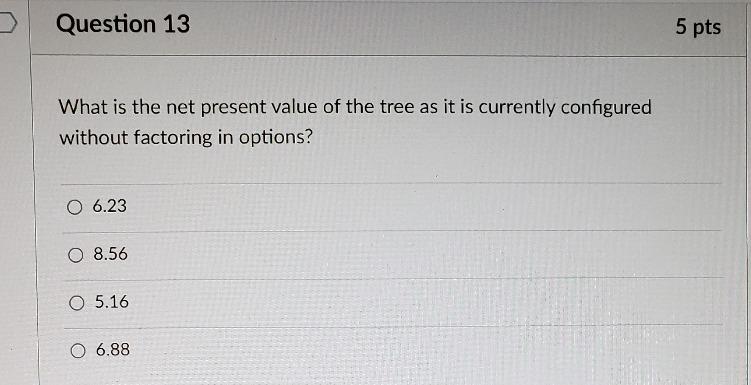

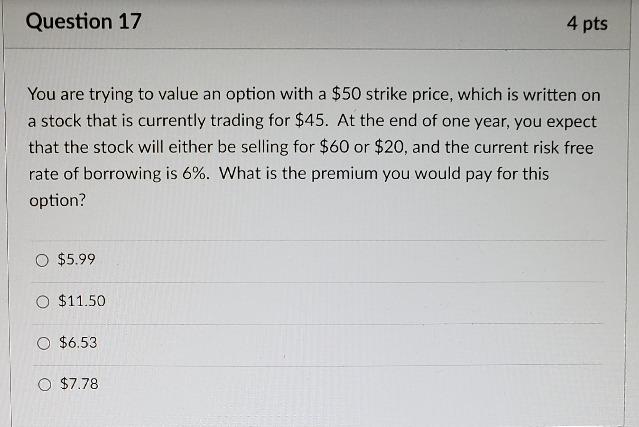

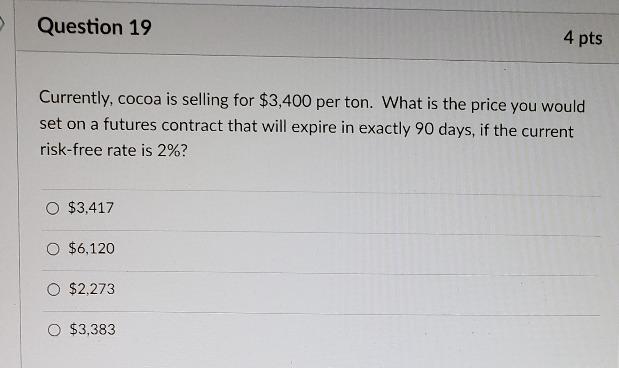

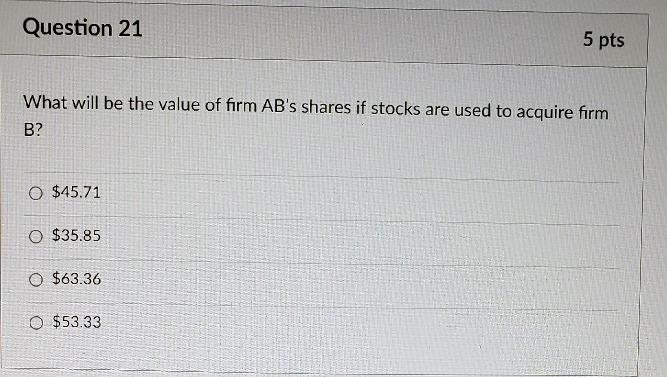

Question 11 3 pts In a Chapter 7 liquidation, which of the following groups would have the highest priority? O Preferred Stock O Tax entities Debtor-in-possession financing O Unsecured Debt Question 12 3 3F Which of these is not one of the three required aspects of the reorganization plan? What each class will be paid in the reorganization plan O Pro-formas and other forecasts showing that the company will be profitable following the reorganization O A revised corporate charter defining new governance rules O Agreements showing that the reorganized firm will be able to obtain new financing Use the following information for problems 13-16. Consider the following probability tree depicting a 2-year project with risky cash flows. This tree reflects the best predictions of what will happen over the next two years. However, you also have the real options isted below in the box. You can assume that the cash flows at timepoint two include any cash gained from the salvage of fixed assets (Ignore salvage value in year two). The project's cost of capital = 18%. Timepoint 2 19 M 10 M .6 8M 5 15 M .6 4M k=18% 3M 1M After observing the market sales trends for the first year, assume that management could take the following actions at timepoint 1: Management could invest another $4M on plant and equipment. This expenditure will boost their expected year-two cash flow by 30% Management could abandon the project. The net salvage value for the equipment at time point 1 is $2M. Question 13 5 pts What is the net present value of the tree as it is currently configured without factoring in options? O 6.23 0 8.56 05.16 06.88 Question 14 5 pts Of the two decisions in the box, which options would add value to the project if exercised? The option to expand. Both options add value. The option to abandon. O Neither option would add value. Question 15 5 pts After changing the tree to reflect the positive NPV option or options, what is the NPV of the optimal decision tree? 0 6.56 O 6.81 O 7.21 O 6.40 Question 16 4 pts What is the value of this option to the project? 0 2.16 O 0.33 O 0.98 0 0.17 Question 18 4 pts Use binomial option pricing to estimate the value of a call with a $30 strike price, written on a stock that is currently selling for $75. At the end of one year, you expect that the stock will either sell for $90 or $50, and the current rate for borrowing is 4%. 0 $40.38 O $46.15 O $26.99 O $6.77 Question 17 4 pts You are trying to value an option with a $50 strike price, which is written on a stock that is currently trading for $45. At the end of one year, you expect that the stock will either be selling for $60 or $20, and the current risk free rate of borrowing is 6%. What is the premium you would pay for this option? O $5.99 O $11.50 O $6.53 O $7.78 Question 19 4 pts Currently, cocoa is selling for $3,400 per ton. What is the price you would set on a futures contract that will expire in exactly 90 days, if the current risk-free rate is 2%? $3,417 O $6,120 O $2,273 O $3,383 Question 21 5 pts What will be the value of firm AB's shares if stocks are used to acquire firm B? 0 $45.71 O $35.85 0 $63.36 O $53.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts