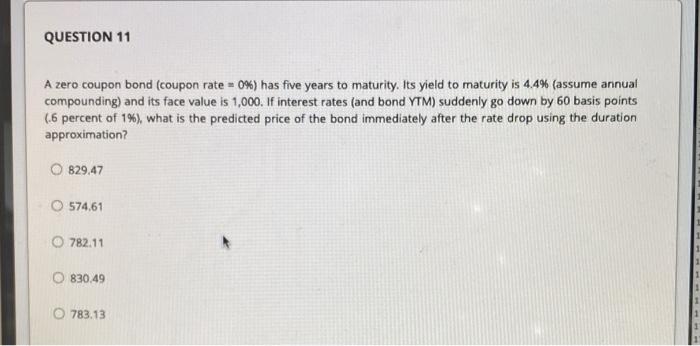

Question: QUESTION 11 A zero coupon bond (coupon rate=0%) has five years to maturity. Its yield to maturity is 4.4% (assume annual compounding) and its face

QUESTION 11 A zero coupon bond (coupon rate=0%) has five years to maturity. Its yield to maturity is 4.4% (assume annual compounding) and its face value is 1,000. If interest rates (and bond YTM) suddenly go down by 60 basis points (.6 percent of 1%), what is the predicted price of the bond immediately after the rate drop using the duration approximation? O 829.47 O 574,61 782.11 O 830.49 O 783.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts