Question: QUESTION 11 Charla Corporation is owned eighty percent (80%) by Jeanette and twenty percent (20%) by Victoria who are unrelated to each other Pursuant to

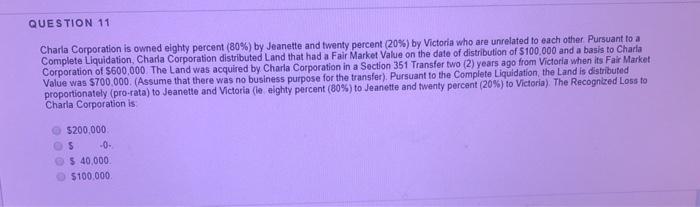

QUESTION 11 Charla Corporation is owned eighty percent (80%) by Jeanette and twenty percent (20%) by Victoria who are unrelated to each other Pursuant to a Complete Liquidation, Charla Corporation distributed Land that had a Fair Market Value on the date of distribution of $100.000 and a basis to Charla Corporation of $600,000 The Land was acquired by Charla Corporation in a Section 351 Transfer two (2) years ago from Victoria when its Fair Market Value was $700,000. (Assume that there was no business purpose for the transfer). Pursuant to the Complete Liquidation, the Land is distributed proportionately (pro-rata) to Jeanette and Victoria (le eighty percent (80%) to Jeanette and twenty percent (20%) to Victoria). The Recognized Loss to Charla Corporation is $200,000 $ -0. $ 40,000 $100,000 QUESTION 11 Charla Corporation is owned eighty percent (80%) by Jeanette and twenty percent (20%) by Victoria who are unrelated to each other Pursuant to a Complete Liquidation, Charla Corporation distributed Land that had a Fair Market Value on the date of distribution of $100.000 and a basis to Charla Corporation of $600,000 The Land was acquired by Charla Corporation in a Section 351 Transfer two (2) years ago from Victoria when its Fair Market Value was $700,000. (Assume that there was no business purpose for the transfer). Pursuant to the Complete Liquidation, the Land is distributed proportionately (pro-rata) to Jeanette and Victoria (le eighty percent (80%) to Jeanette and twenty percent (20%) to Victoria). The Recognized Loss to Charla Corporation is $200,000 $ -0. $ 40,000 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts