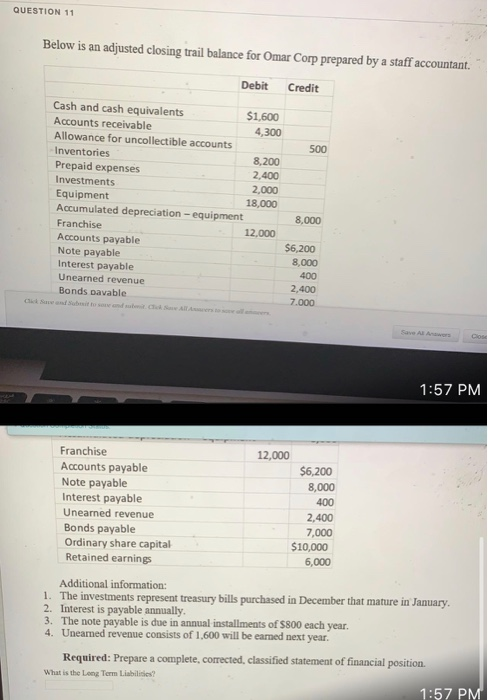

Question: QUESTION 11 Below is an adjusted closing trail balance for Omar Corp prepared by a staff accountant. Debit Credit 500 Cash and cash equivalents $1,600

QUESTION 11 Below is an adjusted closing trail balance for Omar Corp prepared by a staff accountant. Debit Credit 500 Cash and cash equivalents $1,600 Accounts receivable 4,300 Allowance for uncollectible accounts Inventories 8,200 Prepaid expenses 2,400 Investments 2.000 Equipment 18,000 Accumulated depreciation - equipment Franchise 12.000 Accounts payable Note payable Interest payable Unearned revenue Bonds pavable 8.000 $6,200 8,000 400 2,400 7.000 SABA Co 1:57 PM Franchise 12,000 Accounts payable $6,200 Note payable 8,000 Interest payable 400 Uneared revenue 2,400 Bonds payable 7,000 Ordinary share capital $10,000 Retained earnings 6,000 Additional information: 1. The investments represent treasury bills purchased in December that mature in January 2. Interest is payable annually. 3. The note payable is due in annual installments of $800 each year. 4. Uneamed revenue consists of 1,600 will be eamed next year. Required: Prepare a complete, corrected, classified statement of financial position. What is the Long Term Liabilities? 1:57 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts