Question: Question 11 9 pts Smith Brothers doesn't issue bonds yet because it is a small private C-Corporation but financial managers still need to figure out

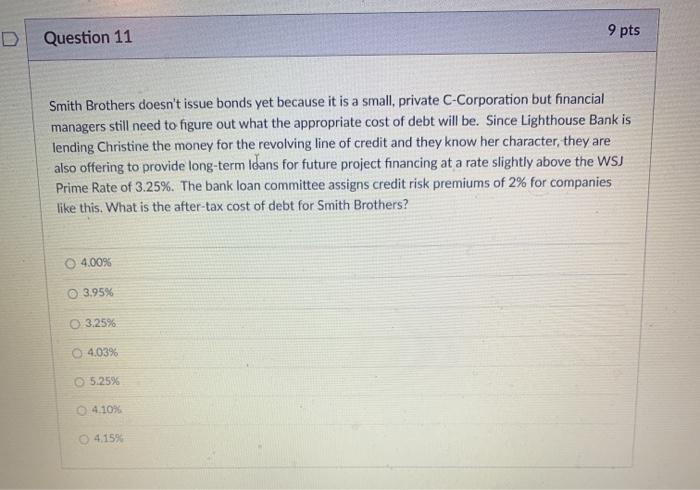

Question 11 9 pts Smith Brothers doesn't issue bonds yet because it is a small private C-Corporation but financial managers still need to figure out what the appropriate cost of debt will be. Since Lighthouse Bank is lending Christine the money for the revolving line of credit and they know her character, they are also offering to provide long-term Ioans for future project financing at a rate slightly above the WSJ Prime Rate of 3.25%. The bank loan committee assigns credit risk premiums of 2% for companies like this. What is the after-tax cost of debt for Smith Brothers? 4.00% 3.95% 0.3.25% 4.03% 5.25% 4.10% 4.15% Question 11 9 pts Smith Brothers doesn't issue bonds yet because it is a small private C-Corporation but financial managers still need to figure out what the appropriate cost of debt will be. Since Lighthouse Bank is lending Christine the money for the revolving line of credit and they know her character, they are also offering to provide long-term Ioans for future project financing at a rate slightly above the WSJ Prime Rate of 3.25%. The bank loan committee assigns credit risk premiums of 2% for companies like this. What is the after-tax cost of debt for Smith Brothers? 4.00% 3.95% 0.3.25% 4.03% 5.25% 4.10% 4.15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts