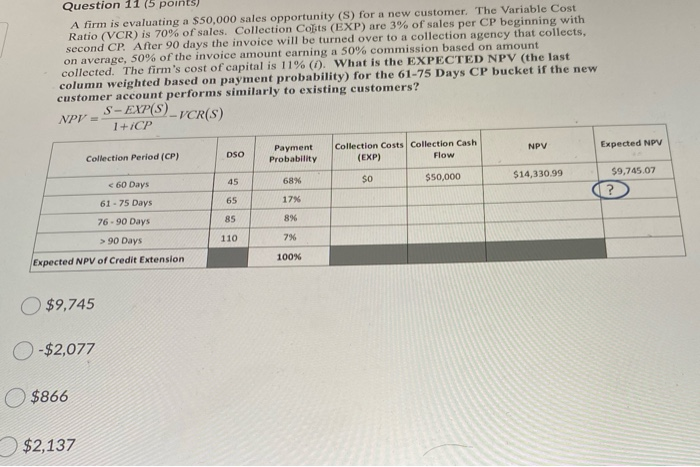

Question: Question 11 (5 points) A firm is evaluating a $50,000 sales opportunity (S) for a new customer. The Variable Cost Ratio (VCR) is 70% of

Question 11 (5 points) A firm is evaluating a $50,000 sales opportunity (S) for a new customer. The Variable Cost Ratio (VCR) is 70% of sales. Collection Cots (EXP) are 3% of sales per CP beginning with second CP. After 90 days the invoice will be turned over to a collection agency that collects, on average, 50% of the invoice amount earning a 50% commission based on amount collected. The firm's cost of capital is 11% (1. What is the EXPECTED NPV (the last column weighted based on payment probability) for the 61-75 Days CP bucket if the new customer account performs similarly to existing customers? S-EXP(S) NPT = - VCR(S) 1 +CP NPV Expected NPV DSO Payment Probability Collection Costs Collection Cash (EXP) Flow Collection Period (CP) 68% SO $50,000 $14,330.99 45 > 90 Days Expected NPV of Credit Extension 100% $9,745 -$2,077 $866 $2,137

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts