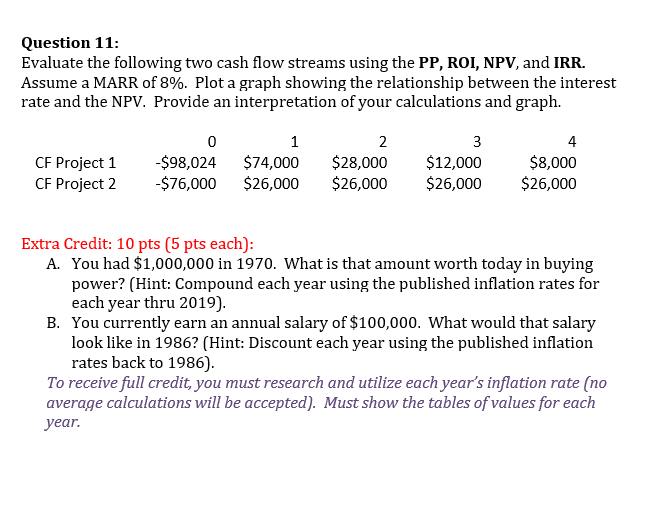

Question: Question 11: Evaluate the following two cash flow streams using the PP, ROI, NPV, and IRR. Assume a MARR of 8%. Plot a graph showing

Question 11: Evaluate the following two cash flow streams using the PP, ROI, NPV, and IRR. Assume a MARR of 8%. Plot a graph showing the relationship between the interest rate and the NPV. Provide an interpretation of your calculations and graph. CF Project 1 CF Project 2 0 $98,024 $76,000 1 $74,000 $26,000 2 $28,000 $26,000 3 $12,000 $26,000 4 $8,000 $26,000 Extra Credit: 10 pts (5 pts each): A. You had $1,000,000 in 1970. What is that amount worth today in buying power? (Hint: Compound each year using the published inflation rates for each year thru 2019). B. You currently earn an annual salary of $100,000. What would that salary look like in 1986? (Hint: Discount each year using the published inflation rates back to 1986). To receive full credit, you must research and utilize each year's inflation rate (no average calculations will be accepted). Must show the tables of values for each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts