Question: Question 11, P 9-28 (similar to) = Homework: Chapter 9 Homework (Copy) > HW Score: 62.53%, 7.5 of 12 points Points: 0.08 of 1 Save

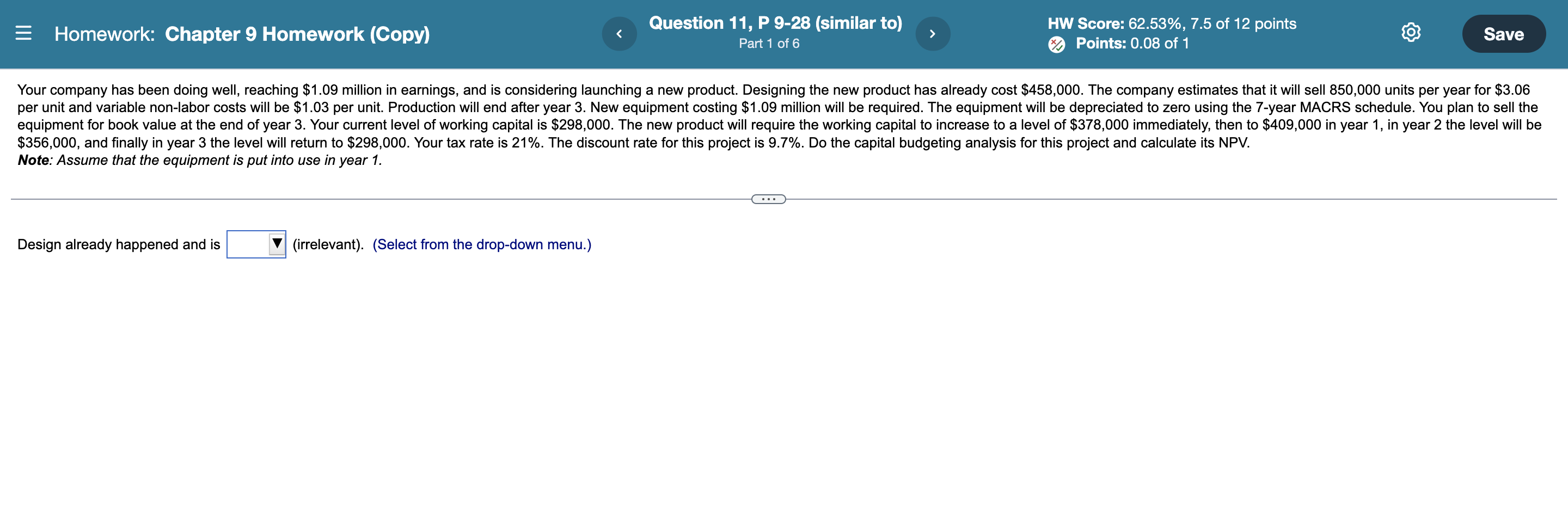

Question 11, P 9-28 (similar to) = Homework: Chapter 9 Homework (Copy) > HW Score: 62.53%, 7.5 of 12 points Points: 0.08 of 1 Save Part 1 of 6 Your company has been doing well, reaching $1.09 million in earnings, and is considering launching a new product. Designing the new product has already cost $458,000. The company estimates that it will sell 850,000 units per year for $3.06 per unit and variable non-labor costs will be $1.03 per unit. Production will end after year 3. New equipment costing $1.09 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $298,000. The new product will require the working capital to increase to a level of $378,000 immediately, then to $409,000 in year 1, in year 2 the level will be $356,000, and finally in year 3 the level will return to $298,000. Your tax rate is 21%. The discount rate for this project is 9.7%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in year 1. Design already happened and is (irrelevant). (Select from the drop-down menu.) Question 11, P 9-28 (similar to) = Homework: Chapter 9 Homework (Copy) > HW Score: 62.53%, 7.5 of 12 points Points: 0.08 of 1 Save Part 1 of 6 Your company has been doing well, reaching $1.09 million in earnings, and is considering launching a new product. Designing the new product has already cost $458,000. The company estimates that it will sell 850,000 units per year for $3.06 per unit and variable non-labor costs will be $1.03 per unit. Production will end after year 3. New equipment costing $1.09 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $298,000. The new product will require the working capital to increase to a level of $378,000 immediately, then to $409,000 in year 1, in year 2 the level will be $356,000, and finally in year 3 the level will return to $298,000. Your tax rate is 21%. The discount rate for this project is 9.7%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in year 1. Design already happened and is (irrelevant). (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts