Question: QUESTION 11 A company issues 10-year, 8% bonds with a par value of $20,000 and semiannual interest payments. On the issue date, the annual market

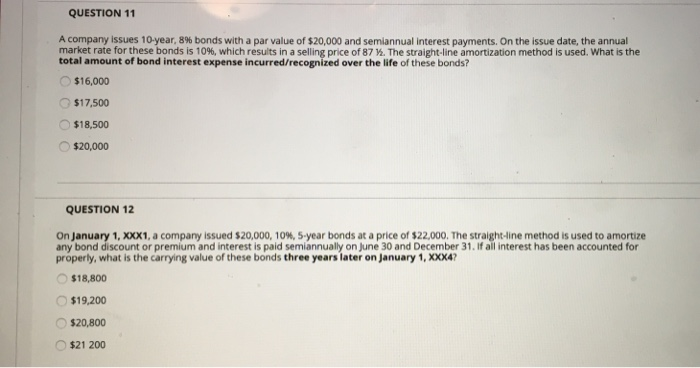

QUESTION 11 A company issues 10-year, 8% bonds with a par value of $20,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%, which results in a selling price of 87 %. The straight line amortization method is used. What is the total amount of bond interest expense incurred/recognized over the life of these bonds? $16,000 $17.500 $18,500 $20,000 QUESTION 12 On January 1, XXX1, a company issued $20,000, 10%, 5-year bonds at a price of $22,000. The straight-line method is used to amortize any bond discount or premium and interest is paid semiannually on June 30 and December 31. If all interest has been accounted for properly, what is the carrying value of these bonds three years later on January 1, XXX4? $18,800 $19,200 $20,800 $21 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts