Question: Question 11 (5 Marks) This is the challenging question. Consider a two-step Binomial-Tree model for the stock price with both steps of length one year.

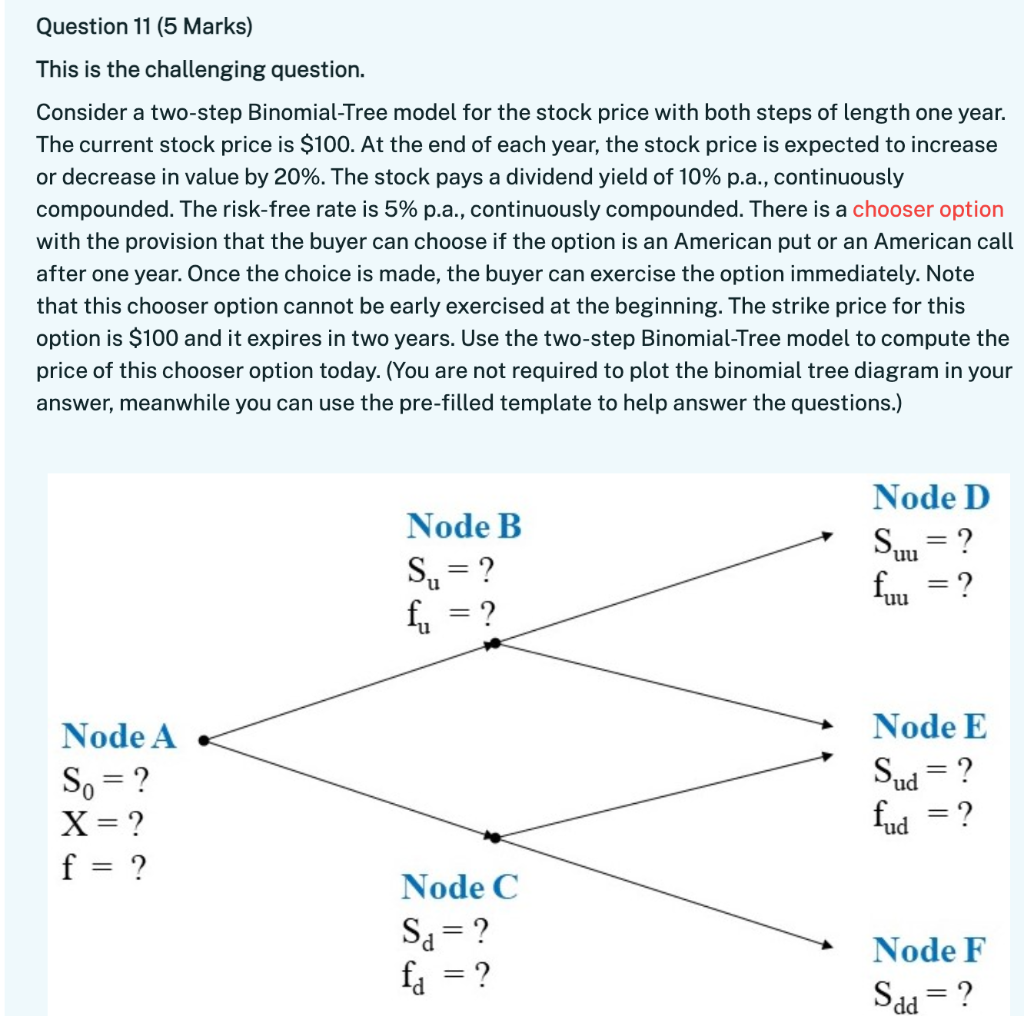

Question 11 (5 Marks) This is the challenging question. Consider a two-step Binomial-Tree model for the stock price with both steps of length one year. The current stock price is $100. At the end of each year, the stock price is expected to increase or decrease in value by 20%. The stock pays a dividend yield of 10% p.a., continuously compounded. The risk-free rate is 5% p.a., continuously compounded. There is a chooser option with the provision that the buyer can choose if the option is an American put or an American call after one year. Once the choice is made, the buyer can exercise the option immediately. Note that this chooser option cannot be early exercised at the beginning. The strike price for this option is $100 and it expires in two years. Use the two-step Binomial-Tree model to compute the price of this chooser option today. (You are not required to plot the binomial tree diagram in your answer, meanwhile you can use the pre-filled template to help answer the questions.) Node D ? fm = ? Node B Su = ? fi ? uu = uu = Node E Node A So = ? X = ? f = ? Sud = ? fud = ? Node C Sa = ? fg = ? Node F Saa = ? dd Question 11 (5 Marks) This is the challenging question. Consider a two-step Binomial-Tree model for the stock price with both steps of length one year. The current stock price is $100. At the end of each year, the stock price is expected to increase or decrease in value by 20%. The stock pays a dividend yield of 10% p.a., continuously compounded. The risk-free rate is 5% p.a., continuously compounded. There is a chooser option with the provision that the buyer can choose if the option is an American put or an American call after one year. Once the choice is made, the buyer can exercise the option immediately. Note that this chooser option cannot be early exercised at the beginning. The strike price for this option is $100 and it expires in two years. Use the two-step Binomial-Tree model to compute the price of this chooser option today. (You are not required to plot the binomial tree diagram in your answer, meanwhile you can use the pre-filled template to help answer the questions.) Node D ? fm = ? Node B Su = ? fi ? uu = uu = Node E Node A So = ? X = ? f = ? Sud = ? fud = ? Node C Sa = ? fg = ? Node F Saa = ? dd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts