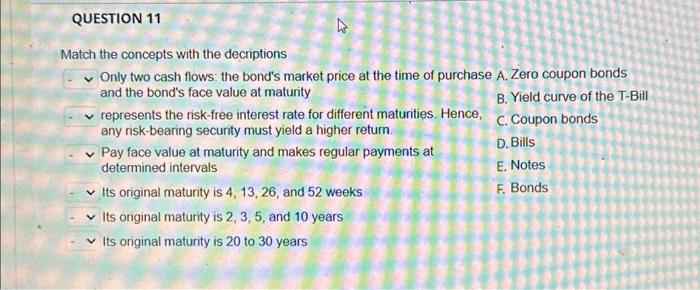

Question: QUESTION 11 Match the concepts with the decriptions Only two cash flows: the bond's market price at the time of purchase A. Zero coupon bonds

Match the concepts with the decriptions Only two cash flows: the bond's market price at the time of purchase A. Zero coupon bonds and the bond's face value at maturity represents the risk-free interest rate for different maturities. Hence, B. Yield curve of the T-Bill any risk-bearing security must yield a higher return. C. Coupon bonds Pay face value at maturity and makes regular payments at D. Bills determined intervals E. Notes Its original maturity is 4,13,26, and 52 weeks F. Bonds Its original maturity is 2,3,5, and 10 years Its original maturity is 20 to 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts