Question: QUESTION 11 Mark is looking to secure a small business loan. The first lender is offering 11% compounded weekly, whereas the second lender is offering

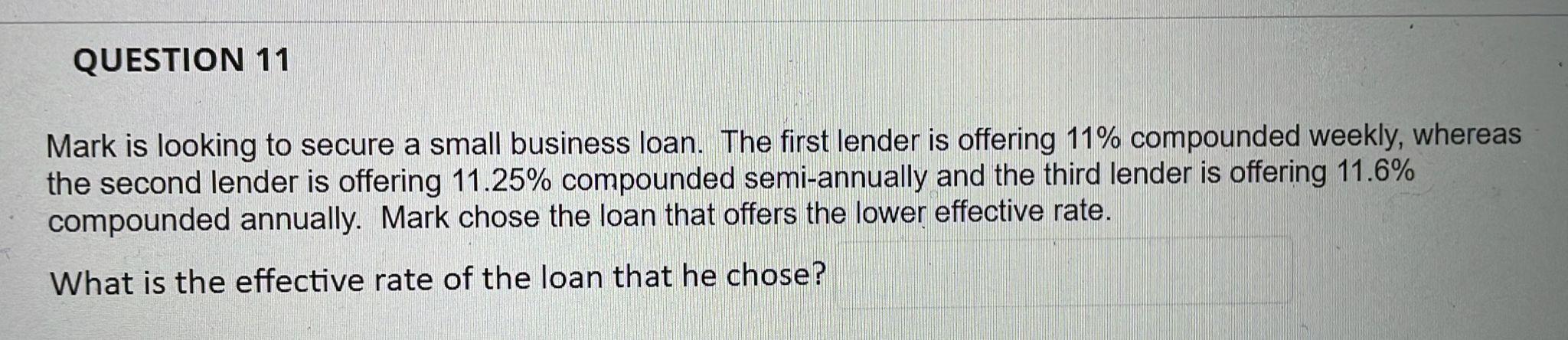

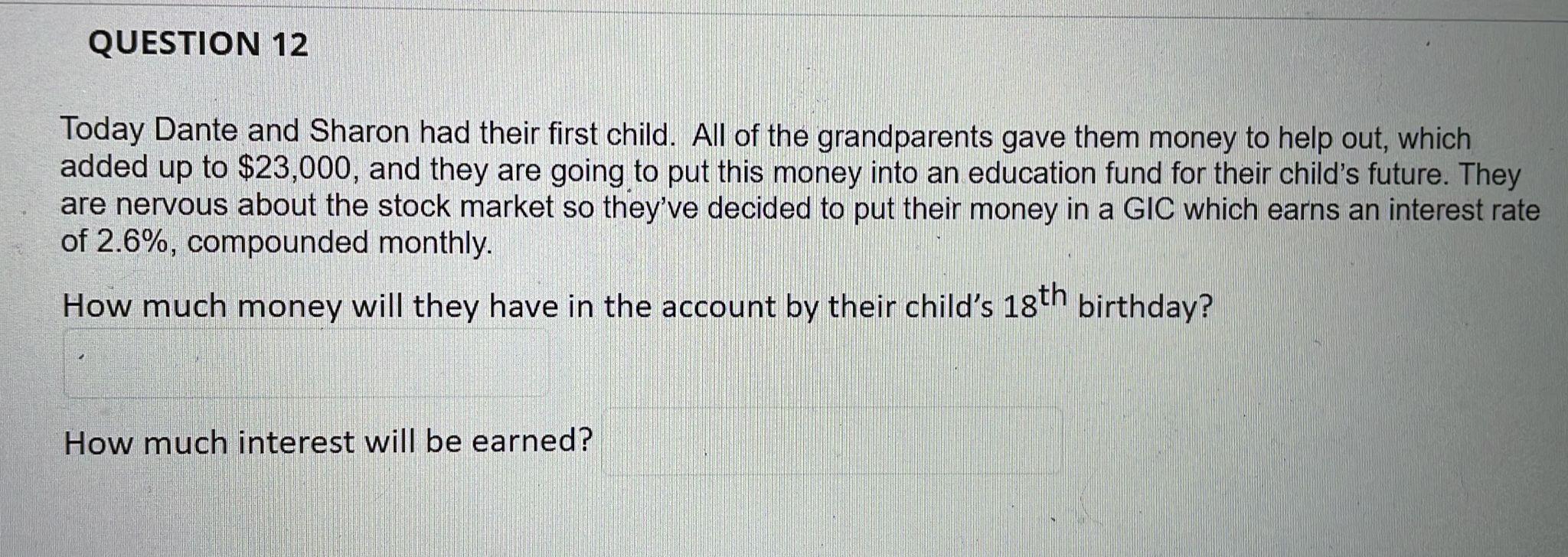

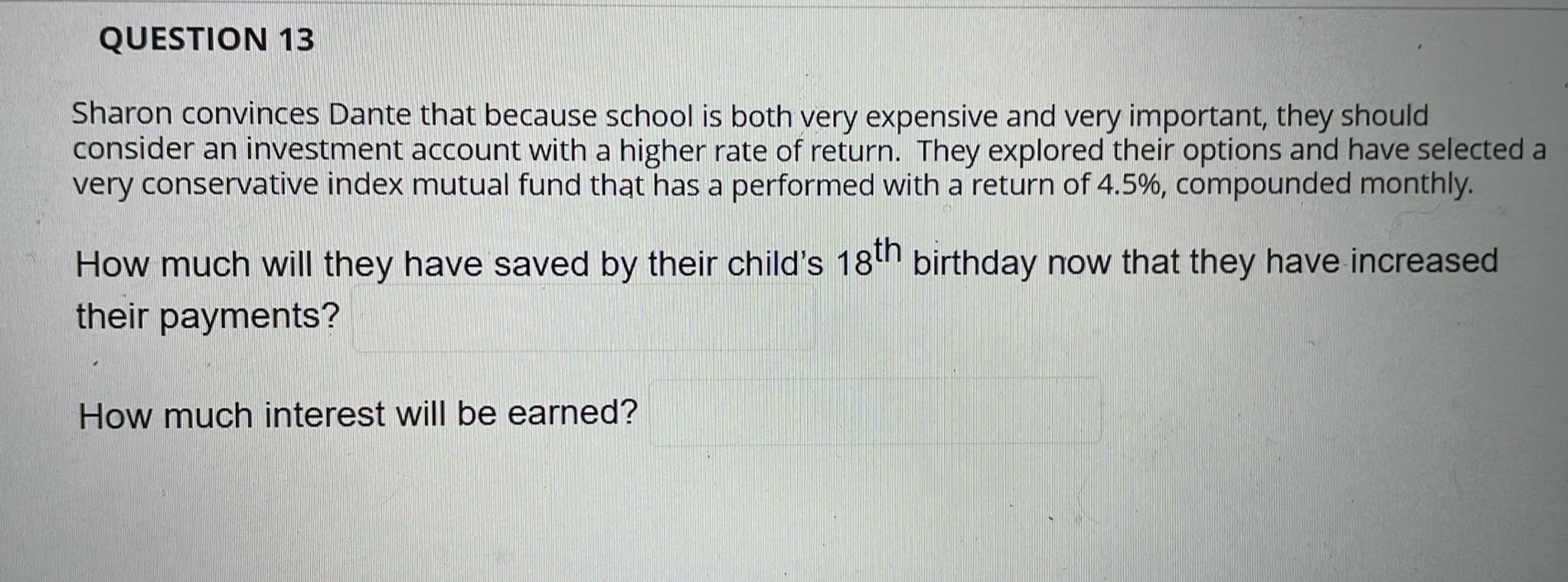

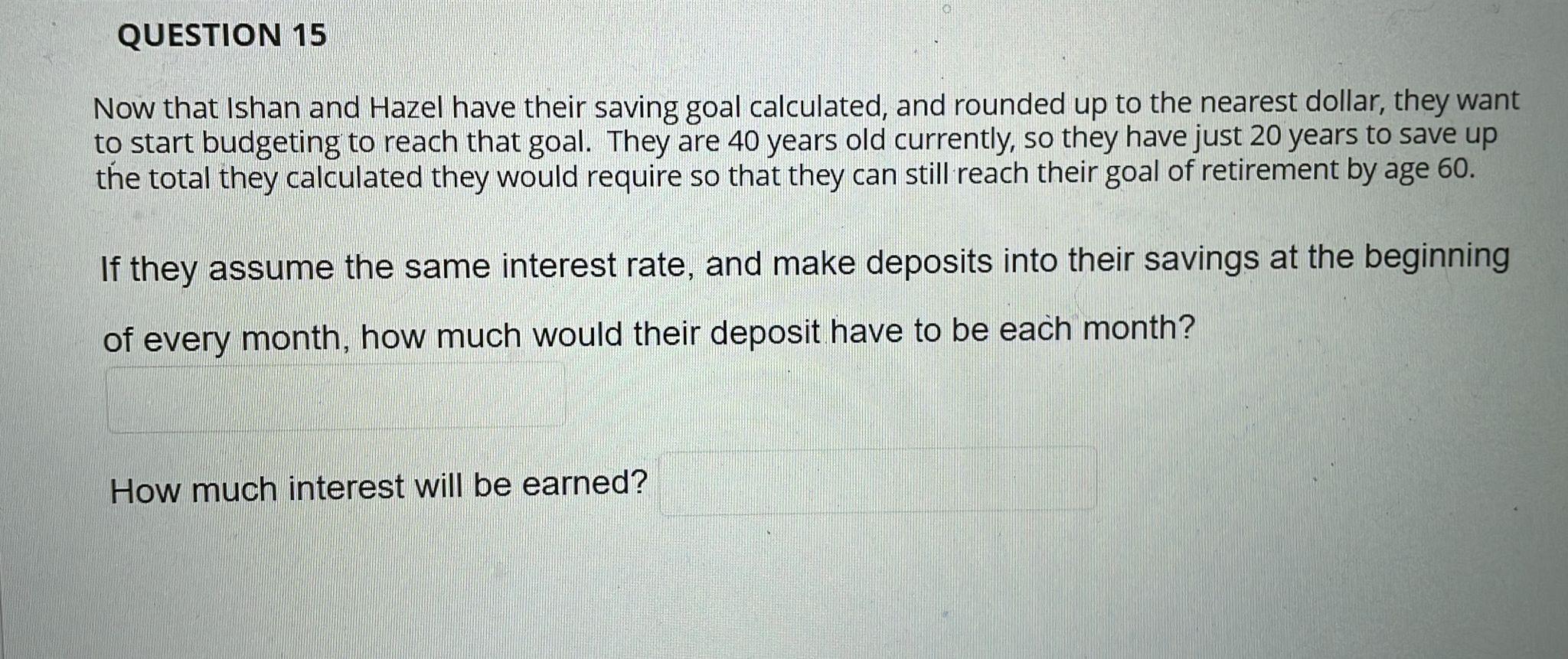

QUESTION 11 Mark is looking to secure a small business loan. The first lender is offering 11% compounded weekly, whereas the second lender is offering 11.25% compounded semi-annually and the third lender is offering 11.6% compounded annually. Mark chose the loan that offers the lower effective rate. What is the effective rate of the loan that he chose? QUESTION 12 Today Dante and Sharon had their first child. All of the grandparents gave them money to help out, which added up to $23,000, and they are going to put this money into an education fund for their child's future. They are nervous about the stock market so they've decided to put their money in a GIC which earns an interest rate of 2.6%, compounded monthly. How much money will they have in the account by their child's 18th birthday? a How much interest will be earned? QUESTION 13 Sharon convinces Dante that because school is both very expensive and very important, they should consider an investment account with a higher rate of return. They explored their options and have selected a very conservative index mutual fund that has a performed with a return of 4.5%, compounded monthly. How much will they have saved by their child's 18th birthday now that they have increased their payments? How much interest will be earned? QUESTION 15 Now that Ishan and Hazel have their saving goal calculated, and rounded up to the nearest dollar, they want to start budgeting to reach that goal. They are 40 years old currently, so they have just 20 years to save up the total they calculated they would require so that they can still reach their goal of retirement by age 60. If they assume the same interest rate, and make deposits into their savings at the beginning of every month, how much would their deposit have to be each month? How much interest will be earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts