Question: Question 11 (5 points) Which of the following is False? If the bond is purchased and held to maturity, the bondholder's YTM will not change,

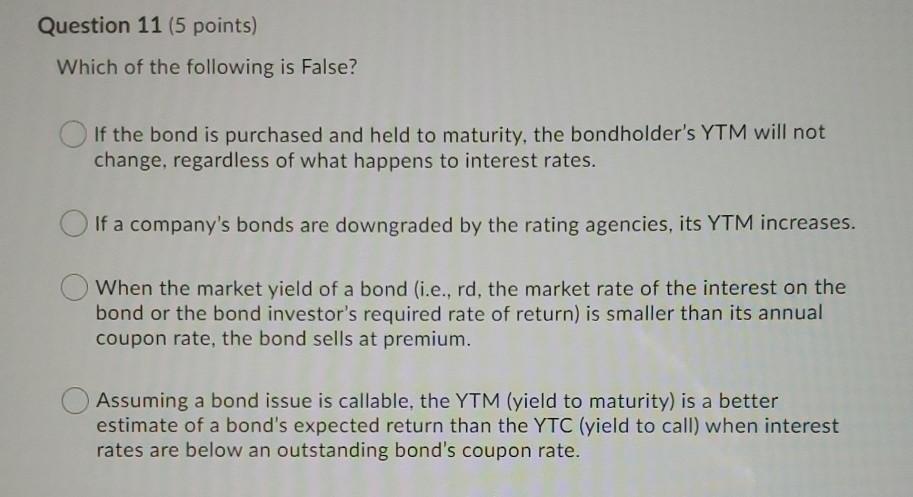

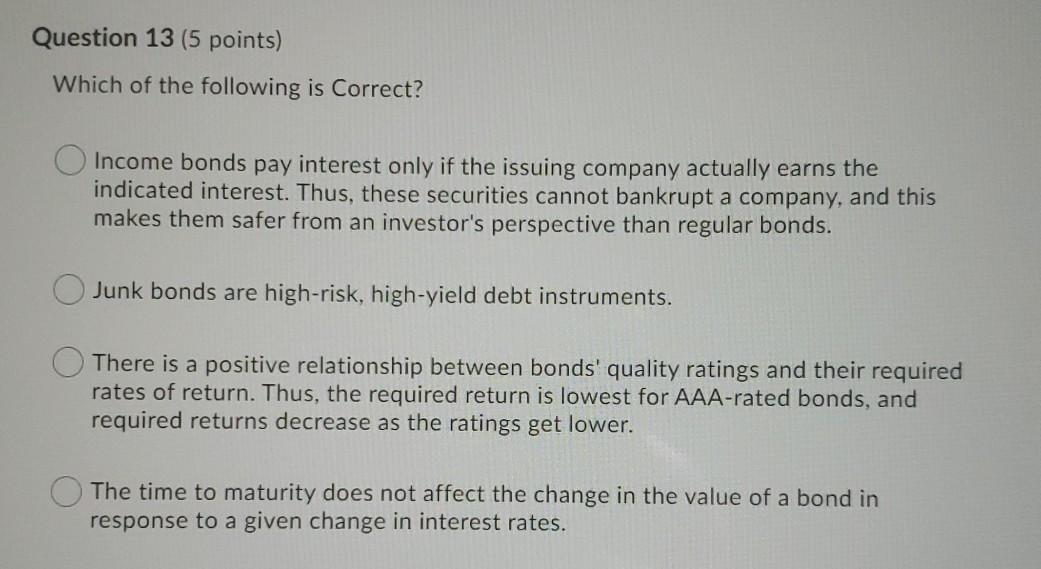

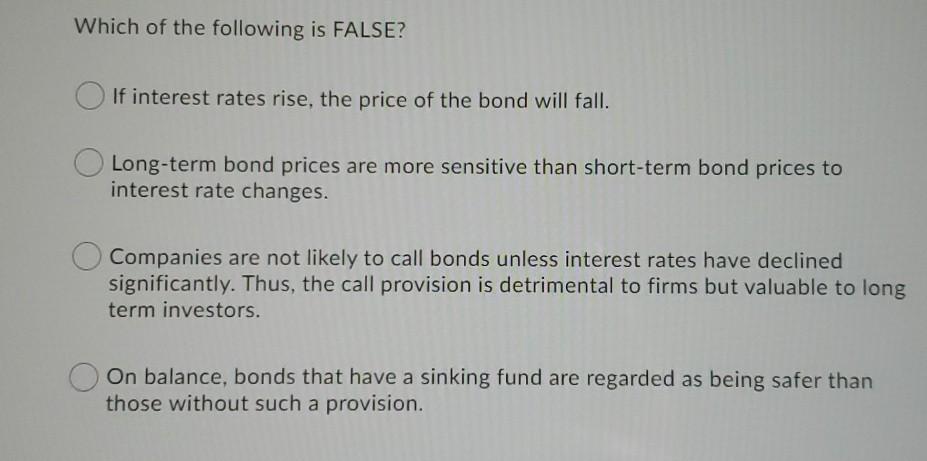

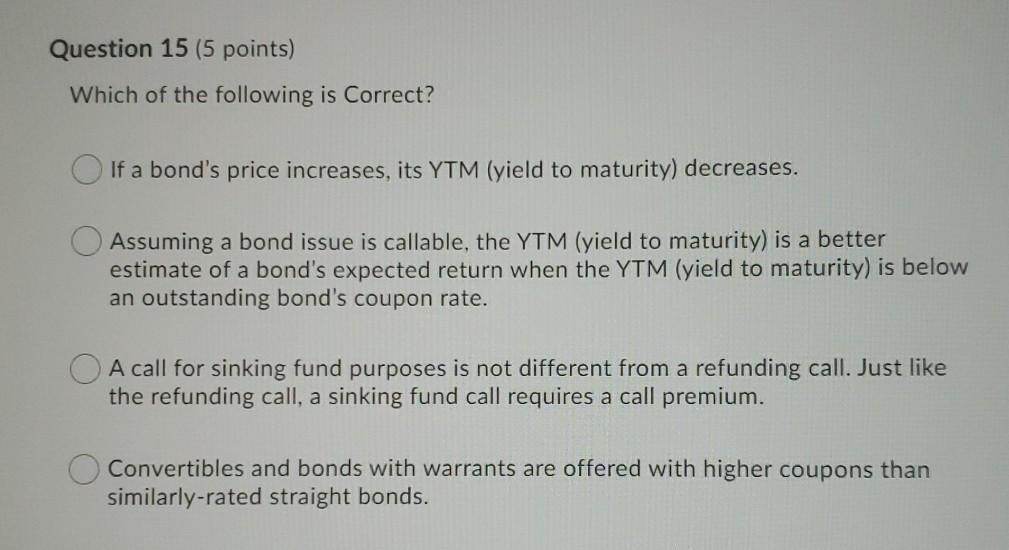

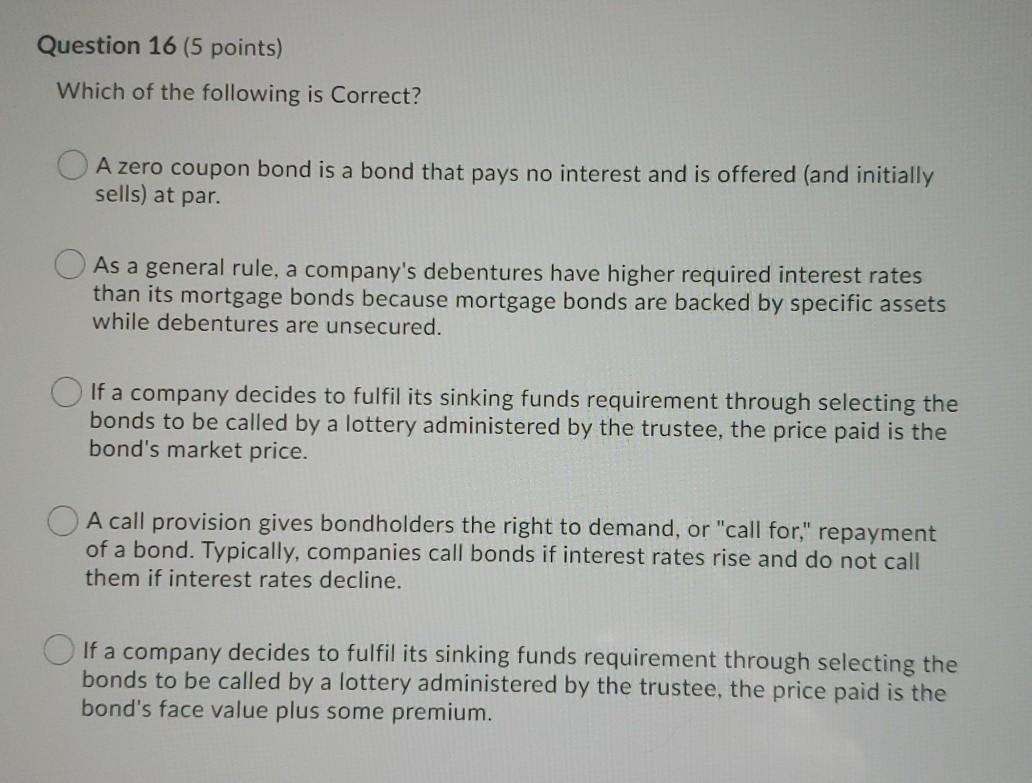

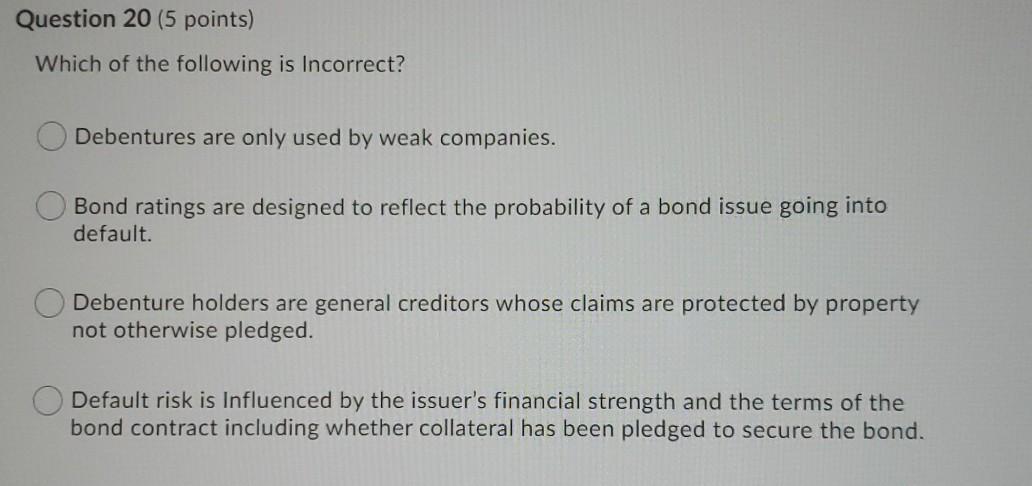

Question 11 (5 points) Which of the following is False? If the bond is purchased and held to maturity, the bondholder's YTM will not change, regardless of what happens to interest rates. If a company's bonds are downgraded by the rating agencies, its YTM increases. When the market yield of a bond (i.e., rd, the market rate of the interest on the bond or the bond investor's required rate of return) is smaller than its annual coupon rate, the bond sells at premium. Assuming a bond issue is callable, the YTM (yield to maturity) is a better estimate of a bond's expected return than the YTC (yield to call) when interest rates are below an outstanding bond's coupon rate. Question 13 (5 points) Which of the following is Correct? Income bonds pay interest only if the issuing company actually earns the indicated interest. Thus, these securities cannot bankrupt a company, and this makes them safer from an investor's perspective than regular bonds. Junk bonds are high-risk, high-yield debt instruments. There is a positive relationship between bonds' quality ratings and their required rates of return. Thus, the required return is lowest for AAA-rated bonds, and required returns decrease as the ratings get lower. The time to maturity does not affect the change in the value of a bond in response to a given change in interest rates. Which of the following is FALSE? If interest rates rise, the price of the bond will fall. Long-term bond prices are more sensitive than short-term bond prices to interest rate changes. Companies are not likely to call bonds unless interest rates have declined significantly. Thus, the call provision is detrimental to firms but valuable to long term investors. On balance, bonds that have a sinking fund are regarded as being safer than those without such a provision. Question 15 (5 points) Which of the following is Correct? If a bond's price increases, its YTM (yield to maturity) decreases. Assuming a bond issue is callable, the YTM (yield to maturity) is a better estimate of a bond's expected return when the YTM (yield to maturity) is below an outstanding bond's coupon rate. A call for sinking fund purposes is not different from a refunding call. Just like the refunding call, a sinking fund call requires a call premium. Convertibles and bonds with warrants are offered with higher coupons than similarly-rated straight bonds. Question 16 (5 points) Which of the following is Correct? A zero coupon bond is a bond that pays no interest and is offered (and initially sells) at par. As a general rule, a company's debentures have higher required interest rates than its mortgage bonds because mortgage bonds are backed by specific assets while debentures are unsecured. If a company decides to fulfil its sinking funds requirement through selecting the bonds to be called by a lottery administered by the trustee, the price paid is the bond's market price. A call provision gives bondholders the right to demand, or "call for," repayment of a bond. Typically, companies call bonds if interest rates rise and do not call them if interest rates decline. If a company decides to fulfil its sinking funds requirement through selecting the bonds to be called by a lottery administered by the trustee, the price paid is the bond's face value plus some premium. Question 20 (5 points) Which of the following is Incorrect? Debentures are only used by weak companies. Bond ratings are designed to reflect the probability of a bond issue going into default. Debenture holders are general creditors whose claims are protected by property not otherwise pledged. Default risk is Influenced by the issuer's financial strength and the terms of the bond contract including whether collateral has been pledged to secure the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts