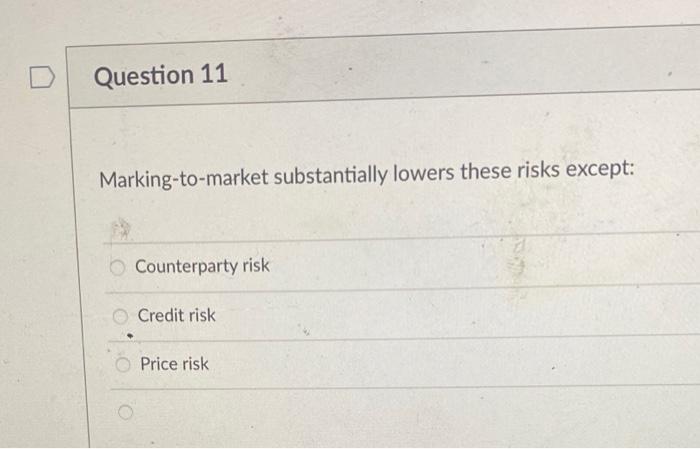

Question: Question 11 Marking-to-market substantially lowers these risks except: Counterparty risk Credit risk Price risk 12.5 p Question 12 An airlines company is most likely to

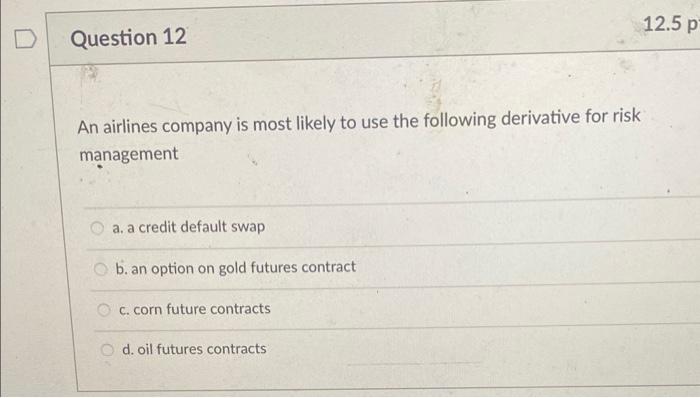

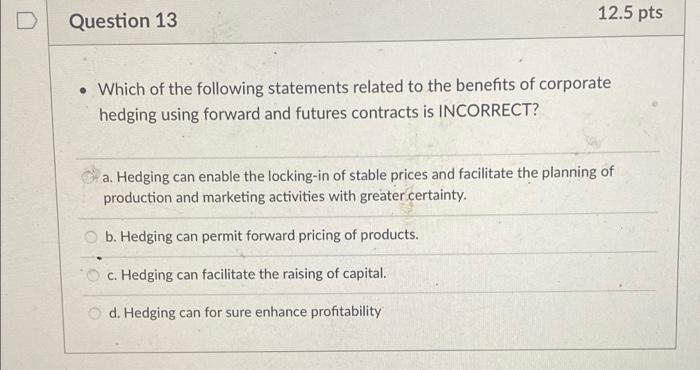

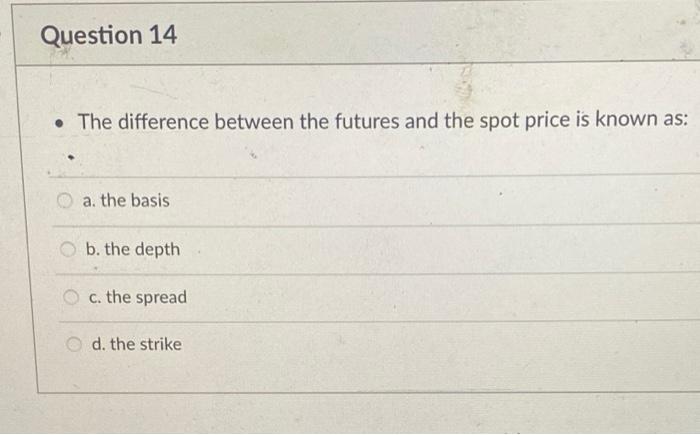

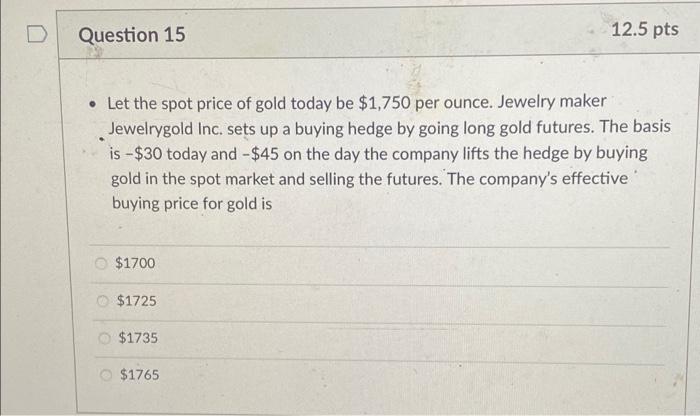

Question 11 Marking-to-market substantially lowers these risks except: Counterparty risk Credit risk Price risk 12.5 p Question 12 An airlines company is most likely to use the following derivative for risk management a. a credit default swap b. an option on gold futures contract c. corn future contracts d. oil futures contracts 12.5 pts Question 13 Which of the following statements related to the benefits of corporate hedging using forward and futures contracts is INCORRECT? a. Hedging can enable the locking-in of stable prices and facilitate the planning of production and marketing activities with greater certainty. b. Hedging can permit forward pricing of products, c. Hedging can facilitate the raising of capital. d. Hedging can for sure enhance profitability Question 14 The difference between the futures and the spot price is known as: a. the basis b. the depth c. the spread d. the strike D Question 15 12.5 pts Let the spot price of gold today be $1,750 per ounce. Jewelry maker Jewelrygold Inc. sets up a buying hedge by going long gold futures. The basis is -$30 today and -$45 on the day the company lifts the hedge by buying gold in the spot market and selling the futures. The company's effective buying price for gold is $1700 $1725 $1735 $1765

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts