Question: Question 11 3 pts Which scenario would cause boxes 1, 3, and 5 on a W-2 to all be different? Gross earnings - $145,000/ Contributions

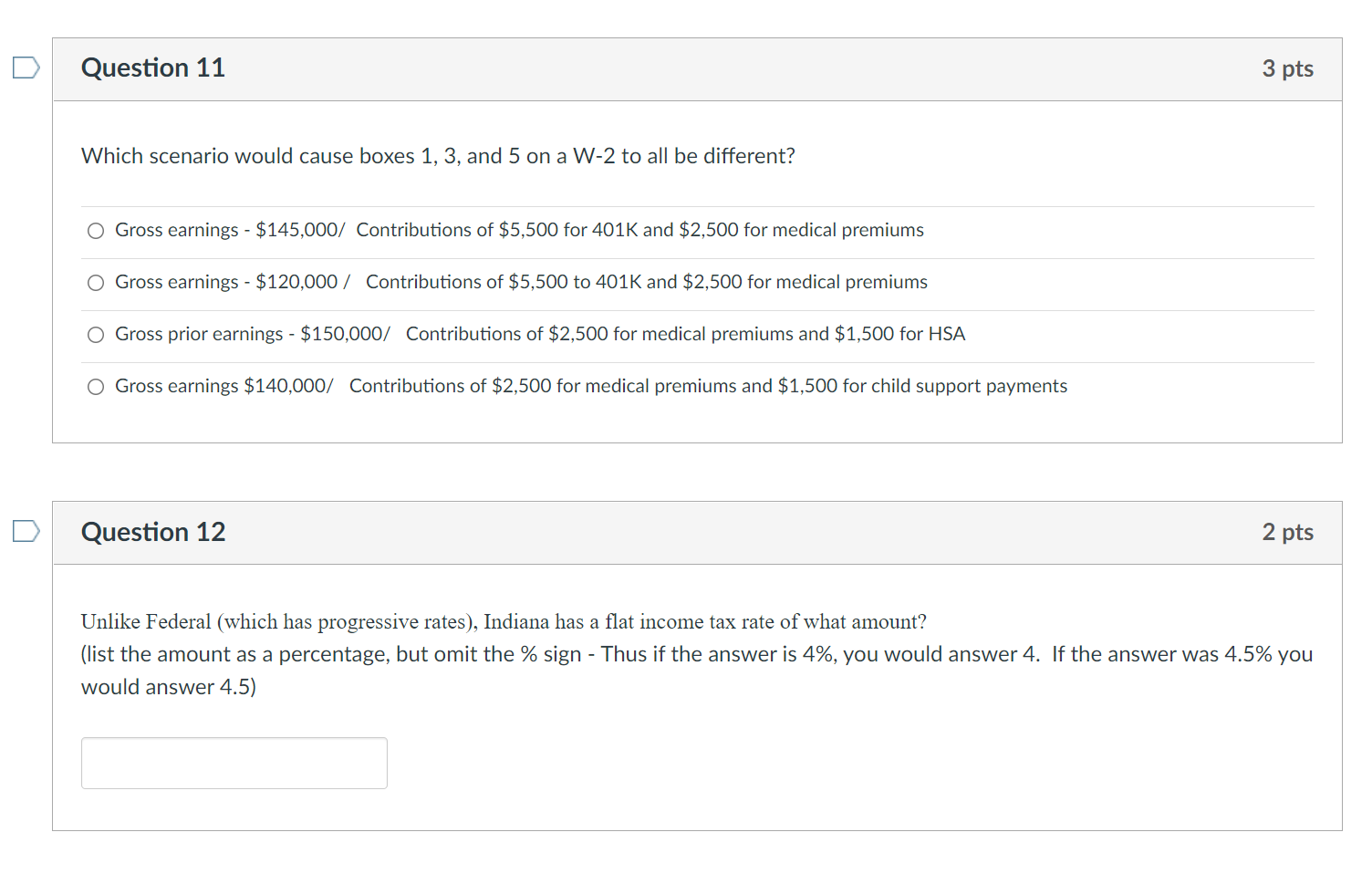

Question 11 3 pts Which scenario would cause boxes 1, 3, and 5 on a W-2 to all be different? Gross earnings - $145,000/ Contributions of $5,500 for 401K and $2,500 for medical premiums Gross earnings - $120,000 / Contributions of $5,500 to 401K and $2,500 for medical premiums Gross prior earnings - $150,000/ Contributions of $2,500 for medical premiums and $1,500 for HSA O Gross earnings $140,000/ Contributions of $2,500 for medical premiums and $1,500 for child support payments Question 12 2 pts Unlike Federal (which has progressive rates), Indiana has a flat income tax rate of what amount? (list the amount as a percentage, but omit the % sign - Thus if the answer is 4%, you would answer 4. If the answer was 4.5% you would answer 4.5) Question 11 3 pts Which scenario would cause boxes 1, 3, and 5 on a W-2 to all be different? Gross earnings - $145,000/ Contributions of $5,500 for 401K and $2,500 for medical premiums Gross earnings - $120,000 / Contributions of $5,500 to 401K and $2,500 for medical premiums Gross prior earnings - $150,000/ Contributions of $2,500 for medical premiums and $1,500 for HSA O Gross earnings $140,000/ Contributions of $2,500 for medical premiums and $1,500 for child support payments Question 12 2 pts Unlike Federal (which has progressive rates), Indiana has a flat income tax rate of what amount? (list the amount as a percentage, but omit the % sign - Thus if the answer is 4%, you would answer 4. If the answer was 4.5% you would answer 4.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts